PILLAR III 2021

-

Foreword

Regulation (EU) No. 2019/876 (CCR2) includes new provisions relating to the calculation of risk-weighted assets and new ratio requirements, applicable from June 28, 2021. The main impacts for Groupe BPCE are as follows:

•the leverage ratio and net stable funding ratio (NSFR) requirements become effective, with a minimum of 3% for leverage and 100% for the NSFR;

•a new Standardized Approach (SA-CCR), corresponding to the sum of the replacement cost and the calculated potential future exposure, is now applied to the calculation of the exposure value of derivatives; until now, this exposure was modeled using the mark-to-market method.

This report presents information on Groupe BPCE’s risks; the format of the Pillar III tables changed on June 30, 2021 according to the technical standards defined by implementing regulation (EU) No. 2021/637.

-

Structure of the Pillar III report

-

1 KEY FIGURES

(1)

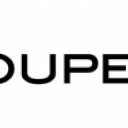

CRR/CRD IV without transitional measures; additional Tier 1 capital takes into account subordinated issues that have become ineligible at the phase-out rate in force.

in millions of euros

12/31/2021

09/30/2021

06/30/2021

03/31/2021

12/31/2020

AVAILABLE CAPITAL

Common Equity Tier 1 (CET1)

69,764

69,897

68,440

69,743

68,969

Tier 1 capital

69,764

69,897

68,440

69,743

68,978

Total capital

82,715

78,093

76,991

78,933

78,235

RISK-WEIGHTED ASSETS

Total risk-weighted assets

441,428

442,119

439,589

434,082

431,222

CAPITAL RATIOS (AS A PERCENTAGE OF RISK-WEIGHTED ASSETS)

Common Equity Tier 1 ratio

15.80%

15.81%

15.57%

16.07%

15.99%

Equity Tier 1 ratio

15.80%

15.81%

15.57%

16.07%

16.00%

Total capital ratio

18.74%

17.66%

17.51%

18.18%

18.14%

ADDITIONAL CAPITAL REQUIREMENTS TO ADDRESS RISKS OTHER THAN THE EXCESSIVE LEVERAGE RISK (AS A PERCENTAGE OF THE RISK-WEIGHTED ASSETS)

Additional capital requirements to address risks other than excessive leverage risk

1.75%

1.75%

1.75%

1.75%

1.75%

of which: to be met with CET 1 capital

1.31%

1.31%

1.31%

1.31%

1.31%

of which: to be met with Tier 1 capital

1.31%

1.31%

1.31%

1.31%

1.31%

Total SREP capital requirement

9.75%

9.75%

9.75%

9.75%

9.75%

OVERALL BUFFER REQUIREMENT AND OVERALL CAPITAL REQUIREMENT (AS A PERCENTAGE OF THE RISK-WEIGHTED ASSETS)

Capital conservation buffer

2.50%

2.50%

2.50%

2.50%

2.50%

Conservation buffer due to macro-prudential or systemic risk at the level of a Member State

0.00%

0.00%

0.00%

0.00%

0.00%

Institution-specific countercyclical capital buffer

0.02%

0.01%

0.01%

0.01%

0.01%

Systemic risk buffer

0.00%

0.00%

0.00%

0.00%

0.00%

Global systemically important institution buffer

1.00%

1.00%

1.00%

1.00%

1.00%

Other systemically important institution buffer

0.00%

0.00%

0.00%

0.00%

0.00%

Overall buffer requirement

3.52%

3.51%

3.51%

3.51%

3.51%

Total capital requirements

13.27%

13.26%

13.26%

13.26%

13.26%

CET1 capital available after compliance with total SREP(1) capital requirements

9.99%

10.00%

9.76%

10.25%

10.18%

LEVERAGE RATIO

Total exposure measure

1,212,857

1,208,391

1,198,965

1,283,262

1,238,142

Leverage ratio

5.75%

5.78%

5.71%

5.43%

5.57%

ADDITIONAL CAPITAL REQUIREMENTS TO ADDRESS THE EXCESSIVE LEVERAGE RISK (AS A PERCENTAGE OF THE TOTAL EXPOSURE MEASURE)

Additional capital requirements to address the excessive leverage risk

0.00%

0.00%

0.00%

of which: to be met with CET 1 capital

0.00%

0.00%

0.00%

Total SREP leverage ratio requirement

3.23%

3.23%

3.23%

LEVERAGE RATIO BUFFER REQUIREMENT AND OVERALL LEVERAGE RATIO REQUIREMENT (AS A PERCENTAGE OF TOTAL EXPOSURE MEASURE)

Leverage ratio buffer requirement

-

-

-

Overall leverage ratio requirement

3.23%

3.23%

3.23%

LIQUIDITY COVERAGE RATIO

Total High Quality Liquid Assets (HQLA) (weighted average)

222,399

230,746

202,842

227,186

203,029

Cash outflows – Total weighted value

205,973

215,817

191,004

203,894

191,463

Cash inflows – Total weighted value

67,903

69,934

70,047

71,610

70,495

Total net cash outflows (adjusted value)

138,069

145,883

120,957

132,284

120,968

Liquidity coverage ratio

161.08%

158.17%

167.70%

171.74%

167.84%

NET STABLE FUNDING REQUIREMENT

Total available stable funding (ASF)

875,323

845,049

841,840

Total RSF

756,669

734,732

726,414

NSFR ratio

115.68%

115.01%

115.89%

-

1.1 Types of risk

Risk macro-categories

Definition

Credit and counterparty risks

The risk of loss resulting from the inability of clients, issuers or other counterparties to honor their financial commitments. It includes counterparty risk related to market transactions (replacement risk) and securitization activities. It can be exacerbated by concentration risk.

Financial risks

•Market risk

The risk of loss of value on financial instruments resulting from changes in market inputs, from the volatility of these inputs or from the correlations between these inputs. Inputs include exchange rates, interest rates and prices of securities (equities, bonds), commodities, derivatives or any other assets, such as real estate assets.

•Liquidity risk

Risk that the Group cannot meet its cash requirements or collateral requirements when they fall due and at a reasonable cost.

•Structural interest rate risk

Risk of loss in interest income or in the value of a fixed-rate structural position in the event of changes in interest rates. Structural interest rate risks are associated with commercial activities and proprietary transactions.

•Credit spread risk

Risk associated with a decline in the creditworthiness of a specific issuer or a specific category of issuers.

•Exchange rate risk

The risk of loss in interest income or in the value of a fixed-rate structural position in the event of changes in exchange rates. Structural interest rate and foreign exchange risks are associated with commercial activities and proprietary transactions.

Non-financial risks

•Non-compliance risk

The risk of a legal, administrative or disciplinary penalty, material financial loss or reputational risk arising from a failure to comply with the provisions specific to banking and financial activities (whether these are stipulated by directly applicable national or European laws or regulations), with professional or ethical standards, or instructions from the executive body, notably issued in accordance with the policies of the supervisory body.

•Operational risk

The risk of loss resulting from inadequacies or malfunctions attributable to procedures, employees and internal systems (including in particular information systems) or external events, including events with a low probability of occurrence, but with a risk of high loss.

Insurance underwriting risks

In addition to asset-liability risk management (interest rate, valuation, counterparty and foreign exchange risks), these risks include pricing risk in respect of mortality risk premiums and structural risks related to life and non-life insurance activities, including pandemics, accidents and disasters (earthquakes, hurricanes, industrial accidents, terrorist acts and military conflicts).

Strategic business and ecosystem risks

•Solvency risk

The risk that the company will be unable to honor its long-term commitments and/or ensure the continuity of its ordinary operations in the future.

•Climate risks

Vulnerability of banking activities to climate change, where a distinction can be made between physical risk directly relating to climate change and transition risk associated with efforts to combat climate change.

