URD 2023

-

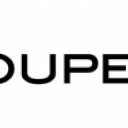

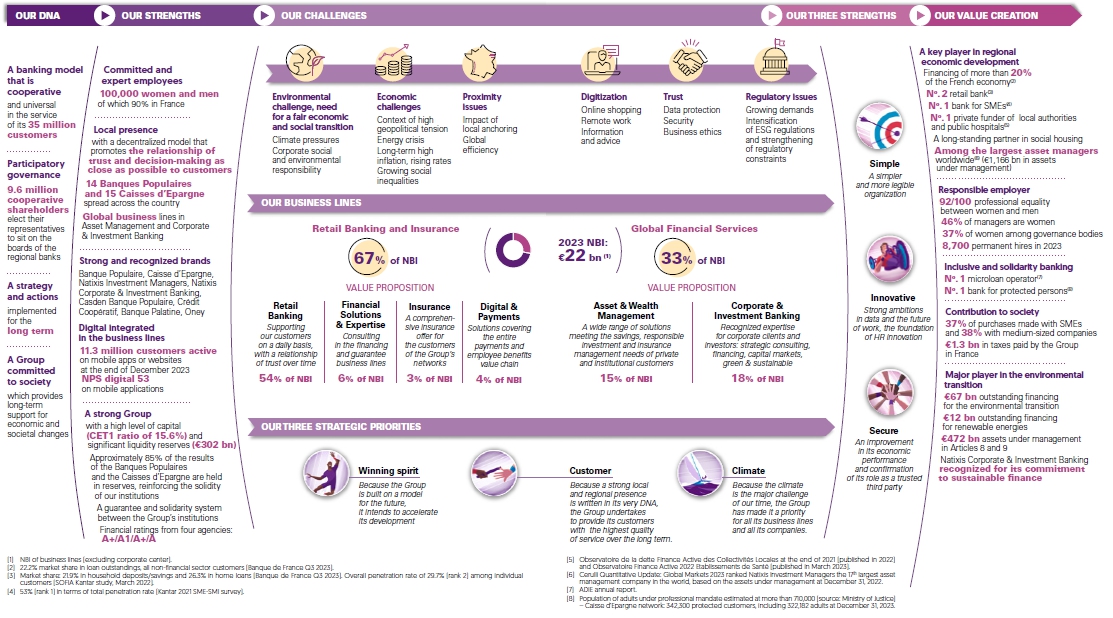

Groupe BPCE, the second largest banking group in France, performs a full range of banking and insurance activities.

With over 100,000 employees, its serves 35 million customers worldwide including individuals, professionals, companies, investors and local authorities. It operates in the retail banking and insurance fields in France via its two major networks, Banque Populaire and Caisse d’Epargne, along with Banque Palatine.

It also pursues its activities worldwide with the asset & wealth management services provided by Natixis Investment Managers and the wholesale banking expertise of Natixis Corporate & Investment Banking.

This Universal Registration Document was filed on March 25, 2024 with the AMF, in its capacity as the competent authority in respect of Regulation (EU) No. 2017/1129, without prior approval pursuant to Article 9 of said regulation. The Universal Registration Document may only be used for the purposes of a public offering or admission of securities to trading on a regulated market if it is accompanied by a memorandum pertaining to the securities and, where applicable, an executive summary and all amendments made to the Universal Registration Document.

The complete package of documents is approved by the AMF in accordance with Regulation (EU) No. 2017/1129. Copies of this Universal Registration Document may be obtained free of charge from BPCE, 7, Promenade Germaine Sablon 75013 Paris.

The English version of this report is a free translation from the original which was prepared in French. All possible care has been taken to ensure that the translation is an accurate presentation of the original. However, in matters of interpretation, views or opinion expressed in the original language version of the document in French take precedence over the translation.

Only the French version of the Universal Registration Document has been submitted to the AMF. It is therefore the onlyversion that is binding in law.

Our Group strengthened its commercial momentum in 2023 while increasing its financial strength to bring it up to the highest standard in Europe. This result is all the more remarkable given that the activity of our business lines took place in a subdued economic context and a tense international environment.

