SUSTAINABILITY REPORT 2024

-

2 SUSTAINABILITY REPORT

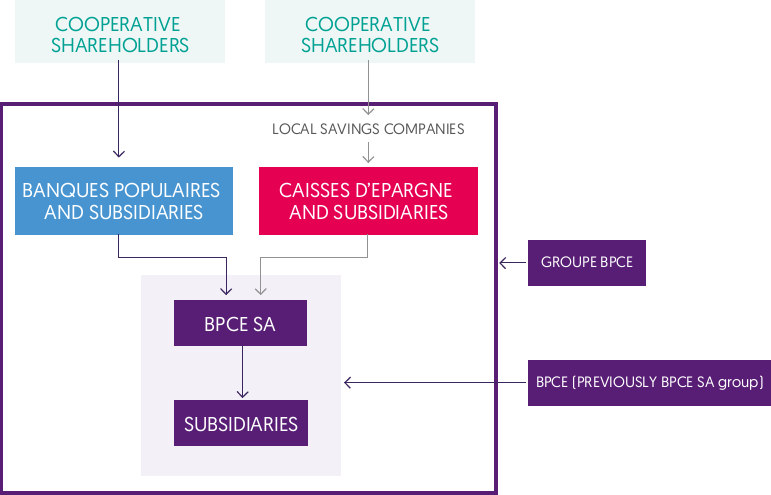

The scope of consolidation of both groups, organized around the central institution, is presented in the diagram below.

In addition to BPCE, Groupe BPCE includes the Banques Populaires, the Caisses d’Epargne and their respective subsidiaries.

-

2.1 Groupe BPCE sustainability report

PART 1 - GENERAL INFORMATION

1.1 Basis for preparation

Groupe BPCE has prepared its sustainability report in accordance with European Sustainability Reporting Standards (ESRS). These standards provide a comprehensive framework for the disclosure of non-financial information on environmental, social and governance issues.

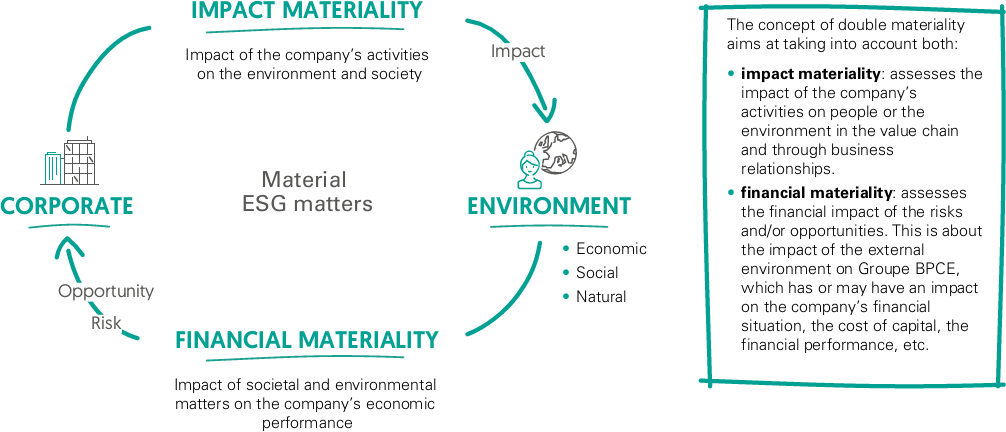

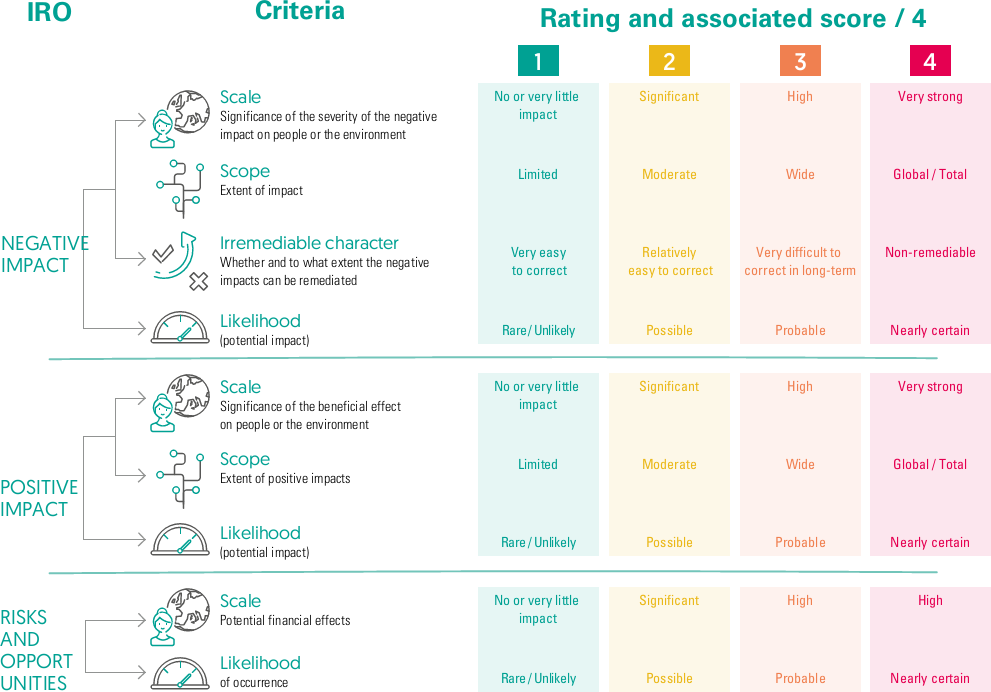

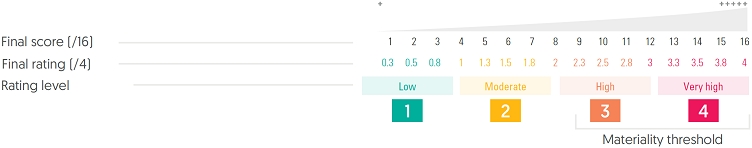

The Group’s sustainability report is based on a double materiality assessment, which takes into account both the impact of Groupe BPCE on the environment and society, and the influence of changes in the environment and society on the company’s performance. This approach takes into account the expectations of stakeholders, in particular employees, investors, customers, cooperative shareholders and the communities in which the Group operates. It results in a list of impacts caused by Groupe BPCE’s activity, and of risks and opportunities (IRO) related to environmental and societal changes.

To prepare this report, Groupe BPCE has collected data on a consolidated basis and across its value chain. This sustainability report is audited as required by the regulations with a limited level of assurance.

The scope of consolidation used for this sustainability report is identical to that of Groupe BPCE’s consolidated financial statements. All entities included in the IFRS (International Financial Reporting Standards) consolidation scope of Groupe BPCE are also included in this sustainability report.

The institutions included in Groupe BPCE’s consolidation, permanently affiliated with BPCE in accordance with Article 10 of Regulation (EU) 575/2013 (CRR) and exempted from the individual and consolidated disclosure obligation in terms of sustainability are the following:

Banques Populaires Caisses d’Epargne Banque Populaire Alsace Lorraine Champagne Caisse d’Epargne Aquitaine Poitou-Charentes Banque Populaire Aquitaine Centre Atlantique Caisse d’Epargne d’Auvergne et du Limousin Banque Populaire Auvergne Rhône Alpes Caisse d’Epargne de Bourgogne Franche-Comté Banque Populaire Bourgogne Franche-Comté Caisse d’Epargne Bretagne Pays de Loire Banque Populaire Grand Ouest Caisse d’Epargne Côte d’Azur Banque Populaire Méditerranée Caisse d’Epargne Grand Est Europe Banque Populaire du Nord Caisse d’Epargne Hauts de France Banque Populaire Occitane Caisse d’Epargne Ile-de-France Banque Populaire Rives de Paris Caisse d’Epargne Languedoc-Roussillon Banque Populaire du Sud Caisse d’Epargne Loire-Centre Banque Populaire Val de France Caisse d’Epargne Loire Drôme Ardèche CASDEN Banque Populaire Caisse d’Epargne de Midi-Pyrénées Crédit Coopératif Caisse d’Epargne Normandie Caisse d’Epargne Provence Alpes Corse Caisse d’Epargne Rhône Alpes Exclusions from the reporting scope by family of indicators are indicated in the description of each indicator.

Groupe BPCE has not made use of the option that allows it to omit certain disclosures relating to intellectual property, know-how or the results of innovations. This option is provided for in Section 7.7 of ESRS 1: Classified and sensitive information, and information on intellectual property, know-how or results of innovation.

In most cases, the material impacts, risks and opportunities have been assessed in the short, medium and long term. To obtain forward-looking information on Groupe BPCE’s material impacts, risks and opportunities in its sustainability reports, the Group has adopted the general principles as defined in Section 6.4 of the ESRS 1 section, namely:

- 1 year as short term (annual financial statement presentation period);

- between 1 year and 5 years as medium term;

- more than 5 years as long term.

When the time horizons deviate from these general guidelines, this information is communicated at the same time as the relevant information concerning the specific material subject. During the preparation of this sustainability report, forward-looking estimates and assumptions were made. The results observed may differ from these estimates and assumptions.