-

1.2 Regulatory changes

Fragmentation and withdrawal accentuated by the health crisis in Europe

At its meetings in June and July 2021, the Financial Services Committee of the European Union, composed of high-level representatives of the Member States and the European Commission, presented an overview of the measures intended to support the banking sector and borrowers faced with the pandemic-related crisis, and proposed that the Member States consider new measures that could be implemented, in particular in terms of regulatory flexibility and supervision.

However, these meetings took place in a general context of mistrust between Member States that do not share the same vision of the Banking Union, which poses the risk of a major political and economic “split” in Europe.

The Franco-German duo no longer imposes its vision on the rest of Europe and its ability to "make common cause" on certain issues appears fragile, after two months of bitter discussions in Germany this autumn to form a coalition government between the Social Democrats of the SPD, the Liberals of the FPD and the Greens, and the early launch ‒ and not without turbulence ‒ of the electoral campaign in France, which will end with the first round of the presidential election on April 10, 2022.

-

2 RISK FACTORS

The banking and financial environment in which Groupe BPCE operates is exposed to numerous risks which obliges it to implement an increasingly demanding and strict policy to control and manage these risks.

Some of the risks to which Groupe BPCE is exposed are set out below. However, this is not a comprehensive list of all of the risks incurred by Groupe BPCE in the course of conducting its business or given the environment in which it operates. The risks presented below are those identified to date as significant and specific to Groupe BPCE, and liable to have a material adverse impact on its business, financial position and/or results. For each of the risk sub-classes listed below, the risk factor considered to date by Groupe BPCE as the most significant is listed first.

-

Strategic, business and ecosystem risks

The ongoing coronavirus (Covid-19) pandemic and its economic consequences may adversely impact the Group’s operations, results and financial position.

The emergence of Covid-19 in late 2019 and rapid spread of the pandemic across the globe led to a deterioration in economic conditions in multiple business sectors, a deterioration in the financial position of economic players, while also disrupting the financial markets. In response, many affected countries were forced to implement preventive health measures (closed borders, lockdown measures, restrictions on certain economic activities, etc.). In particular, the sudden recession gripping affected countries and the drop in global trade have had and will continue to have negative effects on global economic conditions for as long as global production, investments, supply chains and consumer spending are impacted, in turn impacting the business operations of the Group, its customers and its counterparties.

The persistence of the Covid-19 pandemic and the emergence of new strains of the virus have led to new restrictions, even if these have not been as drastic as in 2020 (notably, a new lockdown in France and in a number of European countries, local and national curfews, border closures, or severe travel restrictions) and, after a rebound, the economic environment could deteriorate further. Despite the favorable development of vaccination, the Covid-19 pandemic still remains the master of economic recovery time, with the spread of new variants such as the “Delta” variant in the second half of 2021 or the “Omicron” variant detected in late November 2021 threatening the pace of economic expansion. The epidemic continues to profoundly disrupt international and French economic momentum. Its duration does not cease to surprise, fueling both uncertainty and fatigue in the face of ongoing health restrictions. This situation could last several months, and thus adversely affect the Group’s business, financial performance and results.

Massive fiscal and monetary policy measures to support activity have been put in place since 2020, notably by the French government (State-guaranteed loans for businesses and professional customers, for individual customers, short-time working measures as well as numerous other fiscal, social and bill-paying measures) and by the European Central Bank (more abundant and cheaper access to very large refinancing packages). Groupe BPCE has actively participated in the French State-guaranteed loan program in the interest of financially supporting its customers and helping them overcome the effects of this crisis on their activities and income (e.g. automatic six-month deferral on loans to certain professional customers and micro-enterprises/SMEs). There is no way to guarantee, however, that such measures will be enough to offset the negative impacts of the pandemic on the economy or to fully stabilize the financial markets over the long term.

The lockdown or restriction measures taken at the beginning of this crisis, particularly in France, where the Group mainly operates (84% of exposures (in gross value) as of December 31, 2021 are located in France), have significantly reduced the activity of many economic players. In 2021, the global economy rebounded strongly, but the health crisis continued to affect community services specifically, due to the relative maintenance of health restrictions. The Group’s results and financial position are impacted by such measures, due to decreased income and a decline in the quality of assets both in general and in certain particularly hard-hit sectors. Within the Corporate and Professional portfolios, the sectors most likely to be affected at present are mainly the Wholesale and non-food retail sectors (gross exposure on December 31, 2021 of €16.7 billion), Tourism-Hotels-Catering (gross exposure on December 31, 2021 of €15.5 billion), Automotive (gross exposure on December 31, 2021 of €5.6 billion), Consumer goods excluding cosmetics and personal care (gross exposure on December 31, 2021 of €5.2 billion) and Real Estate Professionals excluding residential exposure (gross exposure on December 31, 2021 of €1.9 billion).

In 2020, this environment resulted in a very significant increase in the cost of risk to nearly €3 billion (equal to 41 basis points compared to 19 basis points in 2019), mainly due to the impact of the Covid-19 crisis on the inclusion of forward-looking information in the assessment of expected losses and to the increase in individual provisions concentrated on the Energy and Natural Resources sector, and more particularly Oil and Gas, in Corporate & Investment Banking. In 2021, the cost of risk fell by 40.5% compared to the cost of risk recorded for 2020 (equivalent to 23 basis points), in a context of low level of defaults, and maintaining the levels of provisions allocated under Stages 1 and 2 in anticipation of potential future defaults. The credit risk impairment methodology applied and the assumptions taken into account in the scenarios are described in § 7.1.2. in the paragraph “Methodology for assessing the deterioration of credit risk and expected credit losses” of Groupe BPCE’s consolidated financial statements included in the 2021 Universal Registration Document.

The Group’s results and financial position may also be impacted by adverse financial market developments (extreme volatility, equity market and index slump, spread tensions, steep and unforeseen decline in dividends, etc.). This was the case in the first half of 2020, as the valuation of certain products was affected by market illiquidity, in particular Natixis’ Corporate & Investment Banking operations, which were exposed to significant adjustment effects of certain valuation parameters such as the “dividend” component.

A deterioration in the economic environment and its impact on the Group could increase the risk of its external ratings being downgraded. Furthermore, the French government’s ratings may end up being downgraded, due in large part to an increase in the national debt and public deficits. These factors could have a negative impact on the Group’s funding cost on the financial markets.

More generally, the Covid-19 epidemic poses a risk to Groupe BPCE, insofar as it (i) causes organizational changes (remote working, for example) that may cause an operational risk; (ii) it induces a slowdown in money market transactions and could have an impact on the supply of liquidity; (iii) it increases the liquidity needs of customers and therefore the amounts loaned to these customers to enable them to withstand the crisis; (iv) it could lead to an increase in business failures, particularly among the most vulnerable companies or in the most exposed sectors; and (v) it causes sudden movements in the valuation of market assets, which could have an impact on the market activities or on the investments of the institutions.

Changes in the situation related to Covid-19 (uncertainty as to the duration, extent and future trajectory of the pandemic, the introduction of new lockdown measures or restrictions in the event of additional epidemic waves related to the emergence of new strains of the virus, the speed of vaccination rollout or the efficacy of vaccines against variants) are a major source of uncertainty and make it difficult to predict the overall impact on the Group’s main markets and, more generally, the global economy; on the filing date (publication) of this Pillar III report, the impact of this situation, taking into account the aforementioned support measures, on Groupe BPCE’s business lines (Retail banking, Insurance, Asset Management, Corporate & Investment Banking), its results (net banking income and cost of risk in particular) and its financial position (liquidity and solvency) remains difficult to quantify.

