URD 2024

-

1.2 Understanding the Group’s organization

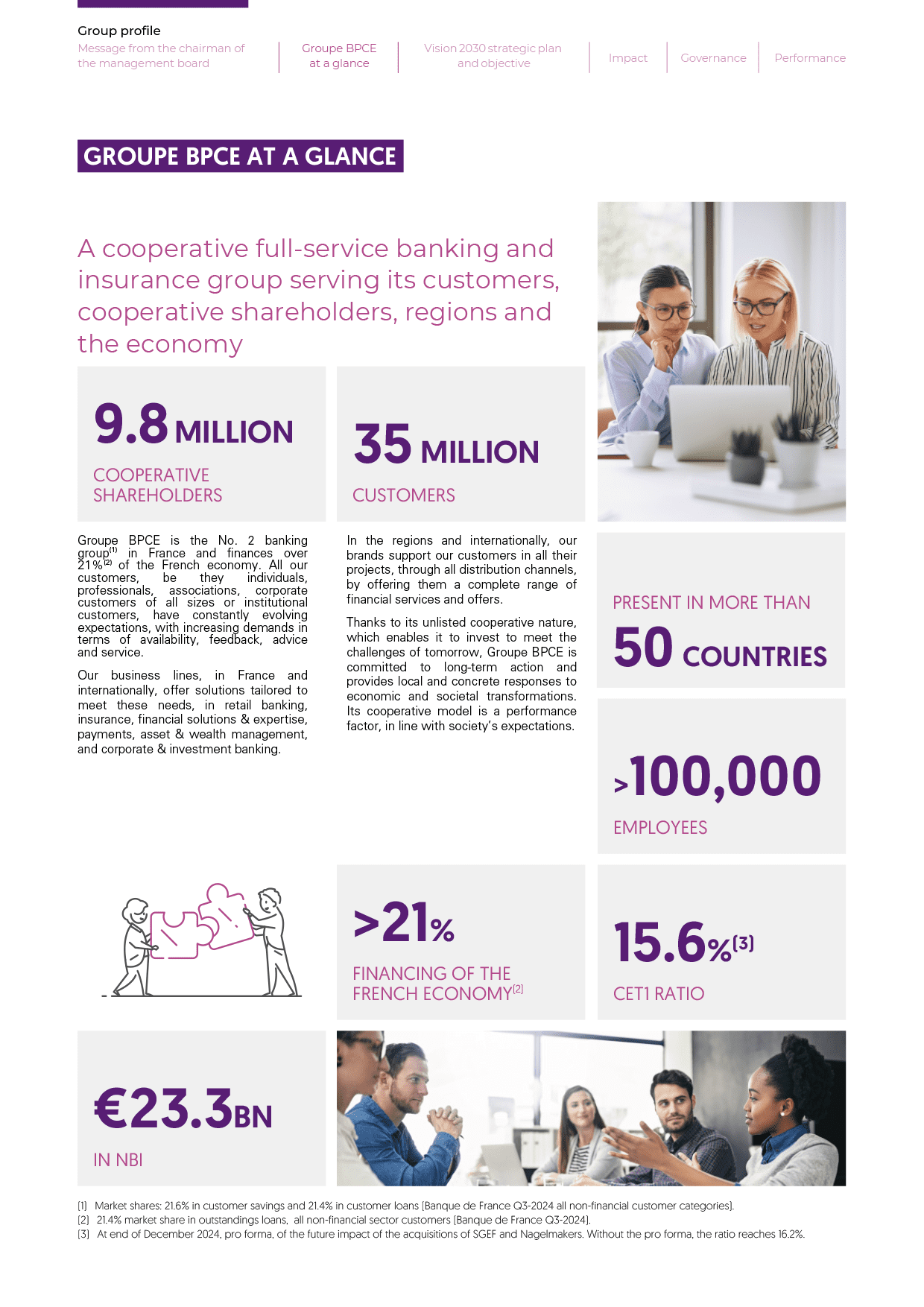

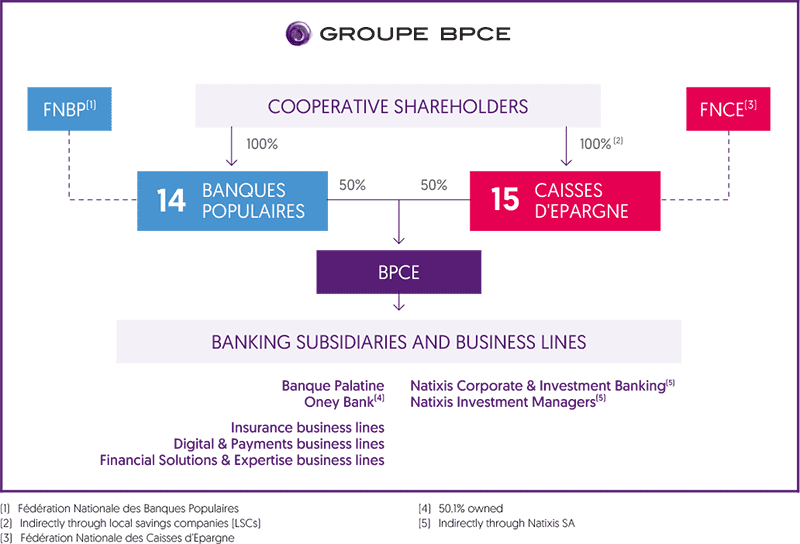

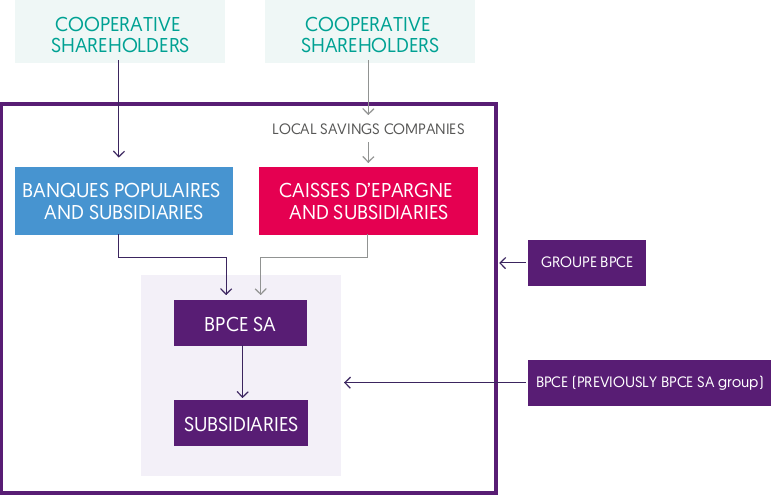

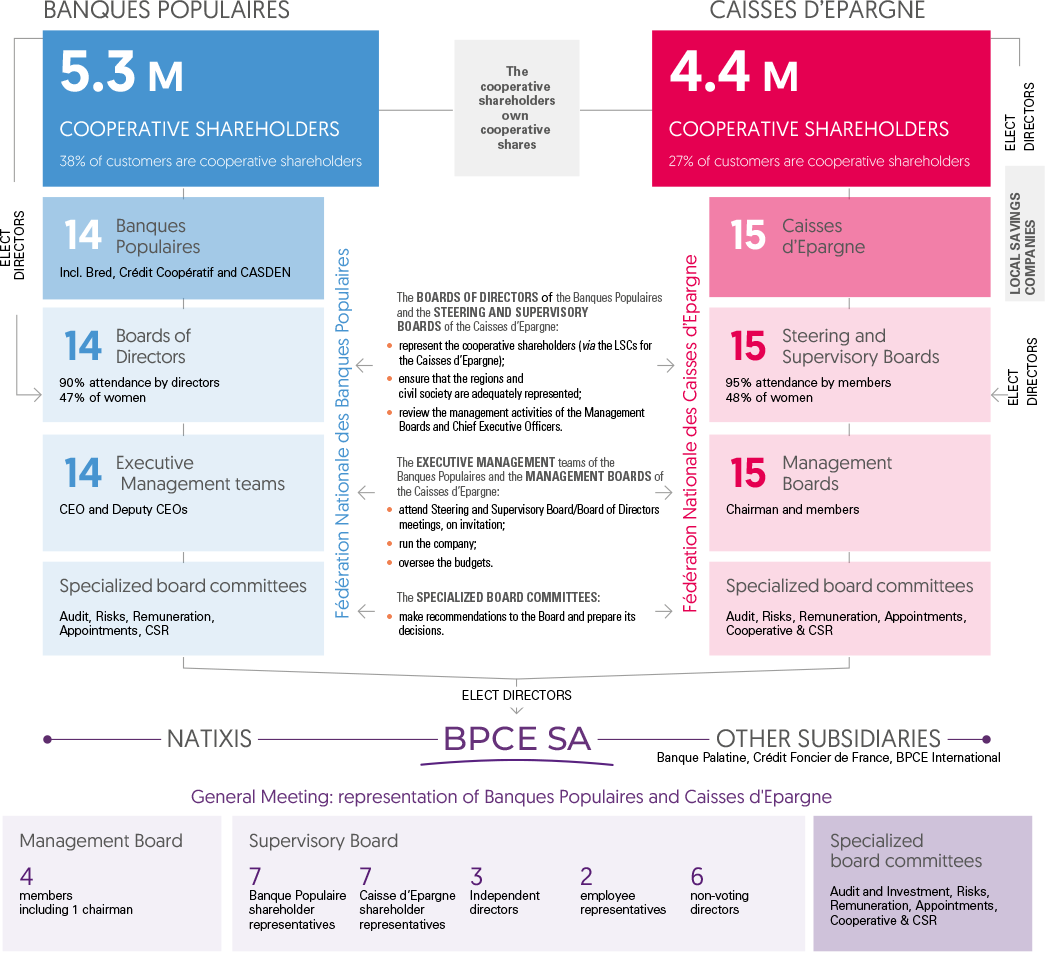

The Banques Populaires and the Caisses d’Epargne are owned by 9.8 million cooperative shareholders. This highly stable shareholding structure is imbued with a strong cooperative spirit.

The 14 Banques Populaires and the 15 Caisses d’Epargne hold an equal 100% stake in BPCE, which is responsible for defining the Group’s policy and strategic orientations, and coordinating the commercial policies of each network.

The Banques Populaires and Caisses d’Epargne are banks in their own right. They collect deposits and savings, distribute loans and define their priorities locally.

The Fédération Nationale des Banques Populaires (FNBP) and the Fédération Nationale des Caisses d’Epargne (FNCE), the bodies that provide deliberation, communication and representation for the two networks and their cooperative shareholders, play an essential role in defining, coordinating and promoting the banks’ cooperative spirit and social responsibility initiatives, in accordance with Groupe BPCE’s commercial and financial objectives. Persons representative of their regional economies sit on the Board of Directors of the Banques Populaires and on the Steering and Supervisory Board of the Caisses d’Epargne. Their resources are first and foremost allocated to meet the needs of local areas and regional customers.

Under the cooperative banking model, the cooperative shareholders are the focal point of the Group’s governance.

The Banques Populaires and Caisses d’Epargne are credit institutions wholly-owned by their cooperative shareholders (via LSCs – Local Savings Companies – for the Caisses d’Epargne).

Cooperative shareholding customers – both individuals and legal entities – play an active part in the life, ambitions and development of their bank.

Being a cooperative shareholder means owning a cooperative share (a percentage of the share capital not quoted on the stock exchange), representing a portion of the share capital in a Banque Populaire or an LSC for a Caisse d’Epargne, and playing a role in the bank’s operation by taking part in General Meetings and voting to approve the financial statements and resolutions, validating management decisions and electing directors.

Each institution is governed by a Board of Directors and a Chief Executive Officer for the Banques Populaires, or a Steering and Supervisory Board (COS) and a Management Board for the Caisses d’Epargne.

BPCE brings together the central institution of Groupe BPCE, the retail and global business lines, as well as the resource pools. To support the Group’s performance, development and strategic ambitions, BPCE ensures the coordination, consistency and synergies between its various brands and companies.

– The central institution, BPCE SA, is responsible for defining the policy and strategic orientations of the Group and each of the two networks.

- coordinate trade policies;

- represent the Group and its networks, and negotiate national/international agreements on their behalf;

- represent the Group and its networks as an employer;

- take all necessary measures to ensure the Group’s liquidity and solvency, risk management and internal control.

All banks affiliated with the central institution are covered by a guarantee and solidarity mechanism.

– Beyond the central institution, BPCE brings together the following business lines, to serve the Group’s development:

- Insurance

- Digital & Payments

- Financial Solutions & Expertise

- BPCE Technologies & Opérations

- Corporate & Investment Banking

- Asset & Wealth Management

-

1.3 Highlights

In partnership with the European Investment Bank, Banque Populaire offers a budget of €150 million to facilitate the installation of health professionals and thus strengthen access to patient care.

BPCE Lease and the European Investment Bank sign a €300 million financial partnership dedicated to the environmental transition of SMEs and mid-sized companies in France and Europe.

Caisse d’Epargne creates an offering for micro-entrepreneurs enabling them to open their professional account online in a few minutes, access dedicated services and benefit from the expertise of an advisor.

Groupe BPCE becomes the first banking group in France to offer “Tap to Pay”, a new generation payment solution for the two main operating systems on the market.

BPCE Assurances announces a new initiative to facilitate access to insurance for customers of the Banque Populaire and Caisse d’Epargne networks who have overcome breast cancer.

Caisse d’Epargne launches a private debt fund of €535 million to finance the development of French mid-sized companies in the regions. This fund is managed by the private debt platform of AEW, the real estate asset management company of Natixis Investment Managers.

Groupe BPCE announces the signature of a memorandum of understanding with Société Générale with a view to acquiring the activities of Société Générale Equipment Finance (SGEF). The transaction is expected to be completed for first-quarter 2025.