The indicators must cover the entire consolidated scope. However, for the calculation of greenhouse gas emissions under ESRS E1-6 (greenhouse gas emissions), the indicator is calculated over an extended scope. Scope 3, category 15 emissions relate to the value chain, in particular financed emissions.

For the calculation of Scope 3 category 15 emissions on the banking book, greenhouse gas data come from several sources:

- data collected from the Group’s customers (DPE); and

- public databases (Centre Scientifique et Technique du Bâtiment).

When data is not available, the Group uses sectoral intensity estimates: either through extrapolation or using a proxy defined through PCAF.

This report, known as the Groupe BPCE sustainability report, was prepared in accordance with the legal and regulatory requirements resulting from the transposition of the European Directive on the disclosure of information on companies’ sustainability (Corporate Sustainability Reporting Directive or “CSRD Directive”). This first year of application is characterized by uncertainties about the interpretation of the texts, which are generalist and cover all sectors of activity but do not specify a specific framework for banking and financial business models. There is also the absence of established practices or comparative information and certain data, in particular within the “value chain”.

In this context, Groupe BPCE has endeavored to apply the normative requirements set by the ESRS, as applicable at the date of the sustainability statement, based on the information available within the timeframe for its preparation, by doing its best to reflect its role as a universal bank-insurer, as well as its various business models.

For the double materiality analysis and, in particular, that relating to its value chain, Groupe BPCE encountered limitations relating to the maturity of its valuation methodologies and the availability of data. As presented in Section 1.5.1.1 on the Environment (E), we considered that only the issue of mitigation and adaptation related to climate change is material within the meaning of the standard. The limitations relating to the market information and methodologies available at this stage did not make it possible to characterize the Nature ESRS’s materiality within the standard’s meaning, which led the Group to assess these environmental issues as non-material. This assessment was carried out based on the definitions of the standard, and the methodologies available to assess and carry out the rating exercises. This assessment can be explained, in particular, by the absence of a consensus on robust methodologies developed on the topics in question and of relevant and appropriate data which would make it possible to establish a link between the impact or risks for Groupe BPCE regarding these topics through its value chain. In view of Groupe BPCE’s continuous improvement approach to these environmental issues, the work and ongoing changes in international methodologies, the standards that are being put in place, the best market practices that are emerging and information and data from its customers, which should gradually become available, this double materiality analysis may change in the coming years. The dual materiality analysis, the results of which are presented in this report, aims to qualify the impacts, risks and opportunities as described in the CSRD standard: this analysis only meets the needs of sustainability reporting and not the analysis of factors risks presented in the chapter on risk management.

For the data points presented in this report, the BPCE Group used methodological options that it deemed relevant and made estimates for many data points, particularly concerning the various activities of its value chain. The data, analysis, and studies carried out do not guarantee that expectations and targets will be achieved: they are based on objectives, commitments, estimates, assumptions, standards, and methodologies under development and currently available data, which continue to evolve and develop. Some of the information contained in this document has been obtained from public sources or from sources that appear to be reliable or from market references: the BPCE Group has not independently verified them. In addition, Groupe BPCE notes that the information expected in terms of sustainability is based on so-called “agnostic” European standards (ESRS), which are generalist and do not reflect the specificities of the financial sector. As a result, certain data items deemed irrelevant or not applicable, given Groupe BPCE’s business models and value chain, have not been produced. The same applies to certain data points relating to the Taxonomy Regulation.

Regarding the climate change mitigation and adaptation transition plan, in its transition plan, Groupe BPCE distinguishes between actions relating to its own operations and the targets and actions that it has set itself in order to contribute to the decarbonization of the economy by supporting its customers. The actions described present, in particular, the achievements and roadmap for the actions that seem to impact the downstream value chain. The Group’s transition plan describes past, current and future efforts to align its financing, investment and insurance portfolios with scientifically established trajectories aimed at achieving global carbon neutrality by supporting its customers with their environmental transition. This report does not quantify the effects of decarbonization levers or future estimates of total financed emissions. Indeed, the actions undertaken by the Group cannot replace those of individual customers, companies or States that it supports with the transition, and the transition of the economy to a low-carbon economy depends on many parameters external to Groupe BPCE.

As regards the assessment of greenhouse gas emissions, as a service company, the Group emits a limited level of CO2e in terms of its own operations, including by integrating the upstream value chain (purchases, including those related to IT and technological investments, mobility including business trips, etc.) and the travel of its customers to its branches or business centers. Most of Groupe BPCE’s GHG emissions come from financed emissions and are subject to a normative calculation for category 15 of the emissions of the downstream “investment” value chain, otherwise known as “financed emissions”, aimed at attributing to the financial institution a portion of the CO2 emissions of its financed customers or securities in which it invests. This calculation takes into account the scopes 1-2-3 of customers, which therefore also include the emissions of their value chain, and leads to a maximum calculation. It is estimated that the financed emissions can be, on average, three times the same greenhouse gas emissions for portfolios of exposure to companies in the same value chain. For this sustainability statement, the Group considered the mandatory categories of financial assets provided for in the Greenhouse Gas (GHG) protocol for calculating financed emissions. The scopes, methodologies used and the main assumptions and data sources are detailed in the paragraph relating to (E1-6) “Gross Scopes 1, 2, 3 and Total GHG emissions”.

With regard to Taxonomy, the assumptions used and limitations are detailed in Chapter 2.1 Indicators of the European taxonomy on sustainable activities.

Groupe BPCE believes that the expectations reflected in these forward-looking statements are reasonable; however, they are subject to numerous risks and uncertainties, are difficult to predict, generally outside of the control of Groupe BPCE, sometimes unknown, and may lead to results or cause events to unfold significantly differently from those expressed, implied, or anticipated by the aforementioned information and forward-looking statements.

As for all French companies, the sustainability report for the 2024 fiscal year is the first such report produced by the Group. Consequently, no change in the definition or calculation of metrics, including those used to set targets and monitor progress towards their achievement, is to be reported.

As indicated above, since this exercice is the first, comparative data with previous periods are not presented. The reporting of errors in previous periods does not extend to the reference periods preceding this first year of application of the sustainability standards by the company. Furthermore, no significant error related to the previous Green Asset Ratio (GAR) period was identified.

1.1.2.6 DISCLOSURES STEMMING FROM OTHER LEGISLATION OR GENERALLY ACCEPTED SUSTAINABILITY REPORTING PRONOUNCEMENTS

With regard to risk management, Groupe BPCE has defined sustainability risk as a risk factor. The chapter on environmental, social and governance risks under Pillar III ESG describes how the Group defines and manages these risks. This chapter also contains an overview of the impact of climate and environmental risks on other types of risks. Further details on the methodologies and management used for traditional types of risks, such as credit risk, market risk, operational risk and liquidity risk, are provided in Chapter 7 - Risk factors and management.

In addition, the elements relating to the eligibility and alignment of the Group’s portfolio as defined in Regulation (EU) 2020/852 and supplemented by Delegated Regulations (EU) 2021/2178, 2021/ 2139 and 2023/2486 are included in Section 2.1. Indicators of the European Taxonomy on sustainable activities.

In order to avoid duplication, ESRS 1 allows the incorporation of parts prepared in other documents, such as the management report or the Universal Registration Document, by means of a simple mention, provided that this information has equivalent characteristics, particularly in terms of reliability. This generally concerns the parts relating to the description of the company’s activities and strategy, its governance, remuneration policies, risk factors and the Duty of Care. The ESRS believe that it is imperative to ensure and explain the consistency between the sustainability report and the financial statements, by paying particular attention to significant amounts, assumptions and projections. The amounts considered as material from the financial statements must be accompanied by a reference, although the presentation of a reconciliation in the form of a comparative table between the amounts of the sustainability report and those of the financial statements remains optional.