On July 8, 2021, Groupe BPCE announced its BPCE 2024 strategic plan. It is structured around the following three strategic priorities: (i) a winning spirit, with €1.5 billion in additional revenues in five priority areas, (ii) customers, by offering them the highest quality service with an adapted relationship model, and (iii) the climate, through concrete and measurable commitments that are part of a Net zero trajectory. The BPCE 2024 strategic plan is based on the following three pillars: (i) simplicity: because Groupe BPCE seeks efficiency and customer satisfaction, it aims for greater simplicity; (ii) innovation: because Groupe BPCE is driven by an entrepreneurial spirit and is aware of the reality of the changes underway, it is strengthening its capacity for innovation; and (iii) security, because Groupe BPCE is committed to the long term, it gives priority to the security of its development model. These strategic objectives were developed in the context of the Covid-19 crisis, which has acted as an indicator and accelerator of fundamental trends (in particular, digitization, hybrid work, energy transition) and reflects Groupe BPCE’s desire to accelerate its development by supporting its customers in their economic recovery and their projects to emerge from the health crisis. The success of the BPCE 2024 strategic plan is based on a very large number of initiatives to be implemented within the various business lines of Groupe BPCE. Although many of these targets can be achieved, it is possible that not all of them will be, nor is it possible to predict which of these goals will not. The BPCE 2024 strategic plan also calls for significant investments, but if the plan’s objectives are not met, the return on these investments may be lower than expected. If Groupe BPCE does not achieve the targets defined in its BPCE 2024 strategic plan, its financial position and results could be more or less significantly affected.

The physical and transition components of climate risk, together with their repercussions for economic players, could adversely affect the activities, income and financial position of Groupe BPCE.

The risks associated with climate change are factors that exacerbate existing risks, including credit risk, operational risk and market risk. In particular, BPCE is exposed to physical and transition climate risk. They potentially carry an image and/or reputation risk.

Physical risk leads to increased economic costs and financial losses resulting from the severity and increased frequency of extreme weather events related to climate change (such as heat waves, landslides, floods, late frosts, fires and storms), as well as long-term gradual changes in climate (such as changes in rainfall patterns, extreme weather variability, and rising sea levels and average temperatures). It could have an extensive impact in terms of scope and magnitude, that may affect a wide variety of geographic areas and economic sectors relevant to Groupe BPCE. For example, the Cévennes episodes that affect the south-east of France every year can cause buildings, factories and offices to flood, slowing down or even making it impossible for some of the Group’s customers to carry out their activities. For example, an SME customer of Groupe BPCE producing a component essential to the opening of buildings was flooded at the end of 2019, causing it to file for bankruptcy. Moreover, this SME was supplying a real estate project whose construction had to stop while a new supplier was found. The real estate project was delayed, which led to a credit risk on the transaction for the bank financing it: late penalties, late opening for sale or rent, etc. Thus, physical climate risk can spread along the value chain of Groupe BPCE’s corporate customers, which can lead to default and thus generate financial losses for Groupe BPCE. These physical climate risks are likely to increase and could lead to significant losses for Groupe BPCE.

The transition risk is connected to the process of adjusting to a low-carbon economy. The process of reducing emissions is likely to have a significant impact on all sectors of the economy by affecting the value of financial assets and the profitability of companies. The increase in costs related to this energy transition for economic players, whether corporates or individual customers, could lead to an increase in defaults and thus significantly increase Groupe BPCE’s losses. For example, the French law “Energie-Climat” of November 8, 2019 is expected to limit from 2028 the sale and rental of real estate with very low energy performances. Some of Groupe BPCE’s customers will therefore have to plan renovation work for a possible future sale or lease of such type of properties. The risk lies in the impossibility for Groupe BPCE’s customers to carry out this costly work and consequently being unable to complete the financial transaction necessary to balance their budget. These customers of Groupe BPCE could therefore become insolvent, which would result in significant financial losses for Groupe BPCE.

A persistently low interest rate environment may have an adverse impact on Groupe BPCE’s profitability and financial position.

The global markets have been subject to low interest rates in recent years, and it appears this situation will not be changing anytime soon. When interest rates are low, credit spreads tend to tighten, meaning Groupe BPCE may not be able to sufficiently lower interest rates paid on deposits to offset the drop in revenues associated with issuing loans at lower market rates. Groupe BPCE’s efforts to reduce the cost of deposits may be restricted by the high volumes of regulated products, especially on the French market, including in particular Livret A passbook savings accounts and PEL home savings plans, which earn interest above the current market rate. In addition, Groupe BPCE may incur an increase in prepayments and renegotiations of home loans and other fixed-rate loans to individuals and businesses, as customers seek to take advantage of lower borrowing costs. Combined with the issuance of new loans at low interest rates prevailing on the markets, Groupe BPCE may see an overall decrease in the average interest rate in the loan book. Reduced credit spreads and weaker retail banking revenues stemming from this decrease may undermine the profitability of the retail banking activities and overall financial position of Groupe BPCE. Furthermore, if market rates begin climbing again and Groupe BPCE’s hedging strategies prove ineffective or only partially offset this fluctuation in value, its profitability may be affected. An environment of persistently low interest rates may also cause the market yield curve to flatten more generally, which in turn may lower the premium generated by Groupe BPCE’s financing activities and have an adverse impact on its profitability and financial position. The flattening of the yield curve may also encourage financial institutions to enter into higher-risk activities in an effort to obtain the targeted level of return, which may heighten risk and volatility on the market.

The stress tests carried out by Groupe BPCE on its capital markets activities show that, at December 31, 2021, the most sensitive hypothetical stress test is the “emerging market crisis” scenario and that the most impacting historical scenario is the “2011 sovereign crisis” scenario.

For information purposes, the change in Groupe BPCE’s projected one-year net interest income calculated under four scenarios (“rate increase,” “rate decrease,” “steepening of the curve,” “flattening of the curve”) compared to the core scenario showed the “rate decrease” to be the most adverse scenario.

Groupe BPCE may be vulnerable to political, macro-economic and financial environments or to specific circumstances in its countries of operation.

Some Groupe BPCE entities are exposed to country risk, which is the risk that economic, financial, political or social conditions in a foreign country (particularly in countries where the Group conducts business) may affect their financial interests. Groupe BPCE predominantly does business in France (81% of net banking income for the fiscal year ended December 31, 2021) and North America (11% of net banking income for the fiscal year ended December 31, 2021), with other European countries and the rest of the world accounting for 5% and 3%, respectively, of net banking income for the fiscal year ended December 31, 2021. Note 12.6 to the consolidated financial statements of Groupe BPCE “Locations by country,” contained in the 2021 Universal Registration Document lists the entities established in each country and gives a breakdown of net banking income and income before tax by country of establishment.

A significant change in the political or macro-economic environment of such countries or regions may generate additional expenses or reduce profits earned by Groupe BPCE.

A major economic disruption, such as the 2008 financial crisis, the 2011 sovereign debt crisis in Europe or the development of a new epidemic like the coronavirus (the magnitude and length of which are still unknown), may have a material adverse impact on all Groupe BPCE activities, particularly if the disruption encompasses a lack of liquidity on the market, making it difficult for Groupe BPCE to obtain funding. In particular, some risks do not occur in the normal economic cycle because they are externally generated. Examples include the very short-term consequences of Brexit, the increase in credit risk associated with corporate debt around the world (leveraged loans market) and the threat of the Covid-19 epidemic growing even worse, or the longer term impacts of climate change. During the financial crisis of 2008 and 2011, the financial markets were subject to strong volatility in response to various events, including but not limited to the decline in oil and commodity prices, the slowdown in emerging economies and turbulence on the equity markets, which directly or indirectly impacted several Groupe BPCE businesses (primarily securities transactions and financial services).

More recently, the armed conflict triggered by the Russian Federation following its invasion of Ukraine, which led the international community to impose sanctions against the Russian Federation, constitutes a significant change that could directly or indirectly penalize the economic activity of the counterparties financed by Groupe BPCE, resulting in additional expenses or reducing the profits earned by Groupe BPCE. For information, Groupe BPCE’s direct on- and off-balance sheet exposures, net of guarantees, to Russian and Ukrainian customers as of February 28, 2022 amounted to €788 million and €63 million respectively (management data). These exposures are very limited in view of Groupe BPCE’s €889 billion in gross outstanding loans and advances at amortized cost at December 31, 2021 (customers and banks).