Natixis CIB announces the extension of Natixis Partners’ minority participation in Clipperton, a boutique specializing in mergers & acquisitions advisory services in the tech sector.

Banque Populaire mobilizes to promote access to healthcare in all regions and offers the Zero Medical Desert Loan to its new professional healthcare customers.

Banque Populaire and Caisse d’Epargne announce the launch of a new exclusive remote monitoring offer with Verisure, French leader in remote monitoring.

With the planned acquisition of HSBC Epargne Entreprise, Natixis Interépargne strengthens its leadership in the employee savings and retirement market in France.

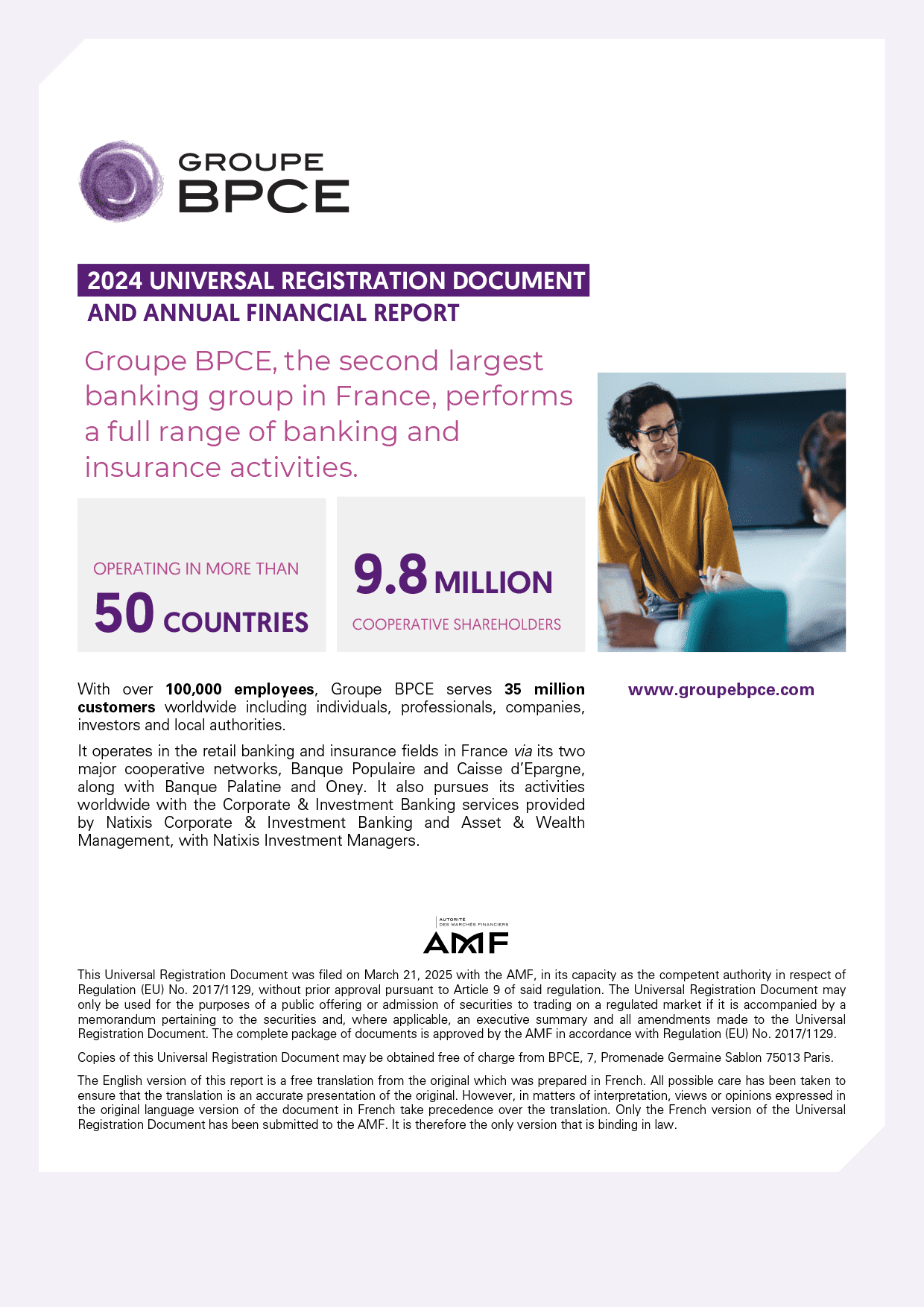

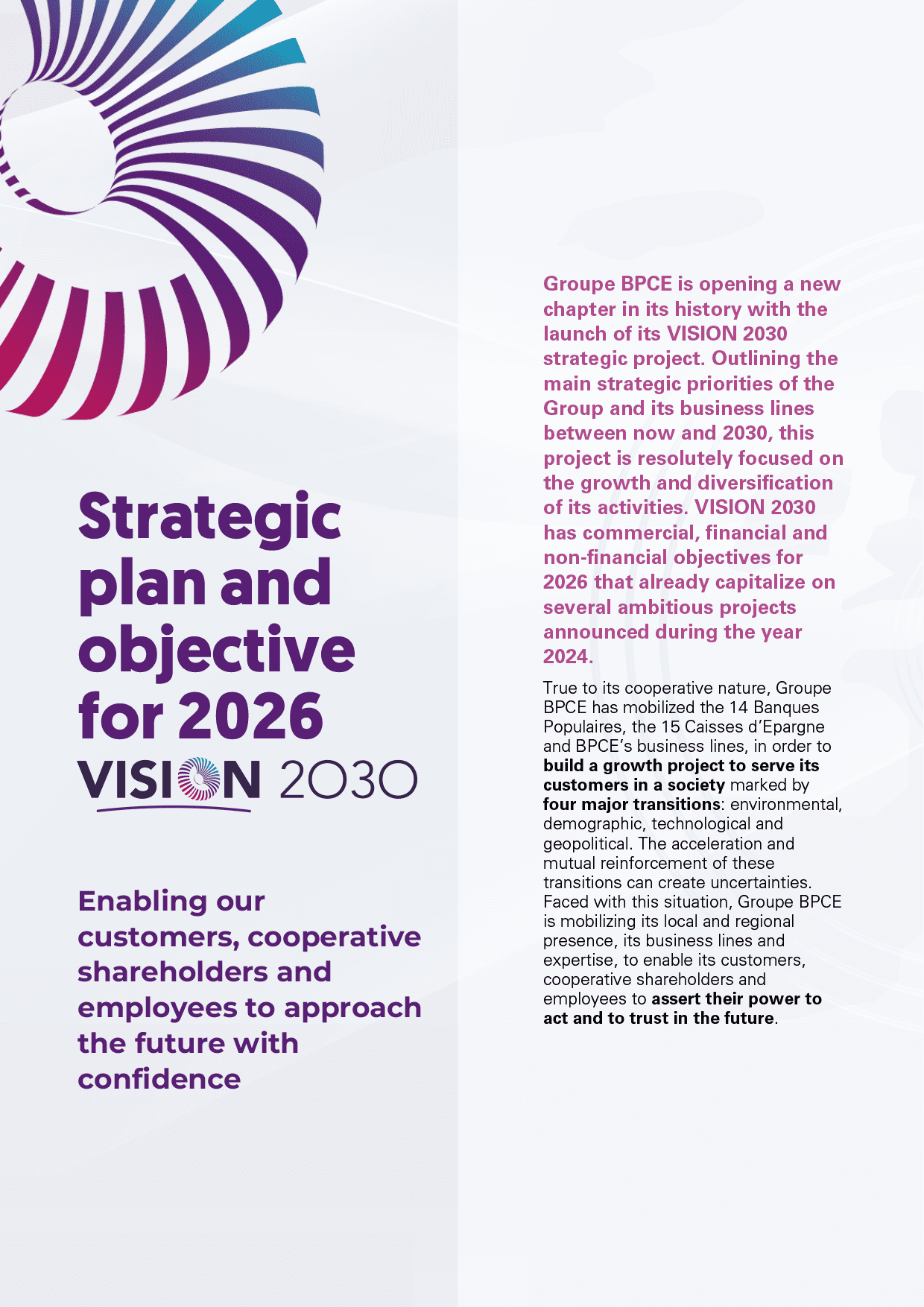

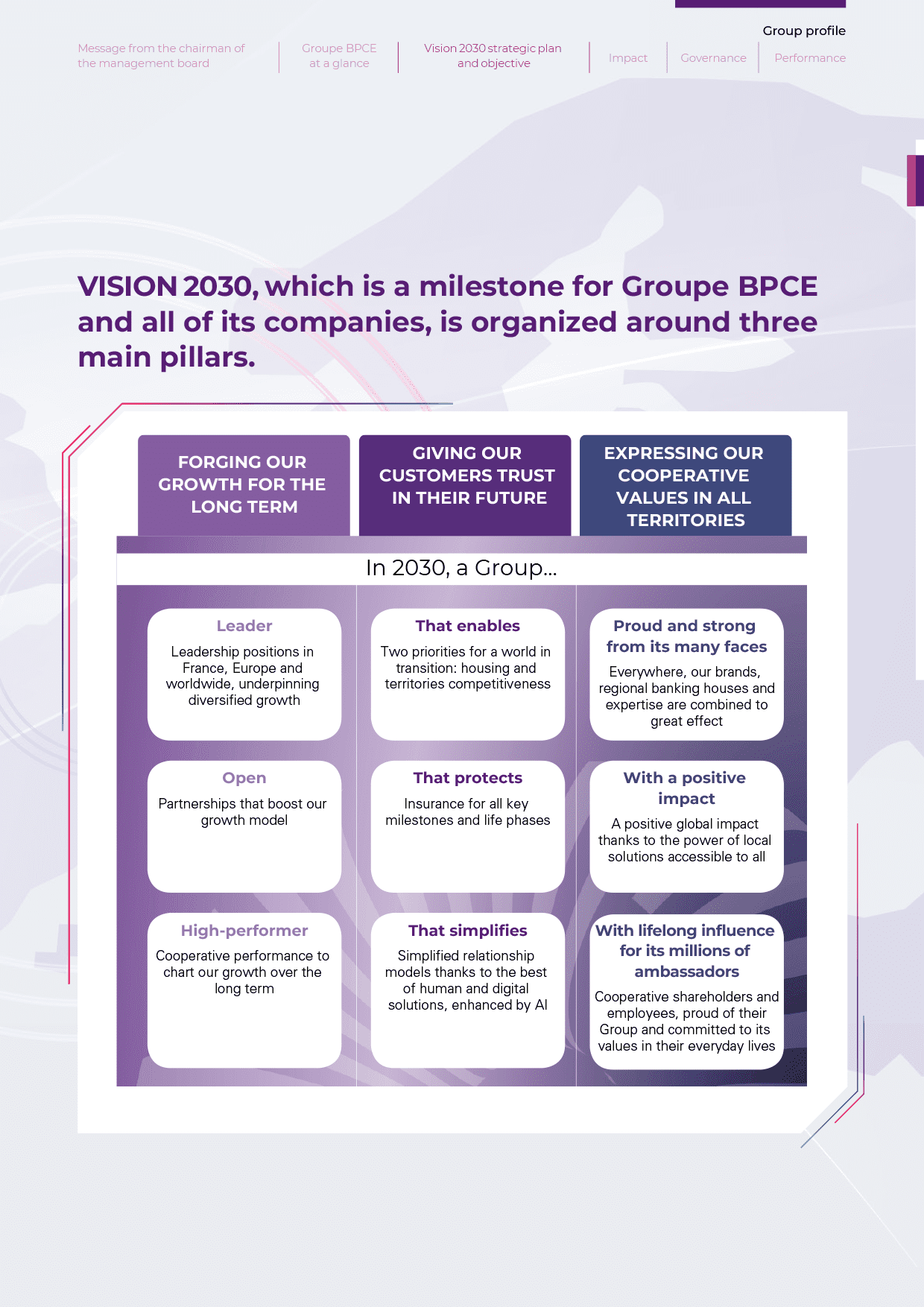

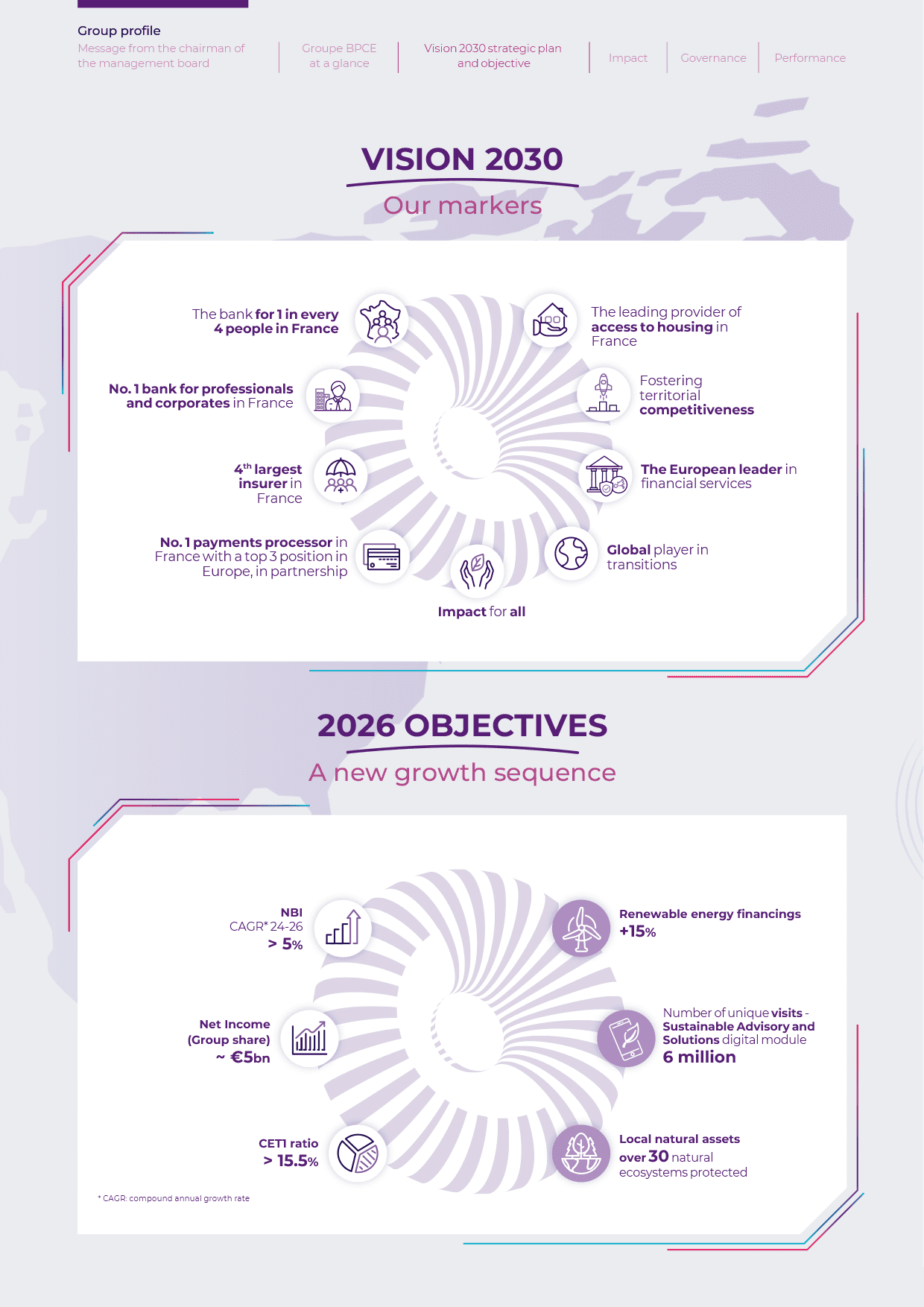

Groupe BPCE opens a new chapter in its history with the launch of its VISION 2030 strategic project.

Banque Populaire, Caisse d’Epargne and Oney forge a partnership with Leroy Merlin to offer their customers a turnkey experience with a comprehensive, integrated solution.

Natixis CIB announces the strategic investments of Natixis Partners in two M&A boutiques: Tandem Capital Advisors (Belgium) and Emendo Capital (the Netherlands).

BNP Paribas and BPCE forge a strategic partnership to create the No. 1 payment processor in France, in the top 3 in Europe.

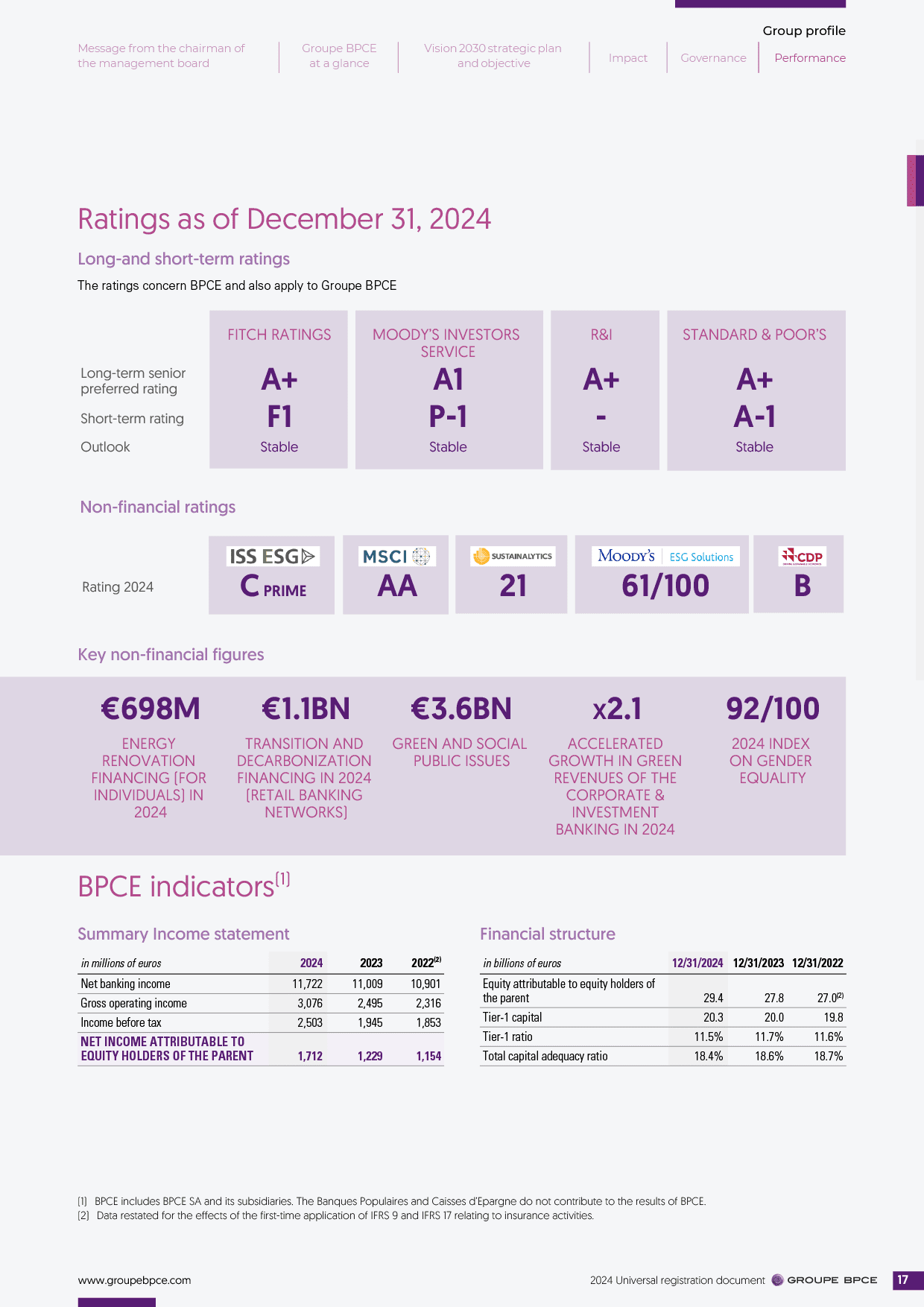

The Standard & Poor’s agency improves Groupe BPCE’s long-term rating, which now stands at A+ with a stable outlook. This rating places the Group at the best European standard.

Caisse d’Epargne Hauts de France announces the signing of a memorandum of understanding with Dajia Insurance Group to acquire 100% of the share capital of Bank Nagelmackers, the oldest bank in Belgium.

Groupe BPCE publishes its new decarbonization commitments for five industrial sectors (aluminum, aviation, commercial real estate, residential real estate, and agriculture) and announces an extension of the scope of its objectives in three sectors already covered (automotive, steel, and cement).