Name of the disclosure requirement Data point Registration document Section of the Registration Document Information provided to and sustainability matters addressed by the undertaking’s administrative, management and supervisory bodies ESRS GOV-2, Para. 26 (a) & (b) Universal Registration Document Chapter 4 - Report on corporate governance - 4.3 Composition of the management and supervisory bodies and 4.4 Role and operating rules of governing bodies Disclosures in relation to specific circumstances ESRS BP-2 Para. 15 Universal Registration Document Chapter 7 - Factors and risk management - 7.16. Environmental, social and governance risks The role of the administrative, management and supervisory bodies ESRS 2 GOV-1 Para. 19 & 21 Universal Registration Document Chapter 4 - Report on corporate governance - 4.3 Composition of the management and supervisory bodies Risk management and internal controls over sustainability reporting ESRS 2 GOV-5 Para. 36 (a) Universal Registration Document Chapter 7 - Factors and risk management - 7.16. Environmental, social and governance risks 1.2 Cooperative dimension

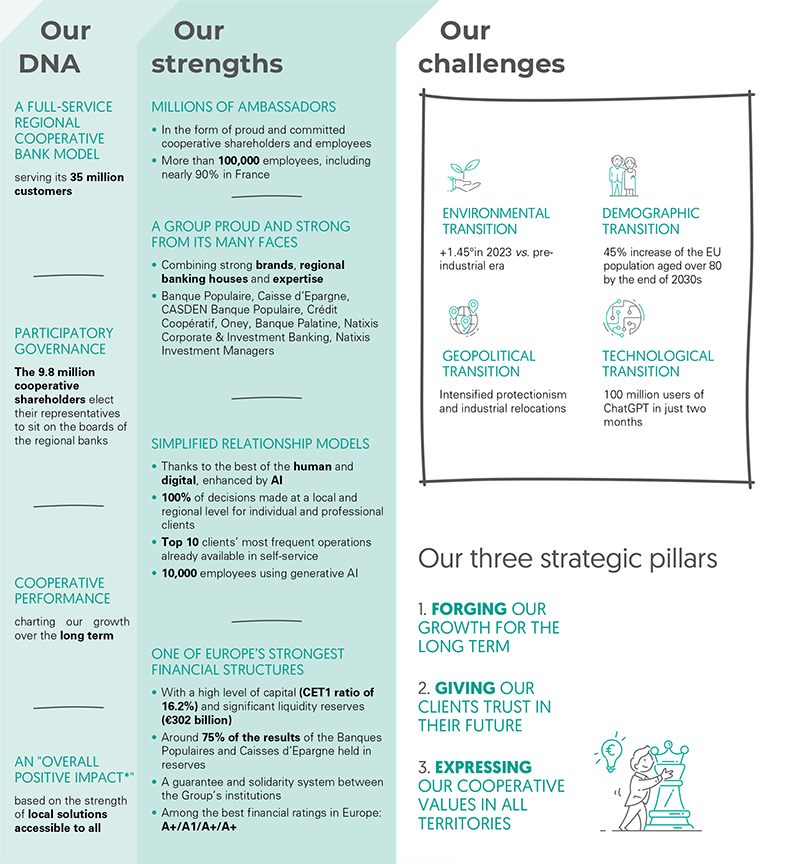

Groupe BPCE is a cooperative full-service bank and insurance Group serving its customers, cooperative shareholders, territories and the economy. Its cooperative model is inseparable from the history of its two historical networks, Banque Populaire and Caisse d’Epargne. These roots, which forge its identity, also condition its performance, both financial and non-financial.

Since its origin, Groupe BPCE has been rooted in a humanist aspiration: making people a core priority, giving everyone the means to save money and finance their projects, and playing a pioneering role in regional development. This DNA, supported by century-old brands, has been embodied at every stage of its history:

- 1818: creation of the first Caisse d’Epargne et de Prévoyance to promote, collect, and manage the general public’s savings;

- 1878: creation of the first Banque Populaire, founded by and for entrepreneurs to help finance their projects;

- 1919: creation of Crédit National, from which Natixis originated, to finance the reconstruction of the French economy;

- 2009: creation of Groupe BPCE through the combination of the Banque Populaire and Caisse d’Epargne groups, sharing common values of solidarity and proximity.

Thanks to its unlisted cooperative nature, which enables it to invest to meet the challenges of tomorrow, the Group’s action is part of the long term and provides local and concrete responses to the transformations of the economy and society. Its sustainable model is based on a positive financial trajectory and economic footprint contributing to both an environmental and societal impact. After fifteen years of transformation and simplification, Groupe BPCE is today a unique and solid group, 100% cooperative and bringing together 9.8 million cooperative shareholders.

By holding the company’s capital through cooperative shares, customers become cooperative shareholders and actively participate in the life, ambitions and sustainable development of their bank, with the aim of implementing a fairer and more inclusive company that is more democratic and guided by the public interest.

- The 9.8 million cooperative shareholders of the Banque Populaire and Caisse d’Epargne networks hold 100% of the capital of the Banques Populaires and the Caisses d’Epargne (through the intermediary of the local savings companies [LSC] for the Caisses d’Epargne). Their representatives sit on the Boards of Directors of the Banques Populaires and on the Steering and Supervisory Boards of the Caisses d’Epargne.

- The 14 Banques Populaires and the 15 Caisses d’Epargne, all with firm roots in their regions, hold 100% of the capital of BPCE, the Group’s central institution.

A fundamental characteristic of its identity, the local presence of the Banques Populaires and the Caisses d’Epargne enables the Group to be attentive to everyone and understand the expectations of society. The Group transforms this proximity into a capacity for innovation to serve regional growth. By acting alongside local players (local authorities, associations, business networks, educational and university communities, etc.), Groupe BPCE brings this proximity to life:

- by making use of a short circuit of money. Local savings and results finance projects on this same scale, purchases are mainly made from local suppliers, and the Group creates jobs as close as possible to the regions;

- by promoting local ecosystems and dialog with its stakeholders such as chambers of commerce and industry, professional associations, social and solidarity-based economy players, NGOs and associations. Aware that solutions to social and environmental challenges require acting together, it stands alongside those who come together to take action.

Strong and proud of its many faces, Groupe BPCE has built itself around solid and complementary brands: Banque Populaire, Caisse d’Epargne, Natixis CIB, Natixis IM, Oney, Banque Palatine, with full-service regional institutions with differentiating expertise. The societal project that guides their activities defines the way in which the Group conducts its business. Coupled with its regional cooperative model, these brands contribute to the Group’s strengths, resources and stability.

With its VISION 2030 strategic project, the Group reaffirms the societal ambition of its activities by placing the cooperative dimension at the heart of its growth. It is now managed on the basis of a “cooperative performance”; both financial and non-financial, with an environmental and societal impact, and is part of a long-term perspective reconciling robustness, subsidiarity and impact.

By being unlisted the Group is protected from any speculation, reserves are indivisible and the value created is distributed fairly among stakeholders. A portion of the surpluses is reinvested in the future of the Group’s companies to develop them and pass them on to future generations, and a portion is paid to the cooperative shareholders as well as used for the local development of the regions.

This model results in regular and low-volatility profitability, a moderate risk appetite and high solvency. The Group thus distinguished itself in Europe, where it maintained some of the highest solvency requirements.

Groupe BPCE’s decentralization and regional presence are real assets for supporting transitions and lasting transformation of society; they are the guarantors of rapid decision-making, as close as possible to the regions.

With its VISION 2030 strategic project, the Group aims to “make impact accessible to all”: this is the meaning of ‘impact for all.’ Its generalization is based on three main principles:

- the impact for all clients: individual clients for their energy renovation projects, corporate clients for their transition plans, local authorities in support of their policies;

- impact for all territories and the society: by enabling local players to join forces, with the help of the Group’s cooperative shareholders and developing regional initiatives;

- impact for all employees and boards of directors: by deploying an Impact Inside operation and by mobilizing 100% of Groupe BPCE’s employees, companies and governing bodies around ESG issues.

Groupe BPCE is convinced that it is a model in line with society’s expectations, whose changes it has always supported.

The philanthropic engagement and solidarity and sponsorship actions of the Banques Populaires and the Caisses d’Epargne

Since 1992, the Fondation Nationale Banque Populaire, an instrument of sponsorship for the 14 Banques Populaires and their cooperative shareholders, has promoted individual initiative and supported, over the life of their projects, talented, creative people with an entrepreneurial spirit and a taste for innovation in three areas: classical music, disability and arts and crafts.

In 2024, the Fédération nationale des Banques Populaires endowment fund continued its support for ADIE, a national and regional association that finances and supports micro-entrepreneurs. Supplemented by the action of each of the Banques Populaires in the regions, Banque Populaire (excluding CASDEN) is once again in 2023 the first financial partner of ADIE with €47.7 million, which financed 10,000 microloans and contributed to the creation or maintenance of 12,200 self-employed and salaried jobs, in addition to skills sponsorship, honor loans, and other training support or Créadie Awards.

In addition to sponsorship, they are involved in actions in favor of civil society. They are highly involved in supporting business creation, integration (through microloans in particular) and solidarity, and actively support education and research. In addition, Crédit Coopératif and its foundation are mainly focused on supporting and promoting the social and solidarity-based economy. CASDEN Banque Populaire naturally favors education and research.

The impact of the sponsorship of the 14 Banques Populaires is one of the components measured each year via the Banque Populaire Cooperative and Societal Footprint (ECS). Based on ISO 26000 (the leading international standard for CSR), this footprint identifies and values in euros the CSR and cooperative actions implemented within each bank for the benefit of society, employees and customers, cooperative shareholders and suppliers. These actions go beyond regulations, excluding commercial, and traditional banking activity. In 2023, the cooperative and societal footprint (ECS) shows that the Banques Populaires network - composed of 12 regional Banques Populaires, CASDEN Banque Populaire and Crédit Coopératif -carried out 6,434 actions for the benefit of society and the regions, for a total amount of €194.6 million. There has been a sharp increase in the number and amount of ECS actions supported.

Created by philanthropists, the Caisses d’Epargne have been working to promote social cohesion and the fight against exclusion since their inception. They are among the leading corporate sponsors in France.