For more detailed information, see Sections 4.2.1 “Economic and financial environment” and 4.7 “Outlook for Groupe BPCE” of the 2021 Universal Registration Document.

Groupe BPCE may encounter difficulties in adapting, implementing and incorporating its policy governing acquisitions or joint ventures.

Although acquisitions are not a major part of Groupe BPCE’s current strategy, the Group may nonetheless consider acquisition or partnership opportunities in the future. Although Groupe BPCE carries out an in-depth analysis of any potential acquisitions or joint ventures, in general it is impossible to carry out an exhaustive appraisal in every respect. As a result, Groupe BPCE may have to manage initially unforeseen liabilities. Similarly, the results of the acquired company or joint venture may prove disappointing and the expected synergies may not be realized in whole or in part, or the transaction may give rise to higher-than-expected costs. Groupe BPCE may also encounter difficulties with the consolidation of new entities. The failure of an announced acquisition or failure to consolidate a new entity or joint venture may place a strain on Groupe BPCE’s profitability. This situation may also lead to the departure of key personnel. In the event that Groupe BPCE is obliged to offer financial incentives to its employees in order to retain them, this situation may also lead to an increase in costs and a decline in profitability. Joint ventures expose Groupe BPCE to additional risks and uncertainties in that it may depend on systems, controls and persons that are outside its control and may, in this respect, see its liability incurred, suffer losses or incur damage to its reputation. Moreover, conflicts or disagreements between Groupe BPCE and its joint venture partners may have a negative impact on the targeted benefits of the joint venture. At December 31, 2021, total investments accounted for using equity method amounted to €1.6 billion, including following the sale of BPCE’s entire stake in CNP Assurances(1). For further information, please refer to Note 12.4 “Partnerships and associates” to the consolidated financial statements of Groupe BPCE, included in the 2021 Universal Registration Document.

Intense competition in France, Groupe BPCE’s main market, or internationally, may cause its net income and profitability to decline.

Groupe BPCE’s main business lines operate in a very competitive environment both in France and other parts of the world where it is does substantial business. This competition is heightened by consolidation, either through mergers and acquisitions or cooperation and arrangements. Consolidation has created a certain number of companies which, like Groupe BPCE, can offer a wide range of products and services ranging from insurance, loans and deposits to brokerage, investment banking and asset management. Groupe BPCE is in competition with other entities based on a number of factors, including the execution of transactions, products and services offered, innovation, reputation and price. If Groupe BPCE is unable to maintain its competitiveness in France or in its other major markets by offering a range of attractive and profitable products and services, it may lose market share in certain key business lines or incur losses in some or all of its activities.

For example, at December 31, 2021, in France, Groupe BPCE is the number one bank for SMEs(2), and the second-ranked bank for individual and professional customers(3). It has a 25.9% market share in home loans(4). In Retail Banking and Insurance, loan outstandings totaled €650 billion and deposits and savings(5) €861 billion (for more information on the contribution of each business line, and each network, see Section 1.4 “Groupe BPCE’s business lines” of the 2021 Universal Registration Document). Moreover, a slowdown in the global economy or the economic environment of Groupe BPCE’s main markets is likely to increase competitive pressure, in particular through greater pricing pressure and a slowdown in business volume for Groupe BPCE and its competitors. New, more competitive rivals subject to separate or more flexible regulation or other prudential ratio requirements could also enter the market. These new market participants would thus be able to offer more competitive products and services. Advances in technology and the growth of e-commerce have made it possible for institutions other than custodians to offer products and services that were traditionally considered as banking products, and for financial institutions and other companies to provide electronic and internet-based financial solutions, including electronic securities trading. These new entrants may put downward pressure on the price of Groupe BPCE’s products and services or affect Groupe BPCE’s market share. Advances in technology could lead to rapid and unexpected changes on Groupe BPCE’s markets of operation. Groupe BPCE’s competitive position, net earnings and profitability may be adversely affected should it prove unable to adequately adapt its activities or strategy in response to such changes.

Groupe BPCE’s ability to attract and retain skilled employees is paramount to the success of its business and failing to do so may affect its performance.

The employees of Groupe BPCE entities are the Group’s most valuable resource. Competition to attract qualified employees is fierce in many areas of the financial services sector. Groupe BPCE’s earnings and performance depend on its ability to attract new employees and retain and motivate existing employees. Changes in the economic environment (in particular tax and other measures aimed at limiting the pay of banking sector employees) may compel Groupe BPCE to transfer its employees from one unit to another, or reduce the workforce in certain business lines, which may cause temporary disruptions due to the time required for employees to adapt to their new duties, and may limit Groupe BPCE’s ability to benefit from improvements in the economic environment. This may prevent Groupe BPCE from taking advantage of potential opportunities in terms of sales or efficiency, which could in turn affect its performance.

At December 31, 2021, Groupe BPCE’s registered headcount totaled 99,900 employees. 6,688 permanent employees were recruited during the year (for further information, please refer to Section 2.4 “Designing the work of the future” of the 2021 Universal Registration Document).

(1)

On December 16, 2021, BPCE sold its entire stake in CNP Assurances, i.e. 16.11%, to Banque Postale.

(3)

Retail market share: 22% in household savings and 25.9% in mortgage loans to households (Banque de France Q3-2021). Overall penetration rate of 29.6% (rank 2) among retail customers (SOFIA Kantar study, March 2020). For professionals: 39.9% (rank 2) penetration rate among professionals and individual entrepreneurs (Pépites CSA 2019-2020 survey).

-

Credit and counterparty risks

Groupe BPCE is exposed to credit and counterparty risks that could have a material adverse effect on the Group’s business, financial position and income.

Groupe BPCE is significantly exposed to credit and counterparty risk through its financing or market activities. The Group could thus incur losses in the event of default by one or more counterparties, in particular if the Group encounters legal or other difficulties in exercising its collateral or if the value of the collateral does not allow it to fully cover the exposure in the event of a default. Despite the due diligence carried out by the Group, aimed at limiting the effects of having a concentrated credit portfolio, counterparty defaults may be amplified within a specific economic sector or world region by the effects of interdependence between these counterparties. Default by one or more major counterparties could thus have a material adverse effect on the Group’s cost of risk, income and financial position.

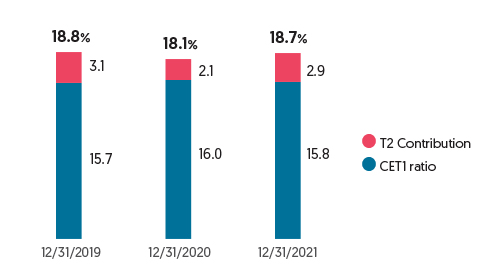

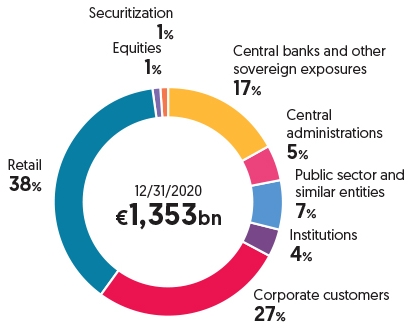

For information, on December 31, 2021, Groupe BPCE’s gross exposure to credit risk amounted to €1,435 billion, with the following breakdown for the main types of counterparty: 38% for retail customers, 27% for corporates, 19% for central banks and other sovereign exposures, and 6% for the public sector and similar entities. Credit risk-weighted assets amounted to €384 billion (including counterparty risk).

The main economic sectors to which the Group is exposed in its Non-Financial Corporations portfolio are Real Estate (36% of gross exposures at December 31, 2021), Finance/Insurance (11%), Wholesale and Retail Trade (11%) and Manufacturing industry (7%).

Groupe BPCE develops its activities mainly in France. The Group’s gross exposure (gross carrying amount) to France is €990 billion, representing 84% of the total gross exposure. The remaining exposures are mainly concentrated in the United States 4%, with other countries accounting for 12% of total gross exposures.