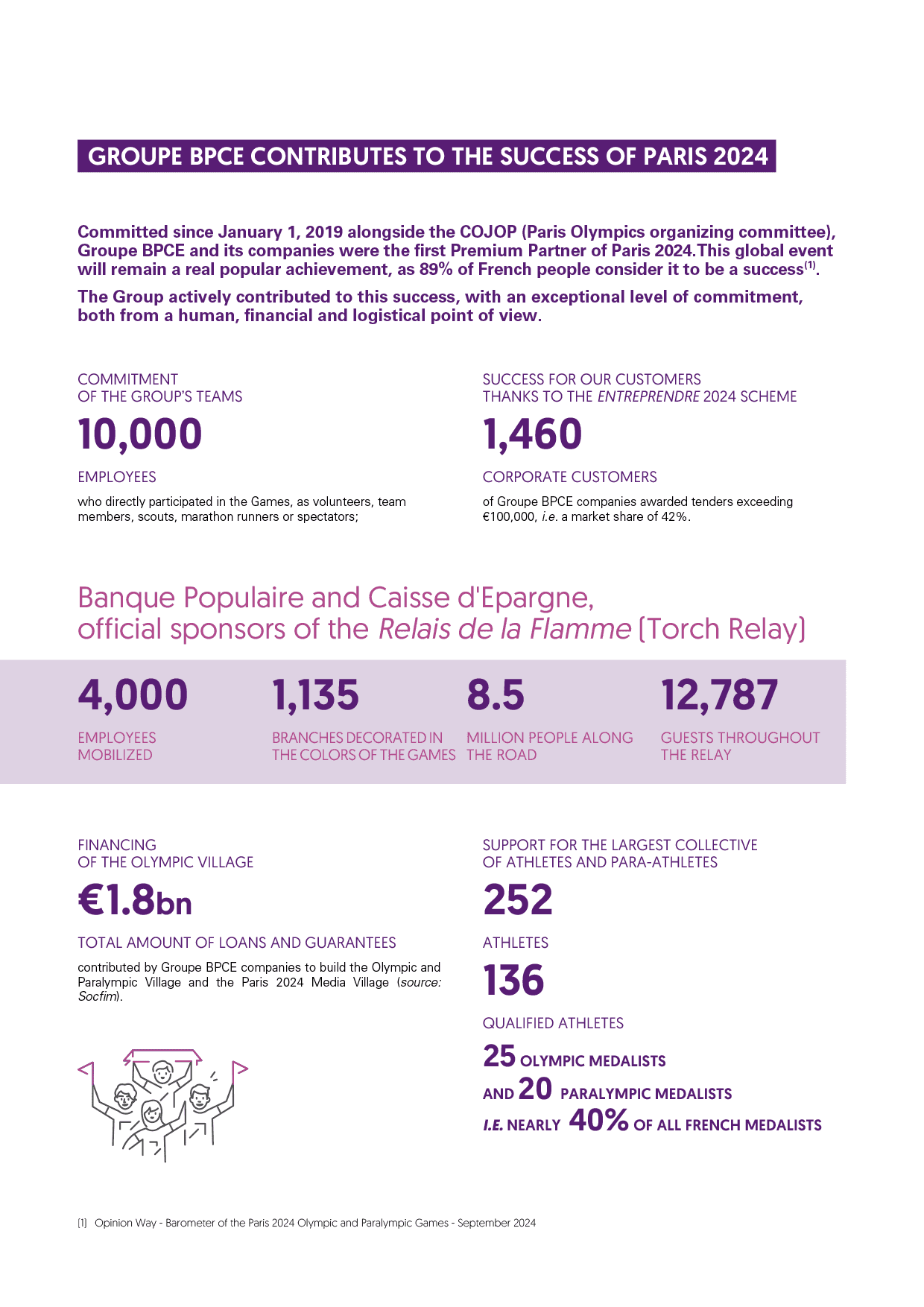

Groupe BPCE is the first Premium Partner of the Paris 2024 Olympic and Paralympic Games. This partnership was signed in 2019.

With the launch of the CATVair and CATVert term accounts, the Banques Populaires and the Caisses d’Epargne offer their customers the opportunity to become players in the energy transition in their regions through their savings.

BPCE acquires iPaidThat in order to have an all-in-one digital financial management solution for the professional and VSE-SME customers of the Banques Populaires and the Caisses d’Epargne.

Banque Populaire and Caisse d’Epargne innovate to facilitate home ownership for individual first-time buyers under the age of 36, by allowing them to borrow more to purchase their main residence and to defer the capital repayment over time up to a limit of 10% to 20% of the total amount financed.

To deal with the cybersecurity challenges faced by their customers in terms of protecting their data and their activities, the Banques Populaires and the Caisses d’Epargne offer a comprehensive, customized system to support their professional and corporate customers.

The European Investment Bank, the European Investment Fund and Groupe BPCE strengthen their partnership to support the financing of innovation and the energy transition of SMEs and mid-sized companies in France, with a total budget of more than €1 billion.

BPCE launches its first “Social Bond” with share coupon with the assistance of Natixis CIB. This social bond, issued for the benefit of the Institut Robert-Debré du Cerveau de l’Enfant supported by the Fondation de l’Assistance Publique - Hôpitaux de Paris, was placed entirely with leading French institutional investors.

Banque Populaire reaffirms its commitment to innovative companies through three key initiatives: the signature of a partnership with the Start Industrie association, an organization representing French industrial start-ups and scale-ups, and two new financing agreements with the European Investment Bank and the European Investment Fund.