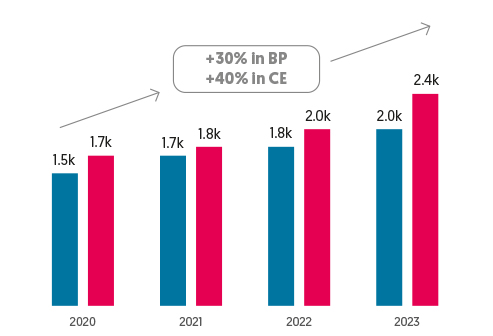

Thanks to particularly strong commercial activity in all customer segments, the Banque Populaire and Caisse d’Epargne networks continued to expand their business, posting a gain of 925,000 new customers over the year, while the insurance, payments and specialized financing activities continued to grow. In the Global Financial Services, Corporate & Investment Banking recorded its highest level of annual revenue, and Asset Management maintained a solid performance in a challenging market for the industry.

As we had anticipated, Groupe BPCE’s financial performance was marked by the rapid rise in interest rates; this impact is commensurate with the place we occupy in the financing of the French economy. For the customers of the Banques Populaires and Caisses d’Epargne who hold loans, this fixed-rate financing model has made it possible to protect their purchasing power, in line with our cooperative values.

I would like to thank our 100,000 employees in France and abroad for their daily commitment alongside our customers. They contribute to making our Group a central player in the economy, at the heart of environmental, technological and societal issues.

The commercial development of our businesses and our solid fundamentals are key assets for our sustainable growth strategy. This is the ambition that drives us with all the Group’s executives as we define the new strategic project that will guide our action for the coming years.

“The commercial development of our business lines and our solid fundamentals are key assets for our sustainable growth strategy.

Groupe BPCE is the second-leading banking group(1) in France and finances 22%(2) of the French economy. All our customers, be they individuals, professionals, associations, corporate customers of all sizes or institutional customers, have constantly evolving expectations, with increasing demands in terms of availability, feedback, advice and service.

Our business lines, in France and internationally, offer solutions tailored to meet these needs, in retail banking, insurance, financial solutions & expertise, payments, asset & wealth management, and corporate & investment banking.

In the regions and internationally, our brands support, with short decision-making circuits, our customers in all their projects, through all distribution channels.

We are convinced that our universal cooperative banking model, successfully built around strong brands recognized and close to their customers, is a model of the future, deeply in line with the aspirations and needs of society. Multi-entrepreneurial and decentralized, it allows us to operate over the long term.

With strong positions in each of its business lines, our Group is able to accelerate its development by always providing better support to our customers in their projects. We intend to deploy the full potential of our model to be a leader in banking, insurance and asset management for all.

(1) Market shares: 21.8% in customer savings and 22.2% in customer loans (Banque de France Q3-2023 all non-financial customer categories). (2) 22.2% market share in loan outstandings, all non-financial sector customer categories (Banque de France Q3-2023). [1] 2023 Kantar SME SMI survey. [2] Observatoire de la dette Finance Active des Collectivités Locales at the end of 2022 and Repères 119 USH at the end of 2023 (low-cost housing projects in figures). [3] 38.4% (rank 2) penetration rate among professional customers and individual entrepreneurs (Pépites CSA 2021-2022 survey). [4] Athling #laminutecreditconso study (2024). [5] Insurance Argus 2022. [6] Cerulli Quantitative Update: Global Markets 2023. [7] Dealogic. [8] Infralogic. Five priority areas defined with a target for additional revenue of around €1.5 billion and acceleration of international development.

• Retail banking: five priority areas: energy renovation, renewable energies, mobility, companies in transition, green savings offers and insurance • Corporate & Investment Banking (CIB): the environmental transition positioned at the heart of the customer relationship, intensification of expertise and green revenues • Asset Management: development of a leading ESG offering, with ambitious targets for assets under sustainable or impact management Already a leader in the financing of public hospitals, Groupe BPCE intends to become the benchmark partner in the healthcare sector:

• Key player for healthcare professionals (hospital civil service, liberal professions, future healthcare professionals) and a leading player in dependency • Recognized healthcare infrastructure provider (EHPADs, senior residences, nursing homes, public hospitals, private clinics, etc.) • Partner of healthcare companies and of the innovative ecosystem (e-health, biotech, medtech, etc.) As a fully-fledged bank-insurer, the Group will rely on its latest generation platform to develop, offer a differentiating customer/advisor experience, support network advisors in marketing and accelerate professional and individual health offers.

Thanks to the equipment potential of Banque Populaire and Caisses d’Epargne customers, Groupe BPCE wants to position itself as a leader in this market, with the launch of new solutions (instant personal loans