For further information, please see Chapters 5 “Credit risk” and 6 “Counterparty risk” in this document.

A substantial increase in impairments or provisions for expected credit losses recognized in respect of Groupe BPCE’s portfolio of loans and advances could have a material adverse effect on its income and financial position.

In the course of its lending activities, Groupe BPCE regularly recognizes charges for asset impairments in order to reflect, if necessary, actual or potential losses on its portfolio of loans and advances. Such impairments are booked in the income statement under “Cost of risk.” Groupe BPCE’s total charges for asset impairments are based on the Group’s measurement of past losses on loans, volumes and types of loans granted, industry standards, loans in arrears, economic conditions and other factors associated with the recoverability of various types of loans. While Groupe BPCE makes every effort to set aside a sufficient level of provisions for asset impairment expenses, its lending activities may cause it in the future to have to increase its expenses for losses on loans, due to a rise in non-performing loans or for other reasons such as the deterioration of market conditions or factors affecting certain countries. Any substantial increase in charges for losses on loans, material change in Groupe BPCE’s estimate of the risk of loss associated with its portfolio of loans, or any loss on loans exceeding past impairment expenses, could have an adverse impact on Groupe BPCE’s results and financial position.

Note: Groupe BPCE’s cost of risk amounts to €1,783 million in 2021 compared to €2,998 million in 2020, with credit risks accounting for 88% of Groupe BPCE’s risk-weighted assets. On the basis of gross exposures, 38% relate to retail customers and 27% to corporate customers (of which 69% of exposures are located in France).

Consequently, the risk associated with a significant increase in impairment expenses on assets booked to Groupe BPCE’s loans and advances portfolio is significant for Groupe BPCE in terms of impact and probability, and is therefore monitored carefully and proactively.

A decline in the financial strength and performance of other financial institutions and market players may have an unfavorable impact on Groupe BPCE.

Groupe BPCE’s ability to execute transactions may be affected by a decline in the financial strength of other financial institutions and market players. Institutions are closely interconnected owing to their trading, clearing, counterparty and financing operations. A default by a sector player, or even mere rumors or concerns regarding one or more financial institutions or the financial industry in general, may lead to a general contraction in market liquidity and subsequently to losses or further defaults in the future. Groupe BPCE is directly or indirectly exposed to various financial counterparties, such as investment service providers, commercial or investment banks, clearing houses and CCPs, mutual funds, hedge funds, and other institutional clients, with which it regularly conducts transactions. The default or failure of any such counterparties may have an adverse impact on Groupe BPCE’s financial position. Moreover, Groupe BPCE may be exposed to the risk associated with the growing involvement of operators subject to little or no regulation in its business sector and to the emergence of new products subject to little or no regulation (including in particular crowdfunding and trading platforms). This risk would be exacerbated if the assets held as collateral by Groupe BPCE could not be sold or if their selling price would not cover all of Groupe BPCE’s exposure to defaulted loans or derivatives, or in the event of fraud, embezzlement or other misappropriation of funds committed by financial sector participants in general to which Groupe BPCE is exposed, or if a key market operator such as a CCP defaults.

-

Financial risks

Groupe BPCE is dependent on its access to funding and other sources of liquidity, which may be limited for reasons outside its control, thus potentially having a material adverse impact on its results.

Access to short-term and long-term funding is critical for the conduct of Groupe BPCE’s business. Non-collateralized sources of funding for Groupe BPCE include deposits, issues of long-term debt and short/medium-term negotiable debt securities, banks loans and credit lines. Groupe BPCE also uses funding secured in particular by reverse repurchase agreements. If Groupe BPCE were unable to access the secured and/or unsecured debt market at conditions deemed acceptable, or incurred an unexpected outflow of cash or collateral, including a significant decline in customer deposits, its liquidity may be negatively affected. Furthermore, if Groupe BPCE were unable to maintain a satisfactory level of customer deposits (e.g. in the event its competitors offer higher rates of return on deposits), it may be forced to obtain funding at higher rates, which would reduce its net interest income and results.

Groupe BPCE’s liquidity, and therefore its results, may also be affected by unforeseen events outside its control, such as general market disruptions, operational hardships affecting third parties, negative opinions on financial services in general or on the short/long-term outlook for Groupe BPCE, changes in Groupe BPCE’s credit rating, or even the perception of the position of Groupe BPCE or other financial institutions among market operators.

Groupe BPCE’s access to the capital markets, and the cost of long-term unsecured funding, are directly related to changes in its credit spreads on the bond and credit derivatives markets, which it can neither predict nor control. Liquidity constraints may have a material adverse impact on Groupe BPCE’s financial position, results and ability to meet its obligations to its counterparties.

Groupe BPCE’s liquidity reserves include cash placed with central banks and securities and receivables eligible for central bank funding. Groupe BPCE’s liquidity reserve amounted to €329 billion on December 31, 2021, covering 247% short-term funding and short-term maturities of MLT debt. The one-month LCR (Liquidity Coverage Ratio) averaged 161% over 12 months on December 31, 2021 versus 156% on December 31, 2020. Any restriction on Groupe BPCE’s access to funding and other sources of liquidity could have a material adverse impact on its results. Given the significance these risks hold for Groupe BPCE in terms of impact and probability, they are carefully and proactively monitored.

Significant changes in interest rates may have a material adverse impact on Groupe BPCE’s net banking income and profitability.

Net interest income earned by Groupe BPCE during a given period has a material influence on net banking income and profitability for the period. In addition, material changes in credit spreads may influence Groupe BPCE’s earnings. Interest rates are highly sensitive to various factors that may be outside the control of Groupe BPCE. In the last decade, interest rates have tended to be low but may increase, and Groupe BPCE may not be able to immediately pass on the impacts of this change. Changes in market interest rates may have an impact on the interest rate applied to interest-bearing assets, different from those of interest rates paid on interest-bearing liabilities. Any adverse change in the yield curve may reduce net interest income from associated lending and funding activities and thus have a material adverse impact on Groupe BPCE’s net banking income and profitability.

Any period of inflation could affect Groupe BPCE’s revenues if it resulted in an increase in regulated savings rates without impacting the cost of credit, thus affecting the net interest margin and income. The sensitivity of the net present value of Groupe BPCE’s balance sheet to a +/-200 bps variation in interest rates remains below the 15% Tier 1 limit. At December 31, 2021, Groupe BPCE’s sensitivity to interest rate increases stood at -11.37% compared to Tier 1 versus -6.21% at December 31, 2020. The measurement of the change in Groupe BPCE’s projected net interest margin over one year according to four scenarios (“rising rates”, “falling rates”, “steepening of the curve”, “flattening of the curve”) in relation to the central scenario, indicates that “falling rates” (shock of -25bp) is the most unfavorable scenario, with a negative impact, as of September 30, 2021, of -0.88% (€82 million) over a sliding year.

Market fluctuations and volatility expose Groupe BPCE (in particular Natixis) to losses in its trading and investment activities, which may adversely impact Group’s BPCE’s results and financial position.

In the course of its third-party trading or investment activities, Groupe BPCE may carry positions in the bond, currency, commodity and equity markets, and in unlisted securities, real estate assets and other asset classes. These positions may be affected by volatility on the markets (especially the financial markets), i.e. the degree of price fluctuations over a given period on a given market, regardless of the levels on the market in question. Certain market configurations and fluctuations may also generate losses on a broad range of trading and hedging products used, including swaps, futures, options and structured products, which could adversely impact Groupe BPCE’s results and financial position. Similarly, extended market declines and/or major crises may reduce the liquidity of certain asset classes, making it difficult to sell certain assets and in turn generating material losses.

Market risk-weighted assets totaled €15.1 billion, i.e. around 3% of Groupe BPCE’s total risk-weighted assets, on December 31, 2021. For information, the weight of Corporate & Investment Banking activities in the Group’s net banking income was 14% for the year 2021. For more detailed information and examples, see Note 10.1.2 (“Analysis of financial assets and liabilities classified in Level 3 of the fair value hierarchy”) to the consolidated financial statements of Groupe BPCE, included in the 2021 Universal Registration Document.