-

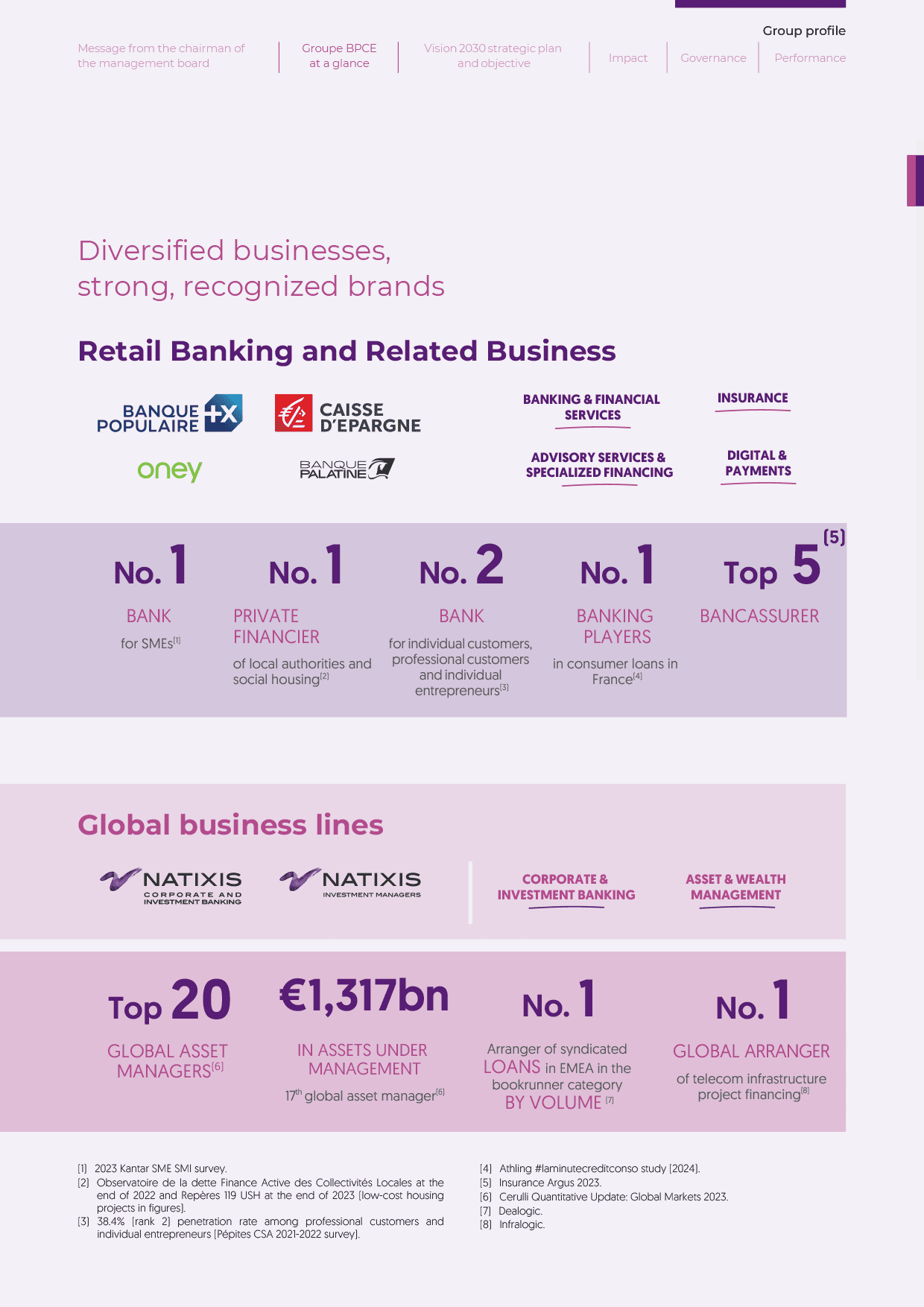

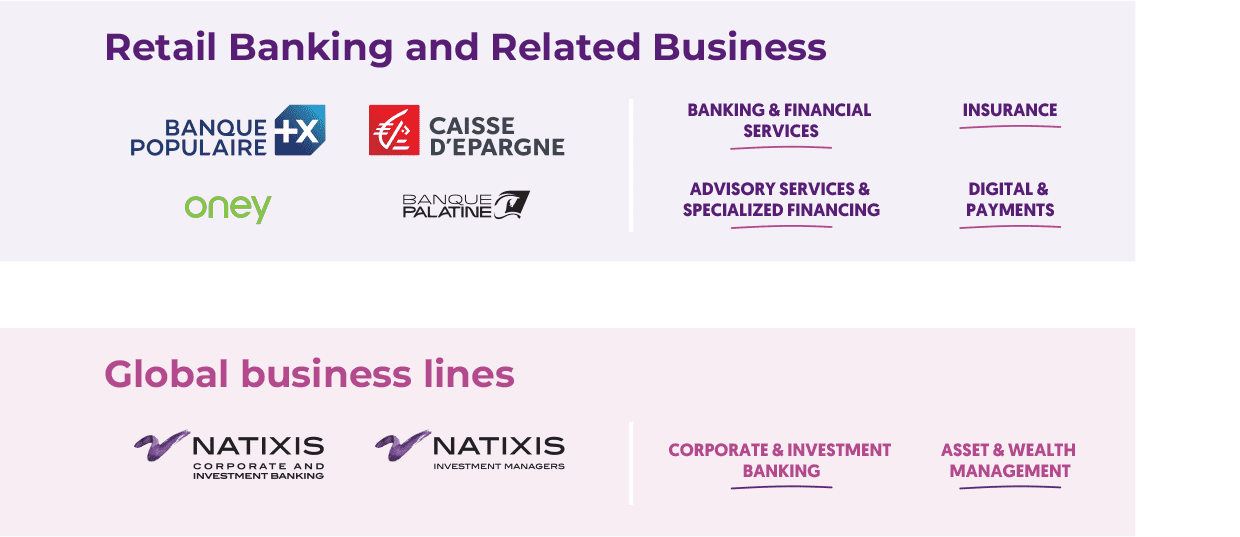

1.4 The Group’s business lines

1.4.1 Retail Banking and Insurance

The 14 Banques Populaires are shareholders in BPCE on an equal footing with the Caisses d’Epargne, and are fully-fledged banks owned by their cooperative shareholders. They form a first-rate banking network made up of 12 regional Banques Populaires and two national affinity banks: CASDEN Banque Populaire, the benchmark bank for the French public sector, and Crédit Coopératif, the bank for the social and solidarity economy.

The Banques Populaires are actively involved in local communities and remain true to their entrepreneurial roots, providing their individual, professional, association, corporate and institutional customers with a full range of financing, savings, insurance, payment and specialized financial services (such as private management, leasing, factoring and social engineering).

The Banques Populaires are wholly-owned by their cooperative shareholders. The strength and durability of their cooperative model is based on balanced governance. Members are cooperative shareholders, co-owners of their bank’s capital, through the purchase of shares. They elect the directors, who are committed local personalities, at the General Meeting, reinforcing the local character of Banque Populaire institutions.

Each year, the Banques Populaires measure the cooperative and responsible actions they carry out in their regions, mainly in three areas: local proximity, entrepreneurial culture, and cooperative and sustainable commitment. These actions are listed in the cooperative and societal footprint, a tool based on ISO 26000 (the international standard for CSR) which references all the voluntary, non-regulatory and non-commercial actions carried out by the 14 Banques Populaires. As an indication, in 2023, more than 6,400 actions were carried out for an amount of nearly €200 million.

IN 2024

- The Banques Populaires innovated by launching the first packaged responsible incentive contract for their corporate customers.

- The Banques Populaires reaffirmed their role as key partners of farmers, in particular by implementing support measures to help them overcome their cash flow difficulties.

- The Banques Populaires strengthened their positioning with healthcare professionals, notably with the launch of several dedicated solutions.

- The Banques Populaires rolled out their new strategy for young people around three initiatives: the launch of the young entrepreneurs package, the introduction of free international operations, and the launch of the Nathan tutoring offer for the children of their customers.

- Premium Partners of Paris 2024 and Official Sponsors of the Relais de la Flamme (Torch Relay) of Paris 2024, the Banques Populaires were strongly committed to the success of the Games (Refer to section 1.3 Highlights / Groupe BPCE contributes to the success of Paris 2024).

In terms of activity, the year 2024 was marked by a slowdown in the real estate market which had an impact on the momentum of winning new customers: the Banques Populaires recorded a 10.3% decrease in the number of new customers in the retail market.

In Consumer Loans, the pace of development remained brisk, with growth of 1% in production, in line with previous years.

The number of principal active banking customers continues to grow, with stock growth of 1.5%, to 4.65 million principal active banking customers.

In non-life insurance (IARD) and personal protection insurance, the Banques Populaires recorded a decrease of 4% in total gross sales, with a stable sales volume on motor vehicles and a decrease of 4% on the sales of multi-risk home insurance policies, in line with the reduction in the home loan activity. Regarding personal protection, overall sales were stable with significant contrasts in performance between the various solutions: MAV (multi-risk personal accidents) recorded an increase of +15% in the gross sales volume; on the other hand, performance was down on family insurance (-3%) and precautionary insurance (-12%). The range was enhanced with a remote monitoring solution, in partnership with Verisure.

The new youth strategy was rolled out around three initiatives: the launch of the young entrepreneurs package, combining the opening of a personal bank account and a professional account at a competitive price, a dedicated advisor, and extra-banking services including a training platform specific to entrepreneurship, developed in partnership with the Conservatoire National des Arts et Métiers (CNAM); the introduction of free international transactions (concerning international withdrawals and payments by card, with no ceiling limit, for all their customers aged 18 to 28 with a banking package); lastly, the launch of the Nathan tutoring offer for the children of Banque Populaire customers (with free access to the myMaxicours tutoring platform throughout the school year).

The digital bank savings pathways were strengthened with the selfcare deployment of several products (Livret de Développement Durable (LDD) passbook savings accounts, home purchase savings schemes and Livret Jeunes youth passbook savings accounts, Livret dépôt solidaire deposit passbook savings accounts and CASDEN Banque Populaire passbook accounts). This change meets a real expectation, as illustrated by the number of Livret A passbook savings accounts opened in selfcare in 2024 (34,000).

Lastly, Banque Populaire innovated in the field of payment wallet solutions with the launch of solutions in partnership with SwatchPay!, Garmin Pay and Google pay.

- €15.3bn in new loans, -15.9%

- €152.3bn in loan outstandings, -1.7%

- €201.7bn in savings deposits, +3.0%

- 309,091 new non-life insurance policies (IARD)

PRIVATE MANAGEMENT

In 2024, the Banques Populaires’ activity was sustained in private banking, with an increase in total customer outstandings of +3.2%.

The percentage of on-balance sheet savings increased by 177 points over a rolling 12-month period, thanks to the strategy of supporting non-equipped customers and the conduct of digital marketing actions. At the same time, the Banques Populaires strengthened their green offering with the launch of the CAT VAIR, which meets the needs of their customers looking for responsible, sustainable and environmental investments. Business was also buoyant in life insurance thanks, in particular, to loan issues and protected structured fund solutions; gross inflows from life insurance amounted to €4.03 billion. In individual retirement savings (PERI), a solution favored by French people, the Banques Populaires recorded 35,000 new contracts, an increase of +40% in the number of contracts.

Lastly, concerning financial savings, 2024 was marked by the launch of funds dedicated to sport (€153 million were invested) and solutions to address transition issues (€221 million were invested in Article 9 funds across all individuals and legal entities markets).

Overall, customer satisfaction increased with an NPS of +38. The quality of all these solutions was recognized at the 39th edition of the “Corbeilles” of the monthly Mieux Vivre votre Argent magazine: Banque Populaire was awarded 3rd place in the long-term five year “Corbeille” category.

- 579,145 customers, +2.7%

- €113bn under management, +3.70%

In an uncertain economic environment, the Banques Populaires reaffirmed their commitment to their customers, craftspeople, retailers, self-employed professionals and farmers, at each stage of their projects: creation/installation, development, disposal/ transmission. This commitment was reflected in the good resilience in the acquisition of new customers, albeit with a contraction of -4.9%.

In the emblematic franchise market, Banque Populaire remains the leader in the franchisor segment (with 60% of the Banques Populaires customer franchise networks) and in the franchise segment (with 25% penetration rate).

Despite a difficult economic situation in certain sectors of activity (construction/masonry, agriculture, clothing, etc.), credit flows held up well, at €162.8 billion, a very slight decrease of -0.2% on the previous year. The intensity of the relationship with professional customers also increased, with an increase in the number of active equipped customers of +2.7% year-on-year and an increase in the number of customers with dual active relationships by +3.7 %.

In terms of financing, equipment loans to professionals recorded a further decline but which was less significant than in 2023. This decrease is the result of a slowdown in demand for financing, in a context of economic and political uncertainty. Conversely, the number of equipment leasing financings increased by +2.1%, confirming the Banques Populaires’ commitment to support professionals in their development projects.

In insurance, the number of contracts sold rose by +7%, a trend driven by professional motor insurance (+10%) and personal protection (+6%).

In employee savings, a +30% increase in outstandings was recorded, reflecting customers’ growing need to prepare for retirement.

Lastly, the number of premium cards rose by +2.1%, boosted by the partnership with Visa in connection with the Paris 2024 Olympic and Paralympic Games.

This dynamic activity was accompanied by a historically high level of customer satisfaction, with an NPS of +23.

In the context of the crisis in the agricultural sector, it reaffirmed its role as a key partner of farmers, by implementing support measures to deal with the cash flow difficulties encountered by the profession.

- The NEXT SANTE affinity platform, which offers advice and practical information to all healthcare professionals, regardless of their specialty, and gives access to a dedicated Banque Populaire expert;

- Financing of €150 million, in partnership with the European Investment Bank, to facilitate the installation of new practitioners, in particular in high-tension areas in order to offer better access to local care in the regions;

- Finally, the “Zero Medical Desert Loan”, a 0% financing up to €20,000, to encourage doctors to set up in medical deserts.

The year was also marked by the strengthening of the Banques Populaires’ positioning as preferred partners of accountants thanks to the launch of new dedicated offers, such as the electronic invoicing offer of the subsidiary iPaidThat, acquired by Groupe BPCE in 2024.