The Fédération nationale des Caisses d’Epargne has adopted CSR and Cooperative Guidelines that provide a shared framework for the actions of the Caisses d’Epargne around four ambitions: be a key player in the transformation of the regions and the local economy (local footprint), pursue the continuous improvement of ESG policies and their integration into all business lines for more impact (overall performance), encourage employees and cooperative shareholders to become cooper’actors (active cooperation) and anticipate societal needs to build solutions that contribute to progress (societal innovation).

The purpose of the endowment fund of the Caisse d’Epargne network constituted by the FNCE, is to encourage and support actions of general interest aimed at combating exclusion and poverty, particularly in banking and financial situations, and to support solidarity actions and assistance programs. It also supports the Finances et Pédagogie association, which deploys educational programs on money issues throughout the country. It also supports other large structures such as the Fondation Belem, which is recognized as a public utility, whose purpose is to promote France’s maritime past and to preserve France’s last large ship of the 19th century, which has been classified as a historic monument since 1984. Lastly, it has a €200,000 fund that responds quickly to natural disasters.

The 15 Caisses d’Epargne have their own sponsorship strategy in their regions. In 2024, sponsorship represented a total of €20.8 million and 1,290 local projects were supported, mainly in the field of youth, solidarity and sport.

Groupe BPCE, a Premium Partner of the Paris 2024 Olympic and Paralympic Games, is building a social and environmental legacy that makes sport accessible to all

Groupe BPCE, with all its companies - Banque Populaire, Caisse d’Epargne, Natixis, CASDEN, Crédit Coopératif, ONEY and Banque Palatine - was the leading Premium Partner of the Paris 2024 Olympic and Paralympic Games. In addition to sharing the values of one of the biggest sporting events in the world, it was an opportunity for the Group to continue to respond in a tangible way to the current challenges of society and to participate in building a social and environmental legacy which makes sport accessible to all:

- making sport a tool for regional planning;

- supporting the local economic fabric and employment;

- taking action to promote the inclusion of people with disabilities.

1.3 Strategy

In 2024, Groupe BPCE rolled out its strategic project VISION 2030, a growth project at the service of its customers and their support in the face of the challenges of the environmental, demographic, technological and geopolitical changes.

The priority given to climate in its latest strategic project has been renewed and integrated into the Impact strategy, with an extra-financial trajectory that includes fifteen key impact indicators. This prioritizes the expansion of impact solutions to all clients of the group, accelerating across all ESG dimensions

VISION 2030, Groupe BPCE’s new strategic project outlines the major priorities it has set for itself in order to build a growth project to serve its customers, in a society marked by four major transitions: environmental, demographic, technological and geopolitical.

Faced with this situation, Groupe BPCE is mobilizing its local and regional presence, its business lines and expertise, to enable its customers, cooperative shareholders and employees to assert their power to act and to trust in the future.

The cooperative nature of the Banques Populaires and the Caisses d’Epargne, combined with the banks’ strong local presence, have made Groupe BPCE a financial player which has notably committed to the decarbonization of the economy in recent years. Groupe BPCE’s global business lines - Natixis Corporate & Investment Banking (Natixis CIB) and Natixis Investment Managers (Natixis IM) - are positioned as key global players in transitions.

Faced with the climate emergency, Groupe BPCE’s approach sets out to ensure the rapid implementation and rollout of measures designed to mitigate and adapt to the already tangible environmental and socio-economic impacts. Making “the impact accessible to all”(2) means raising awareness and providing support to all its clients in the environmental transition by providing them with expertise, advisory services, and comprehensive solutions.

Building on the scenarios defined by science, the BPCE Group and its businesses position themselves as facilitators of transition efforts, with a clear and ambitious goal: to finance a carbon-neutral economy by 2050 by taking action today.

The Group’s approach is based on its cooperative business model: a presence in local communities and a commitment to society geared to financing the economy.

For individual clients: providing support for energy renovations and home adaptations addressing aging and reduced autonomy by offering financing solutions and by mobilizing Groupe BPCE’s role as a housing operator, trusted third party along with its network of partnerships:

- by offering an “Advice and Sustainable Solutions” tool in partnership with ADEME, making it easy for clients to calculate their carbon footprint but also to benefit from advice and assistance for energy renovation work, for decarbonized mobility or green investments;

- by providing support at every stage of energy renovation projects for individual homes and condominiums: energy assessment, search for grants, guarantee of successful completion of work, with financing pathways tailored to each situation;

- by increasing the volume of financing for the energy renovation of buildings.

- Terminology for the strategic project VISION 2030: https://www.groupebpce.com/en/the-group/strategic-plan/

- VISION 2030 strategic project terminology: https://www.groupebpce.com/le-groupe/plan-strategique/

For BtoB customers: supporting the transition of the business models of its clients, from SMEs to the largest international companies. The Group engages with its clients through dedicated dialogue and sector-specific expertise to integrate ESG issues according to the size of the companies and their economic sectors, particularly in energy infrastructure, transportation, waste management and treatment, etc. Sustainable solutions also exist for investor clients with a range of responsible investments and placements: sustainable development passbook accounts, funds with a sustainable investment target, theme-labeled funds, etc..

-

Support for the evolution of the energy mix: faced with the climate emergency, the priority is to accelerate the advent of a sustainable energy system:

- by positioning itself among the world leaders in debt project financing in the renewable energy sector;

- by increasing its financing dedicated to the production and storage of green electricity;

- by providing advice about capital raising processes to its clients commanding leading positions in the infrastructure and equipment sector related to energy transition as well as innovative and high-growth companies in the same sector;

- by advising its customers on energy transformation projects in their financing or capital raising processes;

- by supporting the reindustrialization of regions and energy sovereignty;

- by setting up teams of experts dedicated to low-carbon energies (solar, wind, electrolysis, etc.) and critical metals.

-

Alignment of its financing and insurance portfolios with trajectories compatible with the objectives of the Paris Agreement:

- by developing carbon emission measurement systems;

- by developing its system for identifying and managing physical and transitional climate risks affecting both its clients and its own activities, on the basis of a continuous improvement approach;

- by gradually withdrawing from the most-carbon emitting activities, in particular through adapted ESG policies.

In this context, the Group has joined the Net Zero Banking Alliance initiative of the United Nations Environment Program (UNEP FI), and has a decarbonization ambition for the most carbon-emitting sectors.

- Active and innovative issuer in sustainable finance: in its VISION 2030 strategic project the Group has set itself the target of issuing more than five green, social or health funding instruments per year, using all the debt instruments at its disposal.

The Group is a leading financier in the Social and Solidarity Economy sector, local authorities and a major player in social housing, social entrepreneurship and microcredit.

-

A player in the territories and regions of the world where it operates: Groupe BPCE plays a major role in local ecosystems promoting territorial cohesion, supporting numerous initiatives in favor of social inclusion and the reduction of inequalities:

- the Banques Populaires and the Caisses d’Epargne are key players in the dynamic development of our territories, notably by financing the construction or renovation of infrastructure and facilities necessary for education, health, and mobility. They are the leading providers of private funding for local authorities and the hospital sector;

- on a global scale, Natixis Investment Managers and Natixis Corporate & Investment Banking are developing their Asset & Wealth Management and Corporate & Investment banking business lines in over 40 countries, in line with international commitments in terms of investment and financing activities.

-

Committed to supporting local and national initiatives:

- the impact of the sponsorship activities of the 14 Banques Populaires is measured annually through their Cooperative & Societal Footprint metric. This footprint identifies and values in euros the CSR and cooperative actions implemented within each bank;

- the 15 Caisses d’Epargne have rolled out their Utility Contract in all regions of France: 100% cooperative, 100% regional and 100% useful for the economic, social and environmental development of the territories.

In order to support the transitions of its clients in accordance with the best available standards, Groupe BPCE has launched an internal transformation plan entitled ‘Impact Inside’. In order to expand its impact solutions to its clients and speed up its progress in all the different aspects of ESG, Groupe BPCE has undertaken a transformation of all its companies at every level. It mobilizes its governance and employees, which it trains in ESG issues, and also acts on its own activities by reducing its carbon footprint.

Among the strategic priorities of VISION 2030, Groupe BPCE is renewing its commitment to supporting environmental and societal transitions. It is committed to making “impact accessible to all”(1) and to reinforcing its “global positive based on the strength of local solutions accessible to all.”(2).

The Group’s strategy is accompanied by quantified objectives to implement and steer the Group’s concrete actions by 2026. All of these objectives (depending on the major service groups, customer categories, geographic areas and relations with interested parties) are set out in the table below.

- Terminology for the strategic project VISION 2030 - Environmental impact, Groupe BPCE: https://www.groupebpce.com/en/csr/actor-in-the-environmental-transition/.

- Terminology for the strategic project VISION 2030 - A Group with positive impact, Groupe BPCE: https://www.groupebpce.com/en/csr/our-csr-approach/.