Changes in the fair value of Groupe BPCE’s portfolios of securities and derivative products, and its own debt, are liable to have an adverse impact on the net carrying amount of these assets and liabilities, and as a result on Groupe BPCE’s net income and equity.

The net carrying amount of Groupe BPCE’s securities, derivative products and other types of assets at fair value, and of its own debt, is adjusted (at balance sheet level) at the date of each new financial statement. These adjustments are predominantly based on changes in the fair value of assets and liabilities during an accounting period, i.e. changes taken to profit or loss or recognized directly in other comprehensive income. Changes recorded in the income statement, but not offset by corresponding changes in the fair value of other assets, have an impact on net banking income and thus on net income. All fair value adjustments have an impact on equity and thus on Groupe BPCE’s capital adequacy ratios. Such adjustments are also liable to have an adverse impact on the net carrying amount of Groupe BPCE’s assets and liabilities, and thus on its net income and equity. The fact that fair value adjustments are recorded over an accounting period does not mean that additional adjustments will not be necessary in subsequent periods.

On December 31, 2021, financial assets at fair value totaled €199 billion (with approximately €187 billion in financial assets at fair value held for trading purposes) and financial liabilities at fair value totaled €192 billion (with €162 billion in financial liabilities at fair value held for trading purposes). For more detailed information, see also Note 4.3 (“Net gains or losses on financial instruments at fair value through profit or loss”), Note 4.4 (“Net gains or losses on financial instruments at fair value through other comprehensive income”), Note 5.1 (“Financial assets and liabilities at fair value through profit or loss”) and Note 5.2 (“Financial assets at fair value through other comprehensive income”) to the consolidated financial statements of Groupe BPCE in the 2021 Universal Registration Document.

Groupe BPCE’s revenues from brokerage and other activities associated with fee and commission income may decrease in the event of market downturns.

A market downturn is liable to lower the volume of transactions (particularly financial services and securities transactions) executed by Groupe BPCE entities for their customers and as a market maker, thus reducing net banking income from these activities. In particular, in the event of a decline in market conditions, Groupe BPCE may record a lower volume of customer transactions and a drop in the corresponding fees, thus reducing revenues earned from this activity. Furthermore, as management fees invoiced by Groupe BPCE entities to their customers are generally based on the value or performance of portfolios, any decline in the markets causing the value of these portfolios to decrease or generating an increase in the amount of redemptions would reduce the revenues earned by these entities through the distribution of mutual funds or other investment products (for the Caisses d’Epargne and the Banques Populaires) or through Asset Management activities (for Natixis).

Even where there is no market decline, if funds managed for third parties throughout Groupe BPCE and other Groupe BPCE products underperform the market, redemptions may increase and/or inflows decrease as a result, with a potential corresponding impact on revenues from the Asset Management business.

In 2021, the total net amount of fees and commissions received was €10,323 million, representing 40% of Groupe BPCE’s net banking income. Revenues earned from fees and commissions for financial services came to €582 million and revenues earned from fees and commissions for securities transactions amounted to €258 million. For more detailed information on the amounts of fees and commissions received by Groupe BPCE, see Note 4.2 (“Fee and commission income and expenses”) to the consolidated financial statements of Groupe BPCE in the 2021 Universal Registration Document.

Downgraded credit ratings could have an adverse impact on BPCE’s funding cost, profitability and business continuity.

Groupe BPCE’s long-term ratings on December 31, 2021 were A+ for Fitch Ratings, A1 for Moody’s, A+ for R&I and A+ for Standard & Poor’s. The decision to downgrade these credit ratings may have a negative impact on the funding of BPCE and its affiliates active in the financial markets (including Natixis). A ratings downgrade may affect Groupe BPCE’s liquidity and competitive position, increase funding costs, limit access to financial markets and trigger obligations under some bilateral contracts governing trading, derivative and collateralized funding transactions, thus adversely impacting its profitability and business continuity.

Furthermore, BPCE and Natixis’ unsecured long-term funding cost is directly linked to their respective credit spreads (the yield spread over and above the yield on government issues with the same maturity that is paid to bond investors), which in turn are heavily dependent on their ratings. An increase in credit spreads may materially raise BPCE and Natixis’ funding cost. Shifts in credit spreads are correlated to the market and sometimes subject to unforeseen and highly volatile changes. Credit spreads are also influenced by market perception of issuer solvency and are associated with changes in the purchase price of Credit Default Swaps backed by certain BPCE or Natixis debt securities. Accordingly, a change in perception of an issuer solvency due to a rating downgrade could have an adverse impact on that issuer’s profitability and business continuity.

-

Insurance risks

Groupe BPCE generates 12.9% of its net banking income from its insurance businesses. Net banking income from life and non-life insurance activities amounted to €2,860 million for the year 2021, compared to €2,550 million for 2020.

A deterioration in market conditions, and in particular excessive interest rate increases or decreases, could have a material adverse impact on the personal insurance business and income of the Group.

The main risk to which Groupe BPCE insurance subsidiaries are exposed in their personal insurance business is market risk. Exposure to market risk is mainly related to the capital guarantee as applicable to euro-denominated savings products.

Among market risks, interest rate risk is structurally significant for Natixis Assurances, as its general funds consist primarily of bonds. Interest rate fluctuations may:

•in the case of higher rates: reduce the competitiveness of the euro-denominated offer (by making new investments more attractive) and trigger waves of redemptions and major arbitrages on unfavorable terms with unrealized capital losses on outstanding bonds;

•in the case of lower rates: in the long term, make the return on general funds too low to enable them to honor their capital guarantees.

As a result of the allocation of general funds, the widening of spreads and the decline in the equity markets could also have a significant unfavorable impact on the results of Groupe BPCE’s life and health insurance business, through the recording of provisions for impairment due to the decline in the valuation of investments at fair value through profit or loss.

A mismatch between the loss experience expected by the insurer and the amounts actually paid by the Group to policyholders could have a significant adverse impact on its non-life insurance business and on the personal protection insurance portion of its insurance business, as well as its results and its financial position.

The main risk to which Groupe BPCE’s insurance subsidiaries are exposed in connection with these latter activities is underwriting risk. This risk results from a mismatch between i) claims actually recorded and benefits actually paid as compensation for these claims and ii) the assumptions used by the subsidiaries to set the prices for their insurance products and to establish technical reserves for potential compensation.

The Group uses both its own experience and industry data to develop estimates of future policy benefits, including information used in pricing insurance products and establishing the related actuarial liabilities. However, actual experience may not match these estimates, and unforeseen risks such as pandemics or natural disasters could result in higher-than-expected payments to policyholders. In this respect, changes in climate phenomena (known as “physical” climate risks) are subject to particular vigilance.

In the event that the amounts actually paid by the Group to policyholders are greater than the underlying assumptions initially used to establish provisions, or if events or trends lead the Group to modify the underlying assumptions, the Group may be exposed to more significant liabilities than expected, which could have a negative impact on the non-life insurance business for the personal protection portion, as well as on the results and financial position of the Group.

In the continuing context of the Covid-19 pandemic, fiscal year 2021 was marked by very dynamic commercial activity in both business lines.

Commercial activity for 2021 shows significant growth compared to 2020. At €14.6 billion, revenues at the end of 2021 were up by 32% compared to the end of 2020. This growth was observed in all insurance activities, and was mainly driven by savings (+39%), which benefited from strong momentum in contrast to the very low inflows in the first half of 2020 linked to the first lockdown. As a result, collection is higher than before the health crisis: +11% compared to 2019.

The 2021 result benefited in particular from the 12% increase in outstandings in the savings business, as well as the good performance of the personal protection and borrower insurance activities. It also benefited from a favorable base effect, as fiscal year 2020 was marked by the economic consequences of the health crisis and in particular the decline in the equity markets.