- 1.2 million professional customers

- 558,632 tradesmen

- 185,517 liberal professionals

- 76,319 farmers

- €74.7bn in loan outstandings, -1.0%

CORPORATE CUSTOMERS

In 2024, Banque Populaire continued its drive to win over corporate customers (more than 9,500 new customers), with a particularly marked increase in the mid-sized companies segment (almost +10%), in line with its strategic mid-sized companies program. This momentum can also be seen in the intensity of relationships with positive growth in active and active equipped customers, and a customer stock that recorded growth of more than 3.5%. This change is reflected in a significant increase in credit flows entrusted by corporate customers and the symbolic crossing of the €500 billion mark over a rolling year. On the credit side, investment loans are up by 2% in 2024 and short-term loans are holding up positively. In line with the Climate priority of Groupe BPCE’s VISION 2030 strategic project, the Banques Populaires continued to support the ESG transition of their customers in 2024. Following the deployment of the “BP impact” loan throughout the country in 2023, subscriptions accelerated with a 3.5-fold increase in the number of contracts and a +46% increase in production by amount. Same focus on green financing with an increase in production of +2%. A collaboration with the Impact France movement was also launched to promote the impact score among business leaders. To meet companies’ transition challenges, the Banques Populaires offered tools to support the digital transition, in particular for new payment methods and digital monitoring, thanks to the full digital management of international transactions, transfers with GPI Tracker, or their trade activities with Trade Tracker. Protection against cyber risks is not neglected around three lines of security: anti-fraudulent email software and training for employees, in partnership with Mailinblack; cyber security insurance offers; and tools against banking fraud with SuiteEntreprise.com. Lastly, Banque Populaire broke new ground by launching the first packaged responsible incentive contract. It makes it possible to involve all employees in the company’s results and to increase the incentive bonus thanks to the achievement of CSR criteria. In addition, in 2024, the number of customers supported by employee savings plans was up by +32%.

- 164,259 corporate customers, +3.7%

- 268,691 non-profits and institutions, +2.0%

- No. 1 bank for corporates, 44% are customers

- €44.0bn of medium- and long-term loan outstandings

One year after its launch, Banque Populaire’s communication territory continued to focus on a buoyant discourse on successes. Thank to a constant presence via radio, Internet, social networks, billboards ..., the brand gained ground in terms of spontaneous notoriety, particularly with its historical targets: professionals (+4 points) and companies (+5 points). The year will, of course, remain marked by the Paris 2024 Olympic and Paralympic Games, for which Groupe BPCE was the first Premium Partner. The global success of the event reflected on Banque Populaire, which was the Official Sponsor of the Relais de la Flamme (Torch Relay). The brand generated 1,000 medoa mentions and 259 million contacts through the media. It also reached 8.5 million spectators along the roadsides and at celebration sites.

CASDEN BANQUE POPULAIRE

CASDEN Banque Populaire, a cooperative bank serving specifically members of the French civil service, continued its development. In 2024, it won over 79,798 new cooperative shareholders, of which 66% came from the civil service excluding National Education. Among these new CASDEN cooperative shareholders, 52,380 are also Banque Populaire customers. Today, it brings together nearly 2,359,980 Cooperative shareholders. In 2024, CASDEN maintained its level of new home loans, in a tense market with the distribution of nearly 12,000 home loans. In order to facilitate the first-time home ownership of young civil servants, the Starden Immobilier loan, previously reserved for cooperative shareholders under the age of 30, is now available up to the age of 35, in order to finance a principal residence at a fixed rate. The Real Estate Starden Loan is cumulative with the PTZ (interest-free loan) and the “PTZ + X” (additional loan to the PTZ, granted up to €25,000, up to double the limit of the PTZ). As part of its premium partnership with the 2024 Paris Olympic and Paralympic Games, CASDEN launched the CASDEN Sport loan to encourage its members to take part in sports by enabling them to finance their sports equipment. CASDEN Banque Populaire is committed to supporting its Cooperative shareholders in terms of the ecological transition. With the Cozynergy offer, CASDEN offers them a turnkey service to carry out their energy renovation work. It was the leading Banque Populaire bank on leads for the Cozynergy offer in 2024. And, out of more than 1,500 cooperative shareholders who have completed their projects, 85% are satisfied with its support and 90% believe that the solutions proposed have enabled them to better control the cost of their work. Parnasse Garanties, a surety insurance subsidiary held by CASDEN Banque Populaire at 80% and by MGEN at 20%, now insures the new guarantees of the MGEN mutualists and the entire portfolio of MGEN stock has been transferred to it. More than 57,000 guarantees were taken over by Parnasse Garanties, representing more than €2 billion. The diffusion of the “History, sport and citizenship” exhibition, created with the ACHAC research group continued in schools and public sector establishments. Placed under the high patronage of Emmanuel Macron, this educational program on the history of the Olympic and Paralympic Games is part of the Heritage of Paris 2024 component. Nearly 9,000 events were organized around the exhibition, already having attracted 8.5 million visitors. Finally, the third edition of the Défi des Pas, a sporting and solidarity-based challenge organized by CASDEN and Banque Populaire, raised €30,000 for the Fondation des Hôpitaux.

- More than 2.3 million cooperative shareholders.

- More than 10,000 activists: 248 CASDEN delegates and 10,080 correspondents

As a reference bank for the social and solidarity economy, real economy companies and committed individual customers, Crédit Coopératif is committed alongside its customer-cooperative shareholders to build a fairer, more inclusive, more local economy that is respectful of the environment.

In 2024, Crédit Coopératif recorded an increase in its customers, particularly individual customers (+4.2%). This momentum is reflected in a significant increase in the number of cooperative shareholders, both legal entities (+4.9%) and individual customers (+11.6%).

In the retail market, the launch of the Family plan was one of the highlights of the year. This traced bank account includes an Agir solidarity bank card and the possibility for each family member to personalize their commitment and choose the association they wish to support via a micro-donation system. This solution offers a single and advantageous monthly contribution for the entire family, while preserving everyone’s financial autonomy.

Other solutions have been launched, such as the Millevie retirement savings plan, which provides additional income for retirement while opting for savings with a positive social and environmental impact.

In line with the challenge of offering the same service face-to-face or remotely, online banking continued to expand its services with the online subscription of non-life insurance policies (IARD) and the PER (retirement savings plan), and online payments without providing a bank card number.

At the same time, after Toulouse and Lyon, a third branch dedicated to Individual customers was created in Grenoble. Lastly, customer satisfaction is up sharply with an NPS of 35.

In the legal entity market, two offers were launched in collaboration with recognized partners: Iremia santé (a specialist in the management of third-party payment and administrative conduct of healthcare professionals, which supports customers in managing third-party payments (tiers payant) and reducing payment terms), as well as Mailinblack (cybersecurity experts who offer solutions to combat IT attacks) for the security and peace of mind of its customers on a daily basis.

The “Tap to Pay” solution was also offered to customers with a compatible Android smartphone or tablet. Thus, Crédit Coopératif offers a payment solution adapted to all types of customers, from one-off needs to expert solutions.

Lastly, Crédit Coopératif supported its legal entity customers in their ecological transition by deploying strategic ESG interviews on a massive scale.

- 138,516 cooperative shareholders

- 423,048 customers

- Over €7.1 million in donations, raised from solidarity-based products, distributed to 59 associations

- €2.7bn in new amortizable loans paid (+47%)

The 15 Caisses d’Epargne are equal shareholders of BPCE with the Banques Populaires, and are fully-fledged regional cooperative banks. Committed to local community life, they offer their individual, professional, association, corporate, institutional and local authority customers a comprehensive range of financing, savings, private management, insurance, payment and specialized financial services (such as leasing and factoring). They make decisions and act locally, in a short circuit, and reinvest their customers’ savings where they live to finance useful projects close to home (schools, hospitals, associations, etc.).

As cooperative banks, the Caisse d’Epargne belong solely to their 4.4 million cooperative shareholders, who participate in the decisions of their bank, voting on resolutions at the General Meeting and electing their representatives, the 2,500 Directors, from among their peers. Cooperative shareholders and directors are brought together in the local savings companies (LSC), which hold part of the capital of a Caisse d’Epargne and constitute a local tier, reinforcing the regional anchoring, proximity and expression of the cooperative shareholders.

The Caisses d’Epargne are the only banks to provide long-term support to all players in a given region: individual customers, businesses, professionals, social housing and social and solidarity economy players, institutions, local authorities and associations. As such, they have the capacity to create the synergies required for local development.

In 2023, the 15 Caisses d’Epargne launched their Utility Contract to strengthen their commitment to the regions, for the benefit of those who live there.

- 100% useful to economic development: as banks serving all their customers and their territory, but also as local businesses and major employers in the region;

- 100% useful to the environmental transition: by building solutions to enable everyone to become a player in this transition, and by financing projects that will help accelerate it in local areas;

- 100% useful to social progress: as cooperative banks, having always been committed to the principles of solidarity and the fight against exclusion.

IN 2024

- The Caisses d’Epargne strengthened their customers’ insurance equipment thanks to the development of a global strategy on protection, property insurance, personal risk insurance and remote monitoring.

- The Caisses d’Epargne have launched many innovative payment solutions in partnership with Garmin Pay, SwatchPay and Google Pay, as well as the peer-to-peer solution, WERO.

- The Caisses d’Epargne were one of the lead arrangers of the first French gigafactory project, “Verkor”, established in Dunkerque.

- The Caisses d’Epargne confirmed their commitment to the sports sector through the distribution of the EIB budget for the renovation of sports facilities and participation in the “swimming pool plan”.

- The Caisses d’Epargne, Premium partners of Paris 2024 and Official Sponsors of the Relais de la Flamme (Torch Relay) of Paris 2024, were strongly committed to the success of the Games (Refer to section 1.3 Highlights / Groupe BPCE contributes to the success of Paris 2024).

Supporting young people and families has been a common thread in the strategy of the Individual customers market, with a strong challenge to win new customers and provide access to banking services.

The household mortgage market share was 14.02%, up +19 basis points year-on-year. The Caisses d’Epargne have rolled out several innovative solutions to support their first-time home buyer customers, particularly young people under the age of 35.

Supporting households in the energy renovation of their homes remained a priority in 2024 with the launch of an impact real estate loan offer and a large-scale Renov’ énergie campaign on the financing of works.

In terms of inflows, activity was particularly dynamic in life insurance with gross inflows of €13.7 billion, generating an overall surplus of €4.3 billion. This activity was boosted by the marketing of three Natixis CIB loans and the deployment of a support approach for customers to prepare for their retirement.

The Caisses d’Epargne have also strengthened their customers’ insurance equipment thanks to the development of a global strategy for protection, property insurance, personal risk insurance and remote monitoring - thanks to a partnership with VERISURE.

In the field of payments, the Caisses d’Epargne have launched numerous innovative solutions in partnership with Garmin Pay, SwatchPay and Google Pay, not to mention the peer-to-peer payment solution, WERO. In the end, the Caisses d’Epargne maintained their strong growth in customer satisfaction in the retail market with an NPS of 23, i.e. +7 points compared to 2023. The favorable trend in satisfaction also concerns young customers, with a 4-point increase in NPS over 18-24 year olds.

- €207.7bn in loan outstandings, +0.8%

- €408.1bn in savings deposits, +3.4%

- €13.7bn collected in life insurance, +1.1%

- 6.5 million non-life insurance contracts marketed, +2.1%

PRIVATE MANAGEMENT

The Caisses d’Epargne continued their acquisition momentum with 160,000 new Premium customers and growth of €6 billion in outstandings. In total, 3.4 million customers entrust the Caisses d’Epargne with a total amount of €312 billion in savings. The momentum around life insurance and Individual Retirement Savings Plans was particularly noteworthy, with an inflow of €10.5 billion and surpluses exceeding €3 billion. At the same time, banking services increased, with 70% of principal banked customers, as well as equipment in loans, insurance and protection. The satisfaction of high net-worth customers is constantly increasing, with a net promoter score (NPS) of +29.

- 3.4 million Premium customers

- €312bn in assets under management, +3.31%

The Caisses d’Epargne remain the leading bank for protected persons, persons under guardianship, trusteeship and dependent adults living at home in France. Across France, 200 specialized advisors are on-hand to assist family representatives and legal guardians.

The year was marked by the generalization of the new version of Webprotexion, an online banking service for family or professional representatives of people under legal protection.

PROFESSIONAL CUSTOMERS

Despite a tense economic context, more than 44,000 new Professional customers were gained, representing growth in the customer base of 2.1% year-on-year. Thanks to numerous actions implemented in synergy with the Premium market, the stock of customers with dual Premium relationships increased by 6.4% to reach more than 87,000 customers. In 2024, the Caisses d’Epargne strengthened their positioning as privileged partners of healthcare system players, including healthcare professionals, through several actions:

- The launch of the “EIB Health Pros Budget” subsidized-rate financing offer made available by the European Investment Bank and dedicated to business creation or recovery projects;

- The provision of SantExpert, an online space dedicated to healthcare professionals;

- The development of key partnerships with renewed support for the ISNI (InterSyndicale Nationale des Internes) for the second year running in order to provide long-term support to medical interns and future healthcare professionals. Two new partnerships were forged: one with CERP Rhin Rhône Méditerranée (merged with CERP Rouen in July 2024) to support the installation of young community pharmacists and the other with Médecins Solidaires, to support the development of the association that fights against medical deserts in rural areas.

Among the other highlights of the year, the Caisses d’Epargne launched new non-banking offers: remote monitoring with Verisure and meal and gift vouchers with Swile.

Lastly, the digitalization of customer journeys continued with the development of two new self-care subscription pathways on the Retirement Savings Plan and Tap to Pay offers.

- 447,241 customers, +2.2%

- €4.3bn in loan outstandings

- 8,560 employee savings contracts signed

- 16,716 Pro non-life insurance policies (IARD) taken out

- 34,522,109 personal protection insurance contracts subscribed

With more than 38,800 customers (VSEs, SMEs and mid-sized companies), the Caisses d’Epargne continued their commitment to business development in 2024. As a reference partner for the regions, they have fully played their role with all economic players to promote their growth and that of the regions, not only by meeting their financial needs but also by supporting them in their transition challenges.