Topics Metrics Business lines Clients Geographic

areasCompleted

in 20242026 target Energy renovation with solutions designed to preserve the value of households’ real estate assets Amount of energy renovation financing for individuals

Retail Banking

Individual customers

France

€698m(1)

> €1bn

Number of unique visits to the Sustainable Advisory and Solutions digital module Retail Banking Individual customers France 5.2 million(2) 6 million Local advisory for the transition of our corporate customers’ business models via dialog devoted to this subject and by providing expertise to incorporate ESG issues according to their size and business sector Amount of transition and decarbonization financing

Retail Banking

Corporate customers

France

€1.1bn(3)

€5bn

Percentage of active corporate clients having participated in an ESG dialog Retail Banking Corporate customers France 55%(4) 100% active corporate customers Action plans and/or decarbonization trajectories for the highest carbon-emitting sectors Number of sectors Group N/A World 11 sectors 11 sectors Investment offering geared to sustainable instruments, in sync with planetary limits and societal issues, thereby reducing the carbon impact of € and unit-linked portfolios Reducing the carbon intensity of portfolios Insurance All clients France 34.3% 40% reduction to reach 50 tCO2eq/€m Supporting our clients in their allocations on sustainable investment solutions Growth in AuM (Assets Under Management) in transitions Asset & Wealth Management All clients World +11.7% CAGR +5% Positioning of Corporate & Investment Banking at the heart of transitions Green revenues Corporate & Investment Banking All clients World x2.1 1.5x the rate of CIB growth A GROUP WITH POSITIVE SOCIETAL IMPACT Topics Metrics Business lines Clients Geographic

areasCompleted

in 20242026 target A key player in territories Financing for the social and solidarity economy, social housing and public actors

Retail Banking

SSE, social housing, public sector players

France

+3.7%(5)

+8%

Social entrepreneurship: number of local projects supported / year Retail Banking Professionals France 10,589(6) 11,000 per year A pioneering and ambitious approach in sustainable finance Number of Green, Social, Healthcare bond issuances per year Group N/A World 5 5 per year - The scope for reporting this indicator is made up of the Banque Populaire and Caisse d’Epargne networks. This indicator sums the financing of energy renovation work for individual customers (natural persons). The calculation base for this indicator is made up of production data relating to energy renovation, ECO PTZ MPR and ECO PTZ.

- The scope for reporting this indicator is made up of the Banque Populaire and Caisse d’Epargne networks. This indicator is the cumulative number of unique visitors who have consulted the “Sustainable Advisory and Solutions” section of the Banque Populaire and Caisse d’Epargne networks mobile app since 2023. The basis for calculating this indicator is made up of the almost real-time reporting of digital navigation data traced by the tool Adobe Analytics.

- This indicator calculates, for Groupe BPCE, the percentage of corporate outstandings covered by an ESG dialog. The basis for calculating this indicator is made up of outstandings at risk covered by an ESG dialog for third-party corporate assets in the commercial sense.

- This indicator sums the financing of the public sector, social housing and the social and solidarity economy. It is established for the Caisses d’Epargne on the basis of the Panorama BDR CE + HeR for social housing financing. Source FSE for the Banques Populaires.

- It is established for the Caisses d’Epargne on the basis of the Panorama BDR CE + HeR for social housing financing. Source FSE for the Banques Populaires.

- The scope for reporting this indicator is made up of the Banque Populaire and Caisse d’Epargne networks. This indicator lists the annual number of professional projects financed by microloans. The calculation basis for this indicator is made up of the number of pro take-off loans carried out in the Caisses and the amount of microloans made by the CE and BPs sent by external organizations (France Active, CREA-SOL and ADIE).

- New system currently being rolled out.

- 15% reduction achieved over the 2019-2024 period.

- 21.4% market share in outstanding loans, all non-financial sector customers (Banque de France Q3 2024).

- Market share: 21.9% in household deposits/savings and 26.3% in home loans (Banque de France Q3 2024).

- 2023 Kantar SME SMI survey.

- Observatoire de la dette Finance Active des Collectivités Locales (published in 2024).

- Insurance Argus 2023.

- Cerulli Quantitative Update: Global Markets 2023 ranked Natixis Investment Managers the seventeenth largest asset management company in the world, based on the assets under management at December 31, 2022.

- Population of adults under professional mandate estimated at more than 810,000 (source: Ministry of Justice) – Caisse d’Epargne network: nearly 350,000 protected customers, including over 325,000 adults at September 30, 2024.

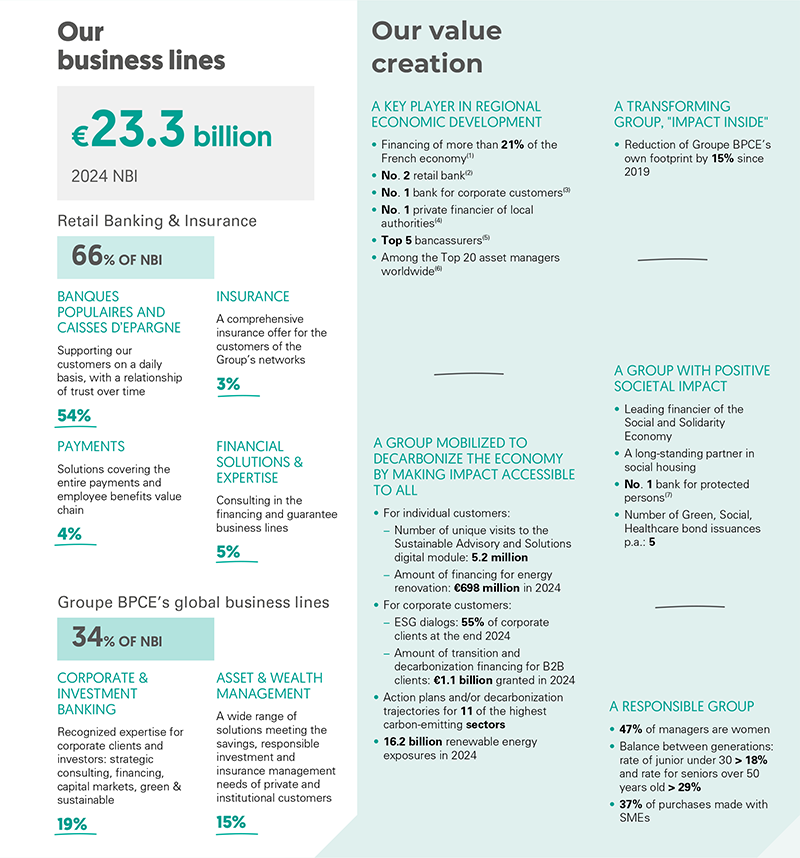

As a universal, cooperative and regional bank, Groupe BPCE is a major player in Retail Banking and Insurance in France, in specialized businesses lines in Europe, and in Corporate & Investment Banking and Asset Management internationally.

Groupe BPCE’s business models and business lines are structured around two divisions: Retail Banking and the related business lines, mainly in France, and the global business lines of Groupe BPCE:

-

Retail Banking: Groupe BPCE is present in the Retail Banking field in France via its two cooperative networks, Banque Populaire and Caisse d’Epargne, along with Banque Palatine:

- the Banques Populaires and Caisses d’Epargne provide their customers with a complete range of solutions in terms of account access, financing, savings, private management, insurance, payment and specialized financial services (such as leasing or factoring);

- Banque Palatine provides its customers with a range of banking products (current accounts, real estate and personal loans, financial investments, financing solutions to meet environmental challenges).

-

Insurance: BPCE Assurances is Groupe BPCE’s Insurance division. A fully-fledged insurer, it designs, distributes and manages a comprehensive range of personal and non-life insurance products for customers of Groupe BPCE’s banking networks:

- personal insurance: life insurance, retirement savings, creditor insurance and individual and professional personal protection insurance;

- non-life insurance: motor insurance, multi-risk home insurance, supplementary health insurance, personal accident insurance (GAV), multimedia equipment insurance, legal protection, parabanking insurance, professional car and multi-risk insurance, etc.

- Digital & Payments: the Digital & Payments division brings together all of Groupe BPCE’s business lines and expertise in the fields of innovation, digital, data and artificial intelligence, payments, and trade finance with Oney.

- Financial Solutions & Expertise: the Financial Solutions & Expertise division brings together the expertise in the financing business lines - these develop revolving credit and personal loan offers for the Group’s banks, offer a complete range of rental solutions (in particular equipment and real estate leasing, long-term leasing, and leasing with option to buy) and develop factoring solutions - as well as in the business lines of insurance, custodial and advisory services.

The Financial Solutions & Expertise business line represents 5% of the Group’s NBI, i.e. €1.3 billion.

- Corporate & Investment Banking: Natixis Corporate & Investment Banking (CIB) provides advice and designs solutions for its corporate customers, financial institutions, institutional investors, financial sponsors and public sector entities, drawing on all of its expertise in advisory, investment and financing, commercial banking and capital markets. It is organized around five main business lines: Global Markets, Investment Banking, Real Assets, Global Trade, M&A.

The Corporate & Investment Banking business line represents 19% of the Group’s NBI, i.e. €4.4 billion.