•in non-life insurance: the loss ratio is at higher levels than in 2020, a year marked by several lockdowns that led to a drop in automotive claims. The deterioration in multi-risk home insurance claims is mainly explained by the recording of serious claims and by climatic events;

•in personal insurance: the loss ratio in personal protection and in borrower insurance improved in 2021, due to reversals of provisions.

In addition, the SCR (Solvency Capital Requirement) is covered at December 31, 2021, thanks in particular to a favorable economic and financial environment. The various actions taken over the last few years, particularly in terms of financial coverage, reinsurance, business diversification and management of investments, have also contributed to the solidity and resilience of the solvency of Natixis Assurances. It should be noted that the deterioration of the economic and financial environment, in particular the decline in the equity markets and the level of interest rates, could adversely affect the solvency of Natixis Assurances, by adversely affecting future margins.

-

Non-financial risks

In the event of non-compliance with applicable laws and regulations, Groupe BPCE could be exposed to significant fines and other administrative and criminal penalties that could have a material adverse effect on its financial position, activities and reputation.

The risk of non-compliance is defined as the risk of sanction – judicial, administrative or disciplinary – but also of financial loss or damage to reputation, resulting from non-compliance with laws and regulations, professional standards and practices, and ethical standards specific to banking and Insurance activities, whether national or international.

The banking and Insurance sectors are subject to increased regulatory oversight, both in France and internationally. Recent years have seen a particularly substantial increase in the volume of new regulations that have introduced significant changes affecting both the financial markets and the relationships between investment service providers and customers or investors (e.g. MIFID II, PRIIPS, the directive on the Insurance Distribution, Market Abuse Regulation, Fourth Anti-Money Laundering and Terrorism Financing directive, Personal Data Protection Regulation, Benchmark Index Regulation, etc.). These new regulations have major impacts on the company’s operational processes.

The realization of the risk of non-compliance could result, for example, in the use of inappropriate means to promote and market the bank’s products and services, inadequate management of potential conflicts of interest, the disclosure of confidential information, or privileged, failure to comply with due diligence on entering into relations with suppliers and customers, particularly in terms of financial security (in particular the fight against money laundering and the financing of terrorism, compliance with embargoes, the fight against fraud or corruption).

Within BPCE, the Compliance function is responsible for overseeing the system for preventing and managing non-compliance risks. Despite this system, Groupe BPCE remains exposed to the risk of fines or other significant sanctions from the regulatory and supervisory authorities, as well as civil or criminal legal proceedings that could have a significant adverse impact on its financial position, activities and reputation.

Any interruption or failure of the information systems belonging to Groupe BPCE or third parties may generate losses (including commercial losses) and may have a material adverse impact on Groupe BPCE’s results.

As is the case for the majority of its competitors, Groupe BPCE is highly dependent on information and communication systems, as a large number of increasingly complex transactions are processed in the course of its activities. Any failure, interruption or malfunction in these systems may cause errors or interruptions in the systems used to manage customer accounts, general ledgers, deposits, transactions and/or to process loans. For example, if Groupe BPCE’s information systems were to malfunction, even for a short period, the affected entities would be unable to meet their customers’ needs in time and could thus lose transaction opportunities. Similarly, a temporary failure in Groupe BPCE’s information systems despite back-up systems and contingency plans could also generate substantial information recovery and verification costs, or even a decline in its proprietary activities if, for example, such a failure were to occur during the implementation of a hedging transaction. The inability of Groupe BPCE’s systems to adapt to an increasing volume of transactions may also limit its ability to develop its activities and generate losses, particularly losses in sales, and may therefore have a material adverse impact on Groupe BPCE’s results.

Groupe BPCE is also exposed to the risk of malfunction or operational failure by one of its clearing agents, foreign exchange markets, clearing houses, custodians or other financial intermediaries or external service providers that it uses to carry out or facilitate its securities transactions. As interconnectivity with its customers continues to grow, Groupe BPCE may also become increasingly exposed to the risk of the operational malfunction of customer information systems. Groupe BPCE’s communication and information systems, and those of its customers, service providers and counterparties, may also be subject to failures or interruptions resulting from cybercriminal or cyberterrorist acts. For example, as a result of its digital transformation, Groupe BPCE’s information systems are becoming increasingly open to the outside (cloud computing, big data, etc.). Many of its processes are gradually going digital. Use of the Internet and connected devices (tablets, smartphones, apps used on tablets and mobiles, etc.) by employees and customers is on the rise, increasing the number of channels serving as potential vectors for attacks and disruptions, and the number of devices and applications vulnerable to attacks and disruptions. Consequently, the software and hardware used by Groupe BPCE’s employees and external agents are constantly and increasingly subject to cyberthreats. As a result of any such attacks, Groupe BPCE may face malfunctions or interruptions in its own systems or in third-party systems that may not be adequately resolved. Any interruption or failure of the information systems belonging to Groupe BPCE or third parties may generate losses (including commercial losses) due to the disruption of its operations and the possibility that its customers may turn to other financial institutions during and/or after any such interruptions or failures.

The risk associated with any interruption or failure of the information systems belonging to Groupe BPCE or third parties is significant for Groupe BPCE in terms of impact and probability, and is therefore carefully and proactively monitored.

Reputational and legal risks could unfavorably impact Groupe BPCE’s profitability and business outlook.

Groupe BPCE’s reputation is of paramount importance when it comes to attracting and retaining customers. Use of inappropriate means to promote and market Group products and services, inadequate management of potential conflicts of interest, legal and regulatory requirements, ethical issues, money laundering laws, economic sanctions, data policies and sales and trading practices could adversely affect Groupe BPCE’s reputation. Its reputation could also be harmed by inappropriate employee behavior, cybercrime or cyber terrorist attacks on Groupe BPCE’s information and communication systems, or any fraud, embezzlement or other misappropriation of funds committed by financial sector participants to which Groupe BPCE is exposed, or any legal ruling or regulatory action with a potentially unfavorable outcome. Any such harm to Groupe BPCE’s reputation may have a negative impact on its profitability and business outlook.

Ineffective management of reputational risk could also increase Groupe BPCE’s legal risk, the number of legal disputes in which it is involved and the amount of damages claimed, or may expose the Group to regulatory sanctions. For more information, see Chapter 10 “Legal risks” of this document. The financial consequences of these disputes may have an impact on the financial position of the Group, in which case they may also adversely impact Groupe BPCE’s profitability and business outlook.

Unforeseen events, such as a serious natural disaster, events related to climate risk (physical risk directly associated with climate change), pandemics, attacks or any other emergency situation can cause an abrupt interruption in the operations of Groupe BPCE entities, affecting in particular the Group’s core business lines (liquidity, payment instruments, securities services, loans to individual and corporate customers, and fiduciary services) and trigger material losses, if the Group is not covered or not sufficiently covered by an insurance policy. These losses could relate to material assets, financial assets, market positions or key personnel, and have a direct and potentially material impact on Groupe BPCE’s net income. Moreover, such events may also disrupt Groupe BPCE’s infrastructure, or that of a third party with which Groupe BPCE does business, and generate additional costs (relating in particular to the cost of re-housing the affected personnel) and increase Groupe BPCE’s costs (such as insurance premiums). Such events may invalidate insurance coverage of certain risks and thus increase Groupe BPCE’s overall level of risk.

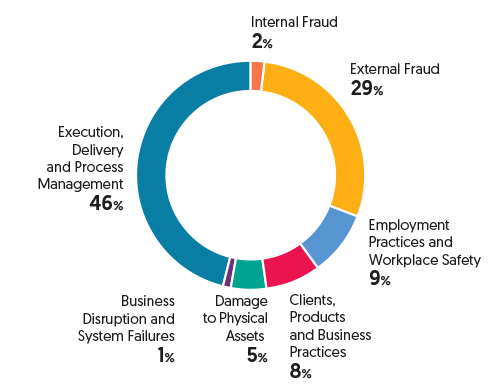

On December 31, 2021, operational risks accounted for 9% of Groupe BPCE’s risk-weighted assets, as on December 31, 2020. At December 31, 2021, Groupe BPCE’s losses in respect of operational risk can be primarily attributed to the “Corporate items” business line (38%). They are concentrated in the Basel category “execution, delivery and process management” for 46%.