The Caisses d’Epargne confirmed the acceleration of their support for the decarbonization of the economy through the deployment of a strategic ESG dialog with business leaders, the increase in their production of green financing and the increase in power of the marketing of Impact Loans dedicated to SMEs and mid-sized companies. In concrete terms, they encourage companies to integrate more non-financial criteria into their activities. This system has been audited by Moody’s ESG Solutions, one of the world leaders in ESG (Environment, Social and Governance) analyses.

This year, the Caisses d’Epargne anticipated significant regulatory and societal changes to provide their corporate customers with genuine support.

The law on value sharing requires companies with 11 to 49 employees to set up a legal value-sharing scheme, as of January 1, 2025.

E-invoicing becomes mandatory for all companies subject to VAT in France, between July 1, 2024 and January 1, 2026, requiring the choice of a platform for the exchange of invoices.

Finally, cybersecurity has become a priority because it is no longer a question of knowing “if” a company is at risk of malicious cyber acts, but “when” it will occur.

In response to all these challenges, Caisse d’Epargne has structured its offers and strengthened its awareness-raising process around these crucial themes.

In the agricultural sector, the member cooperatives of the UFG (Union Finances Grains) were supported by the implementation of the NeuCP (Negotiable European Commercial Paper) program. This issue of short-term negotiable securities represented a credit line of around €132 million for the Caisse d’Epargne network.

The Caisses d’Epargne also confirmed their position as Industry bankers. Their average penetration rate is 20%, including industries both inside and outside of energy.

Through its Néo Business program, the Caisses d’Epargne continued to support the development of innovative companies throughout France and in all business sectors. They now support 2,000 start-ups/scale-ups in their growth with dedicated solutions.

- 38,807 customers (+3.4%)

- 3,352 new relationships (-8.6%)

- €34.1bn in MLT loan outstandings (+1.7%)

- €3.3bn in MLT commitments (excluding CBM & CBI)

- €19.4bn in term deposit outstandings (+12.9%)

FINANCIAL ENGINEERING

The Caisses d’Epargne’s financial engineering activity is growing. It reached €128 million in net fees and commissions generated in 2024, up 25% year-on-year. Over the duration of the 2020-2024 strategic plan, the amount of net fees and commissions generated was multiplied by four. This level of performance validates our choice of organization of the activity around financial engineering teams located locally, as close as possible to the operations and regions, supported where necessary by the action of Groupe BPCE’s subsidiaries and specialized structures.

In terms of private equity activities, the activity of the Regional Investment Companies combined with the support of national vehicles generated a capital gain of approximately €20 million.

In addition, in 2024, a new debt fund, backed by a syndication desk, was launched. Fully subscribed by the Caisses d’Epargne for an amount of €535 million, it meets the financing needs of mid-sized companies. By creating this original system, the Caisses d’Epargne are opening up a new asset class to institutional investors, those of regional mid-sized companies, and enabling these mid-sized companies to diversify their sources of financing at the best price while benefiting from the support of their long-term operations.

Lastly, the Caisses d’Epargne supported emblematic projects in 2024. Drawing on the resources and expertise of the renewable energy and energy transition debt fund launched in 2022, they were among the lead arrangers of the Dieppe le Tréport and Yeu Noirmoutier offshore wind farms, as well as the first French gigafactory project, “Verkor”, located in Dunkerque.

The Institutional market is facing many transitions that require very heavy investments. As such, I4CE (the French Institute of the Economy for the Climate) calculates the additional need for energy, transport and decarbonization for local authorities at €11 billion per year. As for social housing, 1.2 million housing units must undergo an energy-efficient renovation before the end of 2025.

In this context, the Caisses d’Epargne confirmed their presence with their customers to serve the regions. They remain the leading private banks for local authorities, with €26 billion in outstandings and almost €2.7 billion in new financing loans. They are also the leading private bankers for social housing, with Habitat en Région, and for the semi-public sector, with over €2.1 billion in new MLT loans and €11.2 billion in MLT loan outstandings. At the end of December 2024, inflows totaled €9.4 billion (including demand deposit accounts).

In the Professional Real Estate market, the decline in new construction activity continued. Short-term financing for real estate professionals, developers and property dealers was down -10.5%. Long-term financing remained stable at +3.4%.

In 2024, the Caisses d’Epargne confirmed their commitment to the sports sector through the distribution of the EIB budget for the renovation of sports facilities and participation in the “swimming pool plan” alongside Union Sport et Cycle.

In addition to the ESG questionnaires and the distribution of green or impact loans, the Caisses d’Epargne’s commitment to the ecological transition was further strengthened through their participation in the Métamorph-OSE program. This Groupe BPCE program operationally implements Groupe BPCE’s Impact strategy on BtoB customers. It is based on a new commercial approach, tools and specific training. It mobilizes elected officials, companies, associations and citizens to accelerate the process of solidarity and ecological transition in the regions.

Lastly, 2024 was marked by the equity merger with Finances & Territoires, a consulting firm specializing in public financing. This decision will enable the Caisses d’Epargne to establish a long-term approach to bank financing and maximum mobilization of support mechanisms for Institutional investors.

SOCIAL ECONOMY

Caisses d’Epargne is a leading financier of the SSE sector, with loan outstandings of €6.5 billion in 2024, and supports more than 20,600 customers, including associations and other SSE companies. In the field, 130 account managers, dedicated to this not for profit clientele, master all the legal, tax and governance specifics and business models unique to these associations, foundations and impact companies. Over 1,000 new relationships were entered into in 2024. This development is based on a long-standing partnership with the entire SSE ecosystem and social innovation support networks (ESS France, France Active, Impact France movement, La Ruche, etc.), as well as main industry federations (Nexem, FEHAP, FNOGEC, etc.). In 2024, a new national partnership was signed with Le Kiif, an alliance of ten incubators, located in nine French regions, which support the spin-off or development of socially innovative projects in rural areas

- 23.2% credit market share (source: Apri)

- €696m in new medium- and long-term loans

Official sponsor of the Olympic Torch Relay and Premium partner of Paris 2024, Caisse d’Epargne deployed an ambitious communication system for the benefit of the brand’s reputation and image: 4,500 press coverage mentions (TV, PQN, PQR), 8.5 million people present on the Relay route, the first advertising announcer of an opening ceremony followed by 24.4 million French viewers, more than 600 TV trailers broadcast during the Games. Caisse d’Epargne also launched several communication campaigns on essential topics for its customers, in particular, the energy transition (with a new TV film) and savings. At the same time, the brand strengthened its digital presence and launched a TikTok account for young people (5.5 million videos viewed).

In 2024, Caisse d’Epargne received 12 professional awards recognizing the performance of its communication systems (Grands Prix Stratégie, Top Com, Grands Prix du Sport Business, etc.).

Banque Palatine, a 100% subsidiary of Groupe BPCE, is mainly dedicated to mid-sized companies, executives and private banking. For more than 240 years, Banque Palatine has been working alongside entrepreneurs on both a professional and personal level. It provides them with a range of banking products (current accounts, real estate and personal loans, financial investments, financing solutions to meet environmental challenges) and insurance products. Its network consists of 36 offices in France.

Banque Palatine offers value-added expertise dedicated to supporting its customers’ growth and performance: wealth, legal and tax engineering, investment advice, global approach to managers’ assets, corporate finance, specialized approach to real estate, trade finance, customer desk, etc.

In the regulated real estate market, where the Bank is the market leader, and in the audiovisual market, where it is a key player, it deploys a dedicated national organization.

Its signature “The art of being a banker” illustrates Banque Palatine’s determination to develop a model of close relationships based on excellent support for its 13,500 corporate and 46,000 private customers.

Banque Palatine is notably a patron of the French Sports Foundation. Through this sponsorship, Banque Palatine finances the training, socio-professional integration and retraining of four top athletes.

In 2024, the drive to win over companies with revenues exceeding €15 million continued, with 248 new customers active in this segment. Banque Palatine recorded strong momentum in attracting private customers, executives and senior executives with 1,056 new relationships. Inflows in financial savings, equipment of customers with savings products, and the performance of wealth audits also showed a very good trend. On the other hand, the distribution of home loans is behind schedule by 25%.

Structured financing transactions recorded a sustained performance, generating income from fees and commissions of €12.9 million. At the same time, new corporate loans reached €2.2 billion, of which €0.6 billion in structured financing.

In terms of payments, Banque Palatine now offers transfer initiation, which allows companies and property managers to offer a new simple and secure means of payment for their collections and simplify their bank reconciliations.

In terms of innovation, Banque Palatine, with Groupe BPCE, conducted two pilots on generative AI technologies: one on reading and extracting the minutes of General Meetings in real estate, the other on the preparation of interviews between advisors and prospects or customers.

In 2024, Banque Palatine unveiled its purpose, the foundation of its new strategic plan “PALATINE 2030”, focused on three pillars: customers, risks and people and obtained the CSR Committed label from AFNOR.

BPCE Assurances is Groupe BPCE’s Insurance division. A fully-fledged insurer, it designs, distributes and manages a comprehensive range of personal and non-life insurance products for customers of Groupe BPCE’s banking networks:

- personal insurance: life insurance, retirement savings, borrower insurance and individual and professional personal protection insurance;

- non-life insurance: motor insurance, multi-risk home insurance, supplementary health insurance, personal accident insurance (GAV), multimedia equipment insurance, legal protection, parabanking insurance, professional car and multi-risk insurance, etc.

BPCE Assurances’ insurance subsidiaries (BPCE Assurances IARD, BPCE IARD, BPCE Vie, BPCE Life) do not distribute their products. The Group’s banking networks distribute their insurance(1) products.

Personal insurance business was dynamic during 2024, with gross inflows reaching €15.1 billion in savings, marking an increase of 17% compared to the previous year.

The year was marked by the launch, within the Crédit Coopératif network, of the Millevie retirement savings plan, which makes it possible to build up additional income for retirement while opting for savings with a positive social and environmental impact.

In borrower insurance (ADE), the number of termination requests by borrowers stabilized after the entry into force of the Lemoine law. In addition, in a context of stagnation in new home loans, the production of borrower insurance contracts remained limited in the first half of the year before rising again in the second half, at the same time as the fall in interest rates. In 2024, the ADE offer has evolved twice. First of all, the addition of a new “Family assistance” cover makes it possible, when an insured family is faced with the illness, disability or serious accident of one of their children, to alleviate the household’s economic situation by taking on part of the loan repayments. Then, people who have overcome breast cancer and are in the remission phase can now take out a borrower insurance policy for a real estate or professional project, without additional premiums and exclusion, even partial, and without waiting for the legal period of five years set by the law.

Non-life insurance (IARD) business recorded a good level of customer growth, both in the individual customers (+2%) and professional customers (+6%) markets. More specifically, with regard to the Caisses d’Epargne network, 35% of customers are now equipped with non-life insurance (IARD)/personal protection solutions, six months ahead of the target set in the BPCE 2024 strategic plan.

- Firstly, the deployment of non-life insurance (IARD) products in the networks of Société de Banque et d’Expansion (a joint subsidiary of BRED Banque Populaire and Banque Populaire Val de France), Crédit Coopératif and BRED Banque Populaire, including in French overseas territories.

- Then, the launch of a pilot to test a new distribution model for the health product in six customer relationship centers.

- Lastly, the launch of the Sightcall video assistance solution, rolled out in the MRH and AUTO scope, which enables managers to assist their policyholders during the reporting and management of a claim. The policyholder can show the damage in real time and be guided remotely, thus simplifying the interactions and the identification of the claim. This solution enabled BPCE Assurances IARD to win the Argus d’Or 2024 claims management award.

Finally, it should be noted that the exceptional rainfall, which affected many regions of France, strongly impacted the activity of BPCE Assurances’ centers of expertise.

- With the exception of BPCE Life, a subsidiary of BPCE Assurances, which deals directly with certain customers outside the Banque Populaire and Caisse d’Epargne networks.

The Digital & Payments division brings together all of Groupe BPCE’s business lines and expertise in the fields of innovation, digital, data and artificial intelligence, payments, and trade finance with Oney.

Oney, a subsidiary of Groupe BPCE (50.1%) and ELO (formerly Auchan Holding) (49.9%), is a French bank with a European dimension, specializing in payments, consumer financing, insurance and the fight against fraud. Founded in 1983 and a player in new modes of consumption, it supports the daily lives of more than 7 million customers and the development of more than 37,000 merchants and e-merchants by designing solutions for payments, financing, insurance and the fight against fraud. The mobilization of the expertise of its 1,900 employees worldwide allows Oney to offer seamless and secure in-store and online shopping experiences. Oney is currently the leader in payment in three or four installments by bank card in France and, via its subsidiary Oneytrust, in fraud detection and digital identification. Oney is present in 10 countries in Europe.

BPCE Payment Services, with its recognized expertise in the field of electronic payment processing and payment flows, supports Groupe BPCE’s banks and subsidiaries as well as external customers consisting of financial institutions and payment service providers. The subsidiary now manages more than 33 million payment cards, 11 billion transactions per year, and more than 500,000 merchant contracts for their needs in payment terminals and associated services. Its pioneering culture in terms of innovation has enabled the Group’s institutions to position themselves as pioneers in a number of payment market standards, such as Apple Pay, instant transfers and more recently, Tap to Pay.

Payplug, an omnichannel payment solution, specializing in credit card payments and payment acceptance and acquisition offers, this fintech from the BPCE Digital & Payments division is aimed at retailers and e-retailers of all sizes for which the European market and its various local payment methods is a priority issue.

Xpollens, a Groupe BPCE Banking as a Service Platform, enables companies to offer payment services with accounts and cards, as well as the automation of payment flows in the business line interfaces of companies.

- The Digital customer department, composed of digital experts who design remote banking for the Group’s institutions, and ensure its continuous improvement by developing the best applications thanks to AI and Data.

- The AI & Data department designs and deploys services and tools that exploit the potential of data, for the benefit of the competitiveness of each of the Group’s business lines. By placing artificial intelligence at the service of performance and simplicity, they enrich the customer experience, optimize processes for advisors, and facilitate the daily lives of all Group employees.

- The Innovation department whose mission is to build new sources of revenue, incubate internal and external strategic projects and participate in the capital of technology companies. Its work focuses on open finance, blockchain, new payment methods and the energy transition.

IN 2024

2024 was marked by several structuring transactions.

BPCE and BNP Paribas announced their project to create a European player in payment processing, to equip themselves with the best technology in terms of payment processing for cardholders and merchants. This processor aims to handle all card payments in Europe from BNP Paribas and Groupe BPCE, accounting for 17 billion transactions, and could also be opened to other banks. It would thus be the No. 1 processor in France, and both Groups share the ambition to make it one of the Top 3 processors in Europe.

In 2024, the European Payments Initiative (EPI) announced the launch of Wero, the European instant account-to-account payment solution. With Wero, Groupe BPCE now offers all Banque Populaire and Caisse d’Epargne customers a new instant account-to-account payment solution that meets new expectations. As a pioneer in this area, Groupe BPCE successfully completed the first cross-border instant payment transactions in December 2023.

Groupe BPCE and Oney have partnered with Leroy Merlin to support the customers of the Banques Populaires and the Caisses d’Epargne in their energy renovation projects, from financing to completion of the works. Customers benefit from a turnkey program, with a global and integrated solution, and a complete range of financial solutions including the Eco-Loan at Zero Interest Rate.

The Group’s Digital Banking system has increased the number of new functionalities offered to customers of the Banque Populaire and Caisse d’Epargne networks, with the top 10 current customer transactions already available in self-care. And also through a winning mobile strategy that has led to a significant increase in active mobile customers. The applications show a growing use by individual customers, professionals and companies and they retain very high scores (4.7/5 on the App Store, for example).

Lastly, in July 2024, Groupe BPCE acquired iPaidThat, a specialist and leading player in invoicing and business activity management. The integration of iPaidThat into the Digital & Payments division accelerates the development of these solutions and significantly enriches the digital experience offered to the Group’s professional and corporate customers.

On the innovation front, the Digital & Payments division confirmed its dynamism through several initiatives:

- First, the launch of the “Tap to Pay” offer for customers of the Banques Populaires and Caisses d’Epargne equipped with Android smartphones. This service, which allows users to accept contactless payments via their smartphone or tablet, can be used on the main payment schemes. Groupe BPCE thus became the first banking group in France to offer this new generation payment solution on the two main operating systems on the market.

- Then, access to the SwatchPAY! Contactless payment solution. Banque Populaire and Caisse d’Epargne customers were the first in France to be able to make their purchases safely with a simple movement of the wrist, thanks to their watch equipped with contactless payment technology.

- Groupe BPCE has become a partner of Garmin, the world’s leading supplier of navigation products and one of the first manufacturers of sports connected watches to integrate contactless payment.

- Lastly, in accordance with the “VISION 2030” strategic plan, the “AI for all” program was rolled out with the launch of the generative AI tool MAiA which, at the end of December 2024, had 26,000 user employees in the Group and which aims for a target of 50% of employees adopters by 2026.

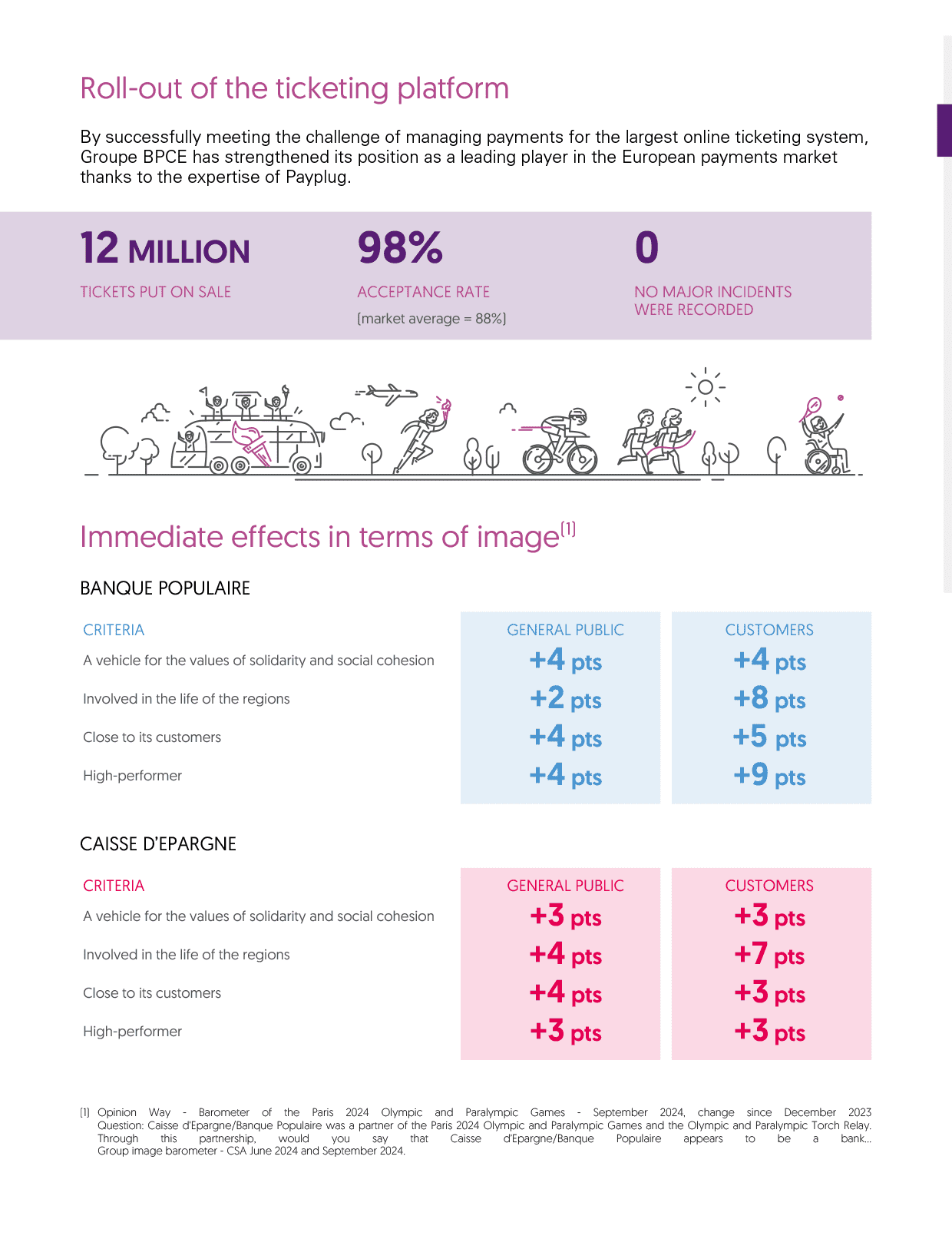

In collaboration with COJOP and Visa, BPCE’s Digital & Payments division, with its fintech Payplug, handled the processing of all 3 million transactions (from more than 170 countries), with a quality of service that can be summed up in one figure: the acceptance rate reached 98%, well above the standard of 92% in France. At the same time, Visa (the official supplier of the International Olympic Committee) entrusted BPCE’s Digital & Payments division with the management of payments within the Paris 2024 forums during the 29 days of competition.

The Financial Solutions & Expertise (FSE) division brings together BPCE’s expertise in financing, insurance, custodial and advisory services for the Group’s corporate customers.

BPCE Financement develops offers and complete solutions for the management of revolving loans and personal loans for Groupe BPCE’s networks.

BPCE Lease offers a complete range of rental solutions: equipment and real estate leasing, trust, long-term vehicle leasing, leasing with purchase option, boating or automotive leasing, IT operational leasing, and renewable energy financing.

BPCE Factor develops factoring solutions for companies of all sizes, at any stage of their growth process (creation, development, external growth, international development, etc.)

SOCFIM is a leading player in the real estate financing market, covering the whole of France and all asset classes: new and existing housing, managed housing (students and seniors), offices, retail and logistics warehouses.

Compagnie Européenne de Garanties et Cautions (CEGC) offers a wide range of financial guarantees in all of the Group’s markets: individuals, professionals and companies, real estate, social economy and social housing.

It should be noted that CEGC joined the Insurance division as of January 1, 2025. This new organization is part of our strategic project VISION 2030, one of the objectives of which is to become the fourth largest insurer in France.

BPCE Solutions immobilières is a major player in real estate consulting in France. It comprises three business line divisions: Expertise & Consulting, Residential, Investment & Rental.

EuroTitres develops a comprehensive range of services for the custody of securities accounts and the management of transactions carried out by individual customers: stock market, mutual funds, securities transactions, portfolio statements, tax forms, etc.

Pramex International specializes in advising French start-ups, SMEs and mid-sized companies on international expansion, either through internal growth (creating and overseeing foreign subsidiaries) or external growth (international acquisitions).

IN 2024

BPCE Financement With total outstandings of €37.1 billion in 2024, BPCE Financement strengthened its position as the leading player in consumer loans in France with a market share of 18.07% in the third quarter of 2024, excluding LOA (lease with purchase option), down -5.1% (source: ASF at the end of November 2024). The year was marked by the overhaul of the revolving credit underwriting process across all institutions, with high levels of satisfaction from advisors. Significant investments in Artificial Intelligence were made, particularly in the orchestration of customer contacts, enabling a significant increase in the contribution of digital marketing to total financing. In addition, an allocated credit chain has been developed for the financing of energy renovation through an initial partnership with Cozynergy.

BPCE Lease After record production in 2023, BPCE Lease again recorded a significant increase in production of +5%. Several areas even outperformed, such as equipment leasing (+10%), renewable energy financing (+17%) and long-term leasing (+22%). Several highlights marked the year:

- The takeover of the new production of Banque Populaire Rives de Paris under a commissioning scheme.

- Acquisition of a majority stake in SIMPEL, a specialist in the management of rental flows and B2B and B2C subscriptions.

- The launch of the Société Générale Equipment Finance (SGEF) portfolio and booking takeover project.

Lastly, a few large-scale projects were financed in 2024, such as the Hilton hotel in Sevilla, the logistics warehouse in Moussy-le-Neuf (Seine et Marne), 34 electrical equipment for Spanish airports, or the electrolyzer gigafactory in Belfort (Territoire de Belfort).

BPCE Factor In 2024, BPCE Factor handled 11 million invoices, supporting the changing working capital requirements of companies, both in their day-to-day business and as they grow. With a 25% market share in France, BPCE Factor is the leader in the factoring market in terms of number of contracts. Its factoring revenues amounted to €61 billion. The year was marked by the continuation of a major program to develop the customer experience, initiated in 2023: creation of an onboarding unit for new customers, deployment of a modernized telephone system, expanded contact hours and enhanced customer relationship intensity through new contact channels. These items resulted in a two-point increase in customer NPS over one year. Finally, for the ninth consecutive year, Bureau Veritas Certification confirmed BPCE Factor’s service certification and label, recognizing the high level of quality perceived by customers, with 92% overall satisfaction.

SOCFIM In a real estate market severely affected by the inflationary context of high interest rates and, more generally, administrative constraints, SOCFIM maintained a satisfactory level of activity with more than €3 billion in new loans to real estate professionals. It thus retained its position as the main financier of property developers and increased its penetration of the long-term investor segment. The structural and financial difficulties encountered by real estate professionals, the wait-and-see attitude of the markets and the general decline in values had an impact on the increase in the portfolio’s risks, partially offset by a reinforcement of dedicated teams, the quality of the customer base and close monitoring. The year was marked by the ramp-up of urban regeneration real estate projects, which now represent more than a quarter of new projects, and of course the timely delivery of the Athletes’ Village, which welcomed participants to the Paris 2024 Olympic and Paralympic Games before starting the Heritage phase of the project.

Compagnie Européenne de Garanties et Cautions (CEGC) guaranteed 146,502 real estate loans for individual customers produced by Groupe BPCE networks, for a total of €20.8 billion, down 34% on 2023, in line with market trends(1).In the construction sectors, CEGC covered the delivery “at the agreed price and deadline” of 7,629 single-family houses and issued financial guarantees for the completion of 599 real estate development projects. Lastly, in the building, construction, business and industry sectors, 115,763 market guarantees were issued, mainly via the www.cautiondemarche.com solution which posted a net promoter score of +53(2). CEGC benefits from the trust of its reinsurers, which renewed 100% of their reinsurance contracts in 2024. With nearly €2.5 billion, CEGC is one of the world’s leading buyers of home loan reinsurance for individual customers. The quality of CEGC’s credit rating was confirmed by the rating agencies Moody’s and DBRS, which renewed their good assessment levels with respective ratings of A1 and A High. Finally, CEGC carried out its first EcoVadis assessment in 2024 and obtained the bronze medal with a score of 64/100. A score that reflects the quality of its policies and actions in the four areas assessed: environment, social and human rights, ethics and responsible purchasing.

BPCE Solutions immobilières continued its sustained activity with the Group’s companies in 2024, mainly in the residential sector. However, the crisis in the real estate market penalized a more marked development. Nearly 850 units were sold to individual customers (600 in 2023), and SCPI inflows totaled €48 million. The Expertise division recorded revenues of €12.8 million in 2024, and continued its development with large institutional investors.

EuroTitres is one of the leaders in the outsourcing of retail custody of financial instruments in France. Retail activity on the stock market and UCIs remained resilient overall in 2024 with 1,890,000 stock market orders processed compared to 2,009,000 last year. The Internet and mobile transactional site was the main channel used by customers, with a constantly improving NPS and a good level of positioning in the benchmark of online stock market sites carried out periodically by the firm Ailancy. In 2024, on collective investments, volumes decreased by 4% with 2,635,000 subscriptions/redemptions. As last year, the stock of ordinary securities accounts and PEA held as well as the number of value lines in the portfolio were stable. The year was marked by two major events:

- firstly, the contribution to the successful placement of BPCE/Natixis loans on the one hand and of structured products on the other;

- then EuroTitres new commercial and technical initiatives for the networks, in support of the relaunch of Securities Financial Savings.

Pramex International In a still uncertain economic and geopolitical context, the number of contract signatures saw slower growth. The year was marked by the launch of Pramex International’s strategic plan focused on two main areas: quality at all levels and the France firm with the aim of expanding the clientele target by welcoming foreign companies wishing to set up in France. In addition, the deployment of the Senta management interface was finalized. This tool will make it possible to manage the production and delivery of services more efficiently and securely. Finally, very attentive to the quality of its service, Pramex conducted a new satisfaction survey on all its subsidiaries. The rate of 88% reflects the high level of overall satisfaction of its customers.

-

1.5 Agenda

-

2 SUSTAINABILITY REPORT

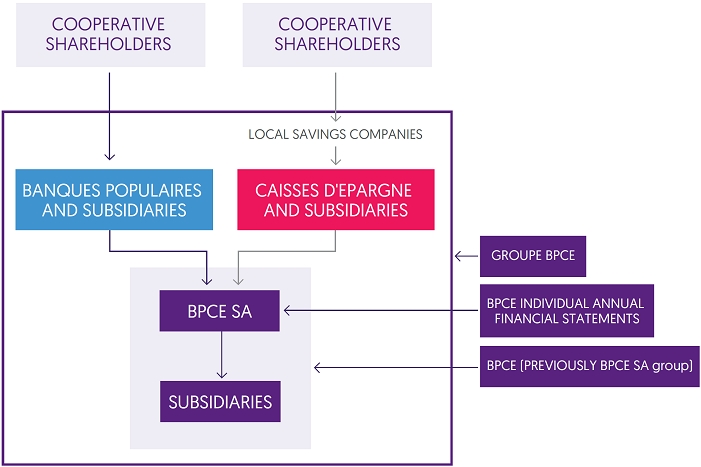

The scope of consolidation of both groups, organized around the central institution, is presented in the diagram below.

In addition to BPCE, Groupe BPCE includes the Banques Populaires, the Caisses d’Epargne and their respective subsidiaries.

-

2.1 Groupe BPCE sustainability report

PART 1 - GENERAL INFORMATION

1.1 Basis for preparation

Groupe BPCE has prepared its sustainability report in accordance with European Sustainability Reporting Standards (ESRS). These standards provide a comprehensive framework for the disclosure of non-financial information on environmental, social and governance issues.

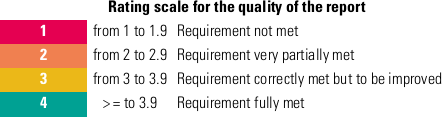

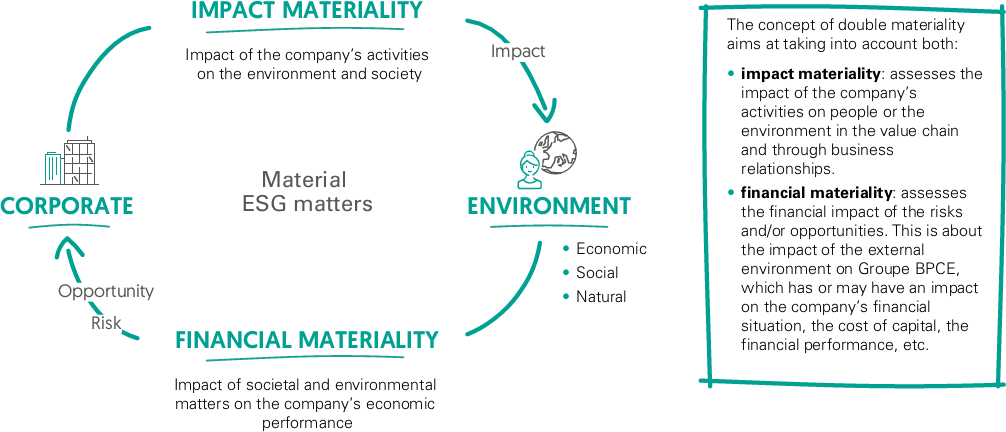

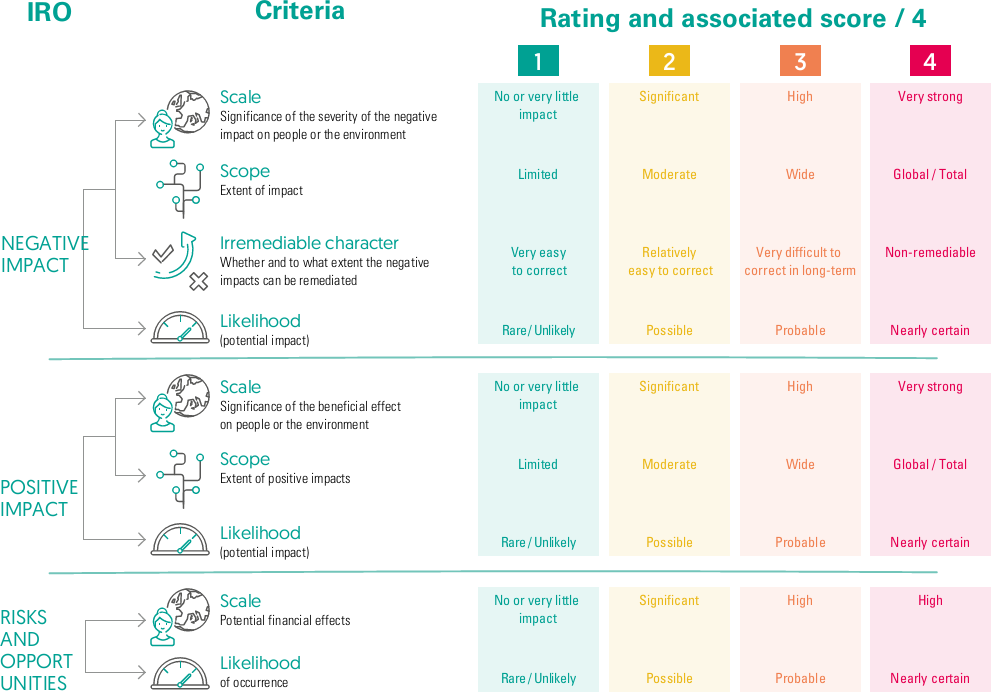

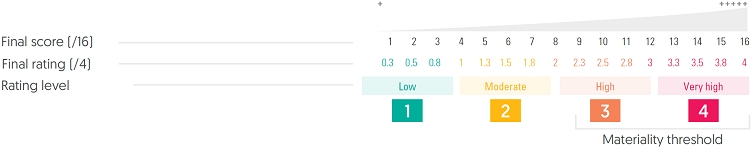

The Group’s sustainability report is based on a double materiality assessment, which takes into account both the impact of Groupe BPCE on the environment and society, and the influence of changes in the environment and society on the company’s performance. This approach takes into account the expectations of stakeholders, in particular employees, investors, customers, cooperative shareholders and the communities in which the Group operates. It results in a list of impacts caused by Groupe BPCE’s activity, and of risks and opportunities (IRO) related to environmental and societal changes.

To prepare this report, Groupe BPCE has collected data on a consolidated basis and across its value chain. This sustainability report is audited as required by the regulations with a limited level of assurance.

The scope of consolidation used for this sustainability report is identical to that of Groupe BPCE’s consolidated financial statements. All entities included in the IFRS (International Financial Reporting Standards) consolidation scope of Groupe BPCE are also included in this sustainability report.

The institutions included in Groupe BPCE’s consolidation, permanently affiliated with BPCE in accordance with Article 10 of Regulation (EU) 575/2013 (CRR) and exempted from the individual and consolidated disclosure obligation in terms of sustainability are the following:

Banques Populaires Caisses d’Epargne Banque Populaire Alsace Lorraine Champagne Caisse d’Epargne Aquitaine Poitou-Charentes Banque Populaire Aquitaine Centre Atlantique Caisse d’Epargne d’Auvergne et du Limousin Banque Populaire Auvergne Rhône Alpes Caisse d’Epargne de Bourgogne Franche-Comté Banque Populaire Bourgogne Franche-Comté Caisse d’Epargne Bretagne Pays de Loire Banque Populaire Grand Ouest Caisse d’Epargne Côte d’Azur Banque Populaire Méditerranée Caisse d’Epargne Grand Est Europe Banque Populaire du Nord Caisse d’Epargne Hauts de France Banque Populaire Occitane Caisse d’Epargne Ile-de-France Banque Populaire Rives de Paris Caisse d’Epargne Languedoc-Roussillon Banque Populaire du Sud Caisse d’Epargne Loire-Centre Banque Populaire Val de France Caisse d’Epargne Loire Drôme Ardèche CASDEN Banque Populaire Caisse d’Epargne de Midi-Pyrénées Crédit Coopératif Caisse d’Epargne Normandie Caisse d’Epargne Provence Alpes Corse Caisse d’Epargne Rhône Alpes Exclusions from the reporting scope by family of indicators are indicated in the description of each indicator.

Groupe BPCE has not made use of the option that allows it to omit certain disclosures relating to intellectual property, know-how or the results of innovations. This option is provided for in Section 7.7 of ESRS 1: Classified and sensitive information, and information on intellectual property, know-how or results of innovation.

In most cases, the material impacts, risks and opportunities have been assessed in the short, medium and long term. To obtain forward-looking information on Groupe BPCE’s material impacts, risks and opportunities in its sustainability reports, the Group has adopted the general principles as defined in Section 6.4 of the ESRS 1 section, namely:

- 1 year as short term (annual financial statement presentation period);

- between 1 year and 5 years as medium term;

- more than 5 years as long term.

When the time horizons deviate from these general guidelines, this information is communicated at the same time as the relevant information concerning the specific material subject. During the preparation of this sustainability report, forward-looking estimates and assumptions were made. The results observed may differ from these estimates and assumptions.

The indicators must cover the entire consolidated scope. However, for the calculation of greenhouse gas emissions under ESRS E1-6 (greenhouse gas emissions), the indicator is calculated over an extended scope. Scope 3, category 15 emissions relate to the value chain, in particular financed emissions.

For the calculation of Scope 3 category 15 emissions on the banking book, greenhouse gas data come from several sources:

- data collected from the Group’s customers (DPE); and

- public databases (Centre Scientifique et Technique du Bâtiment).

When data is not available, the Group uses sectoral intensity estimates: either through extrapolation or using a proxy defined through PCAF.

This report, known as the Groupe BPCE sustainability report, was prepared in accordance with the legal and regulatory requirements resulting from the transposition of the European Directive on the disclosure of information on companies’ sustainability (Corporate Sustainability Reporting Directive or “CSRD Directive”). This first year of application is characterized by uncertainties about the interpretation of the texts, which are generalist and cover all sectors of activity but do not specify a specific framework for banking and financial business models. There is also the absence of established practices or comparative information and certain data, in particular within the “value chain”.

In this context, Groupe BPCE has endeavored to apply the normative requirements set by the ESRS, as applicable at the date of the sustainability statement, based on the information available within the timeframe for its preparation, by doing its best to reflect its role as a universal bank-insurer, as well as its various business models.

For the double materiality analysis and, in particular, that relating to its value chain, Groupe BPCE encountered limitations relating to the maturity of its valuation methodologies and the availability of data. As presented in Section 1.5.1.1 on the Environment (E), we considered that only the issue of mitigation and adaptation related to climate change is material within the meaning of the standard. The limitations relating to the market information and methodologies available at this stage did not make it possible to characterize the Nature ESRS’s materiality within the standard’s meaning, which led the Group to assess these environmental issues as non-material. This assessment was carried out based on the definitions of the standard, and the methodologies available to assess and carry out the rating exercises. This assessment can be explained, in particular, by the absence of a consensus on robust methodologies developed on the topics in question and of relevant and appropriate data which would make it possible to establish a link between the impact or risks for Groupe BPCE regarding these topics through its value chain. In view of Groupe BPCE’s continuous improvement approach to these environmental issues, the work and ongoing changes in international methodologies, the standards that are being put in place, the best market practices that are emerging and information and data from its customers, which should gradually become available, this double materiality analysis may change in the coming years. The dual materiality analysis, the results of which are presented in this report, aims to qualify the impacts, risks and opportunities as described in the CSRD standard: this analysis only meets the needs of sustainability reporting and not the analysis of factors risks presented in the chapter on risk management.

For the data points presented in this report, the BPCE Group used methodological options that it deemed relevant and made estimates for many data points, particularly concerning the various activities of its value chain. The data, analysis, and studies carried out do not guarantee that expectations and targets will be achieved: they are based on objectives, commitments, estimates, assumptions, standards, and methodologies under development and currently available data, which continue to evolve and develop. Some of the information contained in this document has been obtained from public sources or from sources that appear to be reliable or from market references: the BPCE Group has not independently verified them. In addition, Groupe BPCE notes that the information expected in terms of sustainability is based on so-called “agnostic” European standards (ESRS), which are generalist and do not reflect the specificities of the financial sector. As a result, certain data items deemed irrelevant or not applicable, given Groupe BPCE’s business models and value chain, have not been produced. The same applies to certain data points relating to the Taxonomy Regulation.