-

Asset & Wealth Management: Asset & Wealth Management develops solutions to meet the deposits and savings, investment, risk management and advisory needs of the various private banking and institutional customers of Groupe BPCE:

- Asset Management: Natixis Investment Managers (Natixis IM) supports investors on all continents in building their portfolios by offering them a wide range of diversified and responsible solutions. Natixis IM offers a range of more than 200 strategies to enable its investor customers to achieve their investment objectives, and develops its offer around four key areas of expertise: fundamental active management, liability-driven management, real assets, and quantitative management;

- Wealth Management: Natixis Wealth Management designs tailor-made wealth management and financial solutions to structure and manage the assets of business leaders, senior executives, large private investors and holders of family capital. Natixis Wealth Management supports its clients in their initiatives to undertake, invest and transmit by mobilizing a wide range of expertise: corporate advisory, origination, vanilla and complex financing, investment, wealth engineering, asset management and diversification solutions, in particular private equity;

- Employee and retirement savings: Natixis Interépargne supports companies of all sizes in setting up and managing their employee savings and retirement savings (PEE, PERCO, Collective PER, Mandatory PER) as well as employee shareholding.

Groupe BPCE, a universal banking group, serves 35 million customers worldwide. The offers are aimed at a wide range of customers, including the main target customer groups:

- individual customers: Groupe BPCE is the second-largest bank for individuals(1) in France;

- professional customers: Groupe BPCE is the second-largest bank for professional customer and self-employed customers(2). The professional market includes craftspeople, small retailers and liberal professions

- corporate customers: the Group supports companies of all sizes - SMEs, SMIs, medium-sized companies and large companies. Groupe BPCE, thanks in particular to its Banque Populaire network, is the No. 1 bank for SMEs(3);

- local authorities: Groupe BPCE, in particular through the Caisse d’Epargne network, is the main private financier of local authorities(4), the hospital sector(5), and more generally the French public sector;

- social housing operators: Groupe BPCE is a long-standing partner and leading private banker in social housing(6);

- Social and Solidarity Economy (SSE): Groupe BPCE, thanks to the action of its Banque Populaire and Caisse d’Epargne networks, is a major player in the private financing of the Social and Solidarity Economy. They support the various SSE structures, regardless of their size and status: cooperatives, mutuals, associations and foundations, employer structures in the historical sectors of SSE activity.

In addition, as part of its VISION 2030 strategic project, the Group is defining a new growth model to develop simultaneously in three major geographical circles France, Europe and the world. This ambition concerns:

- in France: insurance and individual customers, professional customers and corporate customers;

- in Europe: financial services;

- in the world: the Group’s global business lines, Corporate & Investment Banking and Asset Management.

ESG sector policies govern Groupe BPCE’s activities in sectors deemed sensitive from an environmental, social and governance (ESG) point of view.

- Thermal coal: in October 2015, Natixis Corporate & Investment Banking (CIB) committed to no longer finance coal-fired power plants and thermal coal mines worldwide. This policy has gradually been strengthened. In 2021, Groupe BPCE extended its policy to all of its banking activities and committed to a strategy aimed at gradually reducing its banking activities’ exposure to thermal coal to zero by 2030 (for European Union and OECD countries) and 2040 (for the rest of the world).

- Oil and gas industry: published for the first time in 2017, this ESG policy, initially applicable to Natixis CIB’s activities, was extended in 2023 to all of Groupe BPCE’s banking activities and was strengthened with new criteria.

- Defense industry: Natixis CIB excludes the financing, investment and provision of services to companies involved in the production, storage and trade of anti-personnel mines and cluster munitions.

- Tobacco industry: Natixis CIB has undertaken to cease all dedicated financing related to tobacco activities, as well as all non-dedicated financing in favor of a company whose business is 25% or more tobacco-based.

The European asset management companies affiliated with Natixis Investment Managers also apply sector and/or exclusion policies:

European asset management companies have developed responsible investment policies that explain their overall ESG approach, provide detailed guidance on the integration of environmental factors, and explain their sectoral and/or exclusion policies. All European asset management companies ban controversial weapons from their investments, and have exclusion policies in the coal, non-conventional oil and gas, and tobacco sectors. Some affiliated asset management companies have developed more restrictive exclusion policies, based on recognized frameworks for fossil fuels. The majority of asset management companies offering investment products in non-listed assets completely exclude fossil fuels in favor of transition and renewable energies.

- Market share: 21.9% in household deposits/savings and 26.3% in home loans (Banque de France Q3 2024).

- 37% (rank 2) penetration rate among professional customers and self-employed customers (Pépites CSA 2023-2024 survey).

- 2023 Kantar SME SMI survey.

- Observatoire de la dette Finance Active des Collectivités Locales (published in 2024).

- Observatoire Finance Active Établissements de Santé (published in 2024).

- Repères 136 USH of August 2024 (Les HLM en chiffres).

- Tobacco sector: total exclusion of producers and exclusion of distributors whose tobacco-related turnover exceeds 5% of their total business.

- Controversial weapons: total exclusion.

- Thermal coal: for new investments, exclusion of producers whose turnover from thermal coal is higher than 10%, the annual coal production exceeds 10 million metric tons, or the electricity capacity generated from coal is greater than 5 GW. Distributors developing new thermal coal generation capacities of more than 300 MW are also excluded. For existing investments, divestment planned for 2030 at the latest for companies in OECD countries and for 2040 for companies in non-OECD countries.

- Oil & Gas: for new investments, companies developing new upstream fossil fuel (conventional or non-conventional) exploration or production projects, as well as those whose production of unconventional hydrocarbons or those with a high environmental impact exceeds 10% of their total activity are excluded. For existing investments, divestment no later than 2030 for companies that do not meet these criteria.

- International guidelines: for new investments, companies that violate the United Nations Global Compact (UNGC) and the OECD guidelines are excluded. For existing investments, priority divestment of companies that violate international principles.

- Pesticides: companies whose turnover from the production or marketing of pesticides exceeds 5% and which do not have a biodiversity strategy whose targets are aligned with target 7 of the Kunming-Montreal agreements for new investments are excluded. For existing investments, divestment set no later than 2030 for companies that do not meet the defined criteria.

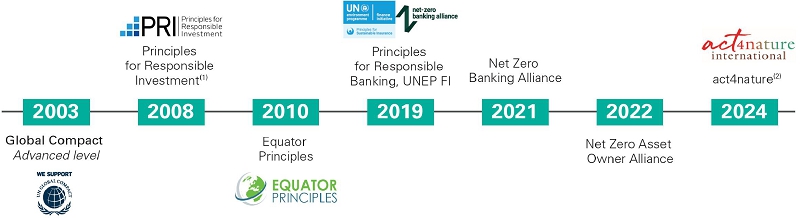

Groupe BPCE has made several long-standing commitments to scale up its actions and accelerate the positive transformations to which it is contributing.

Since 2003, the Group has been a participating member of the Global Compact (United Nations Global Compact), which defines ten principles relating to respect for human rights, labor standards, environmental protection and the fight against corruption.

Since 2008, through Natixis, the Group has adhered to the PRI, which supports institutional investors in incorporating environmental, social and corporate governance considerations into the investment decision-making process.

Since 2010, through Natixis, the Group has been a signatory of the Equator Principles. They aim to take into account social and environmental risks in the context of project financing.

Groupe BPCE and Natixis have signed the Principles for Responsible Banking and are committed to strategically aligning their activities with the United Nations Sustainable Development Goals (SDGs) and the Paris Climate Agreement.

In July 2021, Groupe BPCE joined the Net Zero Banking Alliance (NZBA), a financial initiative of the United Nations Environment Program (UNEP FI) covering more than 40% of the assets financed by banks worldwide. This alliance between banking institutions is a decisive step in the mobilization of the financial sector.

In accordance with its commitment to align the trajectory of its portfolios with the objective of carbon neutrality by 2050, Groupe BPCE has published its ambitions for the eleven sectors with the highest carbon emissions (power generation, oil and gas, automotive, steel, cement, aluminum, aviation, commercial real estate, residential real estate and agriculture).

Since 2022, BPCE Assurances has been a member of the Net Zero Asset Owner Alliance (NZAOA), an international group of investors committed to transitioning their investment portfolios with the aim of contributing to carbon neutrality by 2050.

By joining act4nature international in 2024, Groupe BPCE is strengthening its commitment to the environment by renewing the partnership supported by Natixis since 2018.

By joining act4nature international, a coalition that mobilizes companies, public authorities, scientists and environmental associations in favor of the protection, enhancement and restoration of biodiversity, the Group has set itself 24 proactive objectives as part of its banking, insurance and investing activities.

- Certain affiliates of Natixis Investment Managers (Natixis IM) scope, BPCE Assurances joining the PRI in 2016.

- Commitment made by Natixis in 2018, extended to include Groupe BPCE in 2024.

Actions carried out by Groupe BPCE are often assessed by public and private bodies who provide certificates that guarantee compliance with a particular standard or label.

Banque Populaire Caisse d’Epargne CSR strategy Global CSR approach (ISO 26000) Lucie label 3 CSR Committed Label (AFNOR) 3 CSR Committed Label (AFNOR) 2 Responsible brand 1 CSR Label 2 B-Corp 2 Consumer relations Customer service quality: ISO 9001 and Pepp’s 2 Sustainable and solidarity-based products: Finansol 1 Environment Guaranteed 100% renewable electricity 5 ISO 50001 certification (energy management system) 1 Environmental certifications 6 Green buildings: HQE certification 8 Real estate: HPE label and BBC label 5 Green buildings: Effinergie label 4 Green buildings: other labels 45 Responsible purchasing Supplier Relations and Responsible Purchasing label Supplier Relations and Responsible Purchasing label 7 Diversity, equal opportunities, discrimination Professional equality 10 Professional equality 5 Cancer@Work 7 Cancer@Work 3 Diversity label / AFNOR diversity - inclusion 1 Diversity label / AFNOR diversity - inclusion 4 Cap Handeo 1 Cap Handeo 3 Partner employer label for firefighters 9 Responsible digital 1 As a financial institution, Groupe BPCE receives funds in the form of customer deposits or purchases of financial instruments by investors and grants loans to its customers (banking transformation function).

The downstream value chain includes customers who benefit from Groupe BPCE’s products or services, particularly loans.

Taking into account stakeholder expectations is an essential exercise to better identify and assess the Group’s sustainability impacts. Groupe BPCE’s stakeholder consultation process is based on a large number of systems that aims to involve its stakeholders in its process of identifying and assessing impacts, risks and opportunities, as well as levers for improving both environmental and societal topics. These systems are detailed in the table below.

The Group’s cooperative model places dialog with stakeholders at the heart of its actions. The local presence of the Banques Populaires and the Caisses d’Epargne enables the Group to be attentive to everyone and understand society’s expectations, by promoting local ecosystems and dialog with its stakeholders such as chambers of commerce, professional associations, players in the social and solidarity economy (SSE), entrepreneurial ecosystems, educational structures, associations, foundations, mutuals that the Group has historically supported, given its role as a major financier of the social and solidarity economy.

By holding the company’s capital through cooperative shares, customers become cooperative shareholders and actively participate in the life, strategic and sustainable development of their bank. The members of the Board represent the cooperative shareholders, the regions and civil society within the governance of their bank.

Everywhere in the territories in France and in the regions of the world where the Group operates, stakeholder expectations are identified and taken into account through regular relations with the executives of the Group’s companies, the Fédération Nationale des Banques Populaires, the Fédération Nationale des Caisses d’Epargne, the employee representative bodies, investors roadshows, meetings with rating agencies and NGOs (non-governmental organizations). Lastly, discussions with regulators, and image or forward-looking surveys are all sources of identification of changes in stakeholder expectations.

Stakeholders Dialog methods Purpose

Cooperative shareholders (Banques Populaires and Caisses d’Epargne)

• Participation in General Meetings

• Election of representatives

• Dedicated meetings and newsletters

• Cooperative shareholders club

• Coordination by the Fédération Nationale des Caisses d’Epargne and the Fédération Nationale des Banques Populaires

• Promotion of the cooperative model

• Participation in the life of the bank

• Access to inside information on the bank’s life and its impact on the region

• Measurement of satisfaction

Board members (Banques Populaires a

nd Caisses d’Epargne)• Participation in the Boards of Directors (Banques Populaires) or Steering and Supervisory Boards (Caisses d’Epargne)

• Participation in specialized committees

• Focus groups

• Training programs and seminars

• Dedicated directors website

• Representation of the cooperative shareholders’ interests in governance

• Participation in the definition of strategic orientations

• Monitoring function, in particular risk management and reliability of internal control

Employees

• Social survey (internal survey measuring the social climate in the Group’s companies) and business line satisfaction survey

• Annual interviews

• Training

• Internal communication

• Non-profit networks (women, intergenerational, LGBT+)

• Employee whistleblowing rights

• Consultation of employee representatives and representative trade unions

• Improving quality of life at work, health and safety at work

• Employee loyalty and commitment (career and talent management, skills and expertise development)

• Participation of employee representatives in major strategic and transformation issues and negotiation of agreements

Clients

• Interviews

• Strategic dialog to integrate ESG issues

• Customer events

• NPS satisfaction surveys(1)

• Institutional and commercial partnerships

• Voting policies (available on the websites of the asset management subsidiaries)

• Definition of offers and customer support

• ESG dialog: customer acculturation on ESG issues, support for transformation initiatives, risk assessment for better prevention and management by the customer and for incorporation of ESG criteria in the granting of loans

• Improving customer satisfaction

• Development of a committed shareholder base to encourage companies to transform their strategy and reduce their ESG risks

• Monitoring of the respect for compliance and ethics rules in commercial policies, procedures and sales

• Complaint management

• Mediation

Suppliers and sub-contractors

• Responsible purchasing policy

• Commitment to government initiatives (e.g. “I choose French Tech”)

• Regular meetings with strategic suppliers

• “Supplier voices” survey

• Preparation of certifications

• Listening system and satisfaction surveys

• Supplier whistleblowing rights and establishment of an independent mediator

• Audit

• Responsible Supplier Relations Charter, involving suppliers in the implementation of Duty of Care measures

• Compliance with ESG clauses included in contracts

• Identification of progress plans to better understand supplier expectations

• Improve the level of satisfaction and the relationship

• Consultations and calls for tenders

• Measurement of satisfaction

Institutions, federations, regulators

• Regular meetings (public authorities, regulators, chambers of commerce and industry, etc.)

• Contribution to marketplace work (in particular within the FBF - Fédération Bancaire Française), participation in sectoral working groups

• Responses to public consultations

• Transmission of information and documents

• Board seats (EPL, LS, ESS, etc.)

• Constructively contributing to public debate and participating in collective, fair and informed decision-making

• Taking into account sector specificities

• Regulatory compliance

Rating agencies, investors and independent third parties

• Regular dialog, participation in meetings (technical meetings, roadshows, conferences, etc.)

• Transfer of information and documents for ratings/audits

• Publication of official documents: Universal Registration Document, quarterly earnings, press releases, investor website

• Improving transparency

• Diversification of the Group’s refinancing, in particular by promoting the issuance of Green / social / sustainable bonds

• Improving financial and non-financial ratings

• Meeting the expectations and questions of investors and rating agencies

• Reports publication (CDP, act4nature international, PRB, etc.)

NGOs and non-profits

• Calls for projects

• Sponsorship

• Employee volunteering, skills sponsorship

• Regular dialog

• Contributions to market questionnaires

• Seats on the boards of foundations or associations

• Positive impacts through numerous cultural and solidarity initiatives in various fields: business creation, integration, solidarity, young people, sport, environmental protection, etc.

• Improving transparency

• Contribution of cross-expertise: banking / financial and better understanding of local players

Academic and research sector

• Relations and partnerships with business schools and universities

• Partnership with research chairs

• Participation in forums and events

• Discussions and consultations with scientific experts

• Welcome and recruitment of work-study students and interns

• Improving the employer brand

• Contribution to the Group’s research, working groups and strategies

Certain stakeholders were consulted as part of the double materiality assessment (see 1.5.1.1 IRO-1).

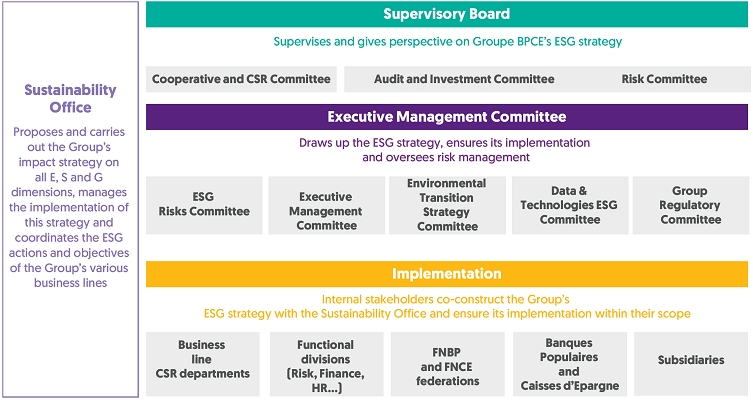

1.4 Governance

The Supervisory Board of Groupe BPCE has 19 members(1): 7 representatives of the Banques Populaires, 7 representatives of the Caisses d’Epargne, 3 independent members(2) and 2 employee representatives. The Supervisory Board includes 6 non-voting directors acting in an advisory capacity.

As of 31st December 2024, with eight women on its Supervisory Board out of a total of seventeen members, Groupe BPCE had a proportion of women of:

- 47.05%(3) (in accordance with Article L. 225-79 of the French Commercial Code, members representing employees are not taken into account in this calculation);

- 42.11%, in accordance with ESRS 2 (European Sustainability Reporting Standards 2) of the CSRD (Corporate Sustainability Reporting Directive).

The Management Board of Groupe BPCE is composed of four members(4), including a Chairman. The diversity rate is 50%(5).

The modalities and details of the composition of the Supervisory Board and Management Board (as well as the Executive Management Committee) are provided in Chapter 4.

Thus, the members of the Supervisory Board and the Management Board are appointed in accordance with the appointment and succession policy (adopted by the Supervisory Board at its meeting of February 7, 2024), which specifies the diversity policy applicable to them.

The Appointments Committee - responsible for formulating proposals concerning the choice of Board members, non-voting directors and external independent members (in compliance with legal and statutory rules and in accordance with the Supervisory Board’s internal rules) - thus verifies the suitability of candidates to join the Board in view of their good repute, skills and independence while pursuing an objective of diversity within the Board, i.e. a situation where the characteristics of the members of the Board differ to a degree ensuring a variety of views within the Board. The Group’s cooperative nature contributes to this diversity.

When assessing a candidate for the Supervisory Board, the Appointments Committee strives to maintain or achieve a balance and have a skill set appropriate for the Group’s activities and strategic project, as well as the technical responsibilities assigned to the various Supervisory Board committees.

The Supervisory Board is mainly composed of representatives from the Banques Populaires and the Caisses d’Epargne, and in particular of the directors and Chairmen of the Boards from both networks. The board chairmen are first and foremost cooperative shareholders of their bank and have in-depth knowledge of the cooperative model, the region and regional specificities.

The skills of the members are reported in the collective skills matrix of the Supervisory Board in Chapter 4(6). This matrix notably mentions all the regulatory skills expected by the supervisor (including banking skills such as: banking and financial markets, accounting and auditing, interpretation of a credit institution’s financial information, risk management, etc.). In addition, these elements are supplemented by the information appearing in the terms of office sheet of each member(7), which describes his or her experience in detail.

In view of the Supervisory Board’s collective skills matrix, the Supervisory Board’s average skill level, particularly with regard to ESG skills, is as follows:

This expertise covers the understanding of climate and environmental risk and its challenges for a banking group, the general regulatory context as regards the environment, the specific expectations on the banking sector, and the measurement of this risk and its main indicators. It also covers knowledge of the action plans implemented by the Group.

- The Supervisory Board of BPCE exercises permanent control over the management carried out by the Management Board and must include, according to the Group’s articles of association, between 10 and 19 members (non-executive company directors) as well as 6 non-voting directors chosen in accordance with the procedures provided for in the diversity policy adopted on February 7, 2024.

- i.e. a proportion of 15.79% of independent members on BPCE’s Supervisory Board. The proportion of independent members on the board committees is specified in Chapter 4.

- The Supervisory Board aims for a minimum of 40% representation of the under-represented gender, a ratio calculated by the ratio of the number of women members of the Supervisory Board to the total number of Supervisory Board members, it being specified that the members representing the employees are not included in the calculation.

- The Management Board has the broadest powers and must include between two and five members according to Groupe BPCE’s articles of association (executive company directors).

- The Management Board of BPCE, which is not subject to any regulatory or statutory obligations, calculates this ratio by dividing the number of women members of the Management Board with the total number of members of the Management Board.

- The matrix presents the average of the collective skills of all of the members. It is based on skill levels (between 1 and 5) as declared by the members. During the assessments, the Appointments Committee checks the consistency of the declared skill levels with the CVs and training completed.

- See 4.3.5 “Directorships and offices held by corporate officers”.

This expertise covers the understanding of the various areas of intervention of the social and solidarity economy (fair trade, responsible consumption, short supply chains, solidarity-based finance, integration through economic activity, confiscation of criminal assets for the use of social utility, social currencies and non-monetary exchange systems, etc.) and its specific challenges, knowledge of social innovations, the role of the various players, and interactions with public authorities.

This expertise covers the specificities of the Banque Populaire and Caisse d’Epargne networks, banks and cooperative companies, which are owned by their cooperative shareholders. As cooperative banking institutions, the operations and missions of the Banques Populaires and the Caisses d’Epargne are governed by law (as is BPCE as the central institution of these institutions): participatory governance, regional proximity, legal duties to implement the principles of solidarity and fight against exclusion, promotion and collection of savings, development of provident insurance, contribution to the protection of popular savings, financing of social housing, improvement of local and regional economic development, and fight against banking and financial exclusion of all players in economic, social and environmental life. Knowledge of these specificities, the very essence of the Group’s model, is the basis of this “cooperative banking experience”.

This competence involves understanding and taking into account the economic and social strengths and weaknesses of the territories.

This expertise covers knowledge of the strategies for the development, revitalization and optimization of a region as well as understanding of the role of the various players and partners and the legal and financial constraints.

In order to strengthen the skills available to the Supervisory Board, training provided by internal and/or external providers is offered to Board members, particularly on sustainability issues. The training program takes into account the diversity of experiences and the needs of the Board members, as well as the proposals made as part of the Board’s annual assessment.

The training offered in 2024 in terms of sustainability, both as part of the regulatory initial training and continuing training, were as follows:

- climate and environmental risks: training delivered by internal and external providers with the aim of understanding climate risk, the general regulatory context regarding the environment, and the specific expectations on the banking sector;

- the challenges of the energy transition and the management of climate and environmental risks: internal training with the aims of improving knowledge about the integration of ESG criteria in risk monitoring, presenting the main regulatory requirements related to climate and environmental risks, and describing the action plans implemented by the Group to respond to them;

- CSRD and transition plan: training delivered by internal and external providers, with the aim of ensuring a good understanding of the CSRD regulatory requirements and the challenges related to this new regulation for Groupe BPCE;

- the climate solutions fresco: external training with the aim of achieving good understanding of the impacts and challenges related to climate risks on the various sectors of the economy;

- Retail Banking operating model: internal training aimed at seeing how the Group is accelerating its transformation of the support functions and how future technologies can trigger new dynamics in Retail Banking operating models;

- governance of cooperative ‘banks’, overview of the governance and organization of cooperative banks in France and Europe: training delivered by internal and external providers with the aim of presenting an overview of the governance and organization of cooperative banks in France and Europe.

1.4.2 GOV-2- Information provided to and sustainability matters addressed by the undertaking’s administrative, management and supervisory bodies

The Supervisory Board supervises and puts the Group’s ESG strategy into perspective. The Executive Management Committee of Groupe BPCE validates the ESG strategy, ensures its implementation and oversees the Group’s risk management (the composition and diversity of the management and supervisory bodies, the roles and responsibilities of the bodies are detailed in Chapter 4 of the Universal Registration Document - Report on corporate governance).

Banques Populaires and Caisses d’Epargne place ESG at the heart of their business model, and ESG issues have historically been an integral part of the governance of each institution.

The Supervisory Board meets as often as the company’s interests and legal and regulatory provisions require. The frequency is at least once per quarter. Several specialized committees have been set up by the Supervisory Board and carry out their activities under its responsibility. Their duties are defined in the Supervisory Board’s internal rules. The Chairman of each of these committees reports on the committee’s work to the Supervisory Board.

In addition to the subjects regularly addressed during Board meetings, such as the quarterly reports of the Management Board, related-party agreements, executive approvals, current events and other matters for information, sustainability subjects are also examined mainly in the context of committee minutes.

Board Chairman Frequency in

2024Duties Main ESG topics addressed in 2024 Audit and Investment Committee Kadidja Sinz - Independent member of the Supervisory Board 9 sessions per year The Audit and Investment Committee:

Monitors the process of preparing the sustainability information and the process implemented to determine the information to be published in accordance with the sustainability reporting standards.

Monitors the effectiveness of the internal control and risk management systems, and where applicable the internal audit, regarding the procedures relating to the preparation and processing of accounting and financial information used for sustainability reporting.

Monitors the performance of the statutory audit by the Statutory Auditors and certification of sustainability information and ensures compliance with the independence conditions required of the parties involved in the audit and certification of sustainability information.

Reports regularly to the collegiate body in charge of administration or to the supervisory body on the performance of its duties. It also reports on the results of the certification of the financial statements and the sustainability information, as well as on the way in which these missions have contributed to the integrity of the financial and sustainability information. It reports on the role it has played in this process.

Monitoring of the construction and progress of the CSRD sustainability report:

•

result of the sustainability auditor’s call for tenders;

•

methods for implementing the CSRD regulation (structuring and construction of the project).

Presentation of CSRD issues for Groupe BPCE (joint meeting with the Risk Committee).

Presentation of the double materiality assessment approach followed, results of the exercise and guidelines adopted by Groupe BPCE for the rating, overall view of the Group’s materiality positions.

Presentation by the sustainability auditor of his strategy and approach to verification of the sustainability report.

Cooperative and CSR Committee The Chairmen of Fédération Nationale des Banques Populaires and Fédération Nationale des Caisses d’Epargne alternately 4 sessions per year The Cooperative and CSR Committee:

Develops proposals and recommendations aimed at promoting and translating the cooperative and social values of long-term engagement, as well as professional and interpersonal ethics, within the activities of the Group and networks, thereby strengthening the cooperative and CSR dimension of the Group and each of the networks.

Develops proposals on strategy and institutional communication related to ESG issues.

Reviews the sustainability report, as well as any other document or report relating to current or future legal obligations (taxonomy, etc.).

Monitors the communication plan and the indicators used to measure the actions of the Group’s strategic plan around the actions falling within the scope of the Cooperative and CSR Committee.