The failure or inadequacy of Groupe BPCE’s risk management and hedging policies, procedures and strategies may expose it to unidentified or unexpected risks which may trigger unforeseen losses.

Groupe BPCE’s risk management and hedging policies, procedures and strategies may not succeed in effectively limiting its exposure to all types of market environments or all kinds of risks, and may even prove ineffective for some risks that the Group was unable to identify or anticipate. Furthermore, the risk management techniques and strategies employed by Groupe BPCE may not effectively limit its exposure to risk and do not guarantee that overall risk will actually be lowered. These techniques and strategies may prove ineffective against certain types of risk, in particular risks that Groupe BPCE had not already identified or anticipated, given that the tools used by Groupe BPCE to develop risk management procedures are based on assessments, analyses and assumptions that may prove inaccurate. Some of the indicators and qualitative tools used by Groupe BPCE to manage risk are based on the observation of past market performance. To measure risk exposures, the heads of risk management carry out a statistical analysis of these observations.

These tools or indicators may not be capable of predicting future exposure to risk. For example, these risk exposures may be due to factors that Groupe BPCE may not have anticipated or correctly assessed in its statistical models or due to unexpected or unprecedented shifts in the market. This would limit Groupe BPCE’s risk management capability. As a result, losses incurred by Groupe BPCE may be higher than those anticipated on the basis of past measurements. Moreover, the Group’s quantitative models cannot factor in all risks. While no significant problem has been identified to date, the risk management systems are subject to the risk of operational failure, including fraud. Some risks are subject to a more qualitative analysis, which may prove inadequate and thus expose Groupe BPCE to unexpected losses.

Actual results may vary compared to assumptions used to prepare Groupe BPCE’s financial statements, which may expose it to unexpected losses.

In accordance with current IFRS standards and interpretations, Groupe BPCE must base its financial statements on certain estimates, in particular accounting estimates relating to the determination of provisions for non-performing loans, provisions for potential claims and litigation, and the fair value of certain assets and liabilities. If the values used for the estimates by Groupe BPCE prove to be materially inaccurate, in particular in the event of major and/or unexpected market trends, or if the methods used to calculate these values are modified due to future changes in IFRS standards or interpretations, Groupe BPCE may be exposed to unexpected losses.

-

Regulatory risks

Groupe BPCE is subject to significant regulation in France and in several other countries around the world where it operates; regulatory measures and changes could have a material adverse impact on Groupe BPCE’s business and results.

The business and results of Group entities may be materially impacted by the policies and actions of various regulatory authorities in France, other governments of the European Union, the United States, foreign governments and international organizations. Such constraints may limit the ability of Groupe BPCE entities to expand their businesses or conduct certain activities. The nature and impact of future changes in such policies and regulatory measures are unpredictable and are beyond Groupe BPCE’s control. Moreover, the general political environment has evolved unfavorably for banks and the financial industry, resulting in additional pressure on the part of legislative and regulatory bodies to adopt more stringent regulatory measures, despite the fact that these measures may have adverse consequences on lending and other financial activities, and on the economy. Because of the continuing uncertainty surrounding the new legislative and regulatory measures, it is not possible to predict what impact they will have on Groupe BPCE; however, this impact may be highly adverse.

For example, legislation and regulations have recently been enacted or proposed with a view to introducing a number of changes, some permanent, in the global financial environment. While the objective of these new measures is to avoid a recurrence of the global financial crisis, the impact of the new measures could substantially change, and may continue to change, the environment in which Groupe BPCE and other financial institutions operate.

As a result of some of these measures, Groupe BPCE has reduced, and may further reduce, the size of certain activities in order to comply with the new requirements. These measures are also liable to increase the cost of compliance with new regulations. This could cause revenues and consolidated profit to decline in the relevant business lines, sales to decline in certain activities and asset portfolios, and asset impairment expenses.

The purpose of the 2019 adoption of the final versions of the Banking Package was to align prudential requirements for banks with Basel III standards. The implementation of these reforms may result in higher capital and liquidity requirements, which could impact Groupe BPCE funding costs.

On November 11, 2020, the Financial Stability Board (“FSB”), in consultation with the Basel Committee on Banking Supervision and national authorities, reported the 2020 list of global systemically important banks (“G-SIBs”). Groupe BCPE is classified as a G-SIB by the FSB. Groupe BPCE also appears on the list of global systematically important financial institutions (“G-SIFIs”).

These regulatory measures, which may apply to various Groupe BPCE entities, and any changes in such measures may have a material adverse impact on Groupe BPCE’s business and results.

Legislation and regulations have recently been enacted or proposed with a view to introducing a number of changes, some permanent, in the global financial environment. These new measures, aimed at avoiding a new global financial crisis, have significantly altered the operating environment of Groupe BPCE and other financial institutions, and may continue to alter this environment in the future. Groupe BPCE is exposed to the risk associated with changes in legislation and regulations. These include the new prudential backstop rules, which measure the difference between the actual provisioning levels of defaulted loans and guidelines including target rates, depending on the age of the default and the presence of guarantees.

In today’s evolving legislative and regulatory environment, it is impossible to foresee the impact of these new measures on Groupe BPCE. The development of programs aimed at complying with these new legislative and regulatory measures (and updates to existing programs), and changes to the Group’s information systems in response to or in preparation for new measures generates significant costs for the Group, and may continue to do so in the future. Despite its best efforts, Groupe BPCE may also be unable to fully comply with all applicable laws and regulations and may thus be subject to financial or administrative penalties. Furthermore, new legislative and regulatory measures may require the Group to adapt its operations and/or may affect its results and financial position. Lastly, new regulations may require Groupe BPCE to strengthen its capital or increase its total funding costs.

The risk associated with regulatory measures and subsequent changes to such measures is significant for Groupe BPCE in terms of impact and probability, and is therefore carefully and proactively monitored.

BPCE may have to help entities belonging to the financial solidarity mechanism in the event they experience financial difficulties, including entities in which BPCE holds no economic interest.

As the central institution of Groupe BPCE, BPCE is responsible for ensuring the liquidity and solvency of each regional bank (Banques Populaires and Caisses d’Epargne) and the other members of the group of affiliates which are credit institutions subject to French regulations. The group of affiliates includes BPCE subsidiaries, such as Natixis, Crédit Foncier de France and Banque Palatine. For Groupe BPCE, all entities affiliated with the central institution of Groupe BPCE benefit from a guarantee and solidarity mechanism, the aim of which, in accordance with Articles L. 511-31 and L. 512-107-6 of the French Monetary and Financial Code, is to ensure the liquidity and solvency of all affiliated entities and to organize financial solidarity throughout the Group.

This financial solidarity is based on legislative provisions establishing a legal principle of solidarity obliging the central institution to restore the liquidity or solvency of affiliates in difficulty, and/or of all the affiliates of the Group, by mobilizing, if necessary, all of the affiliates’ liquid assets and equity.

The three guarantee funds created to cover Groupe BPCE’s liquidity and insolvency risks are described in Note 1.2 “Guarantee mechanism” to the consolidated financial statements of Groupe BPCE included in the 2021 Universal Registration Document. On December 31, 2021, the Banque Populaire and Caisse d’Epargne funds each contained €450 million. The Mutual Guarantee Fund holds €172 million in deposits per network. The regional banks are obligated to make additional contributions to the guarantee fund on their future profits. While the guarantee fund represents a substantial source of resources to fund the solidarity mechanism, there is no guarantee these revenues will be sufficient. If the guarantee funds prove insufficient, BPCE, by virtue of its role as central institution, will be obliged to make up the shortfall by mobilizing its own resources and, if necessary, all of the affiliates’ liquid assets and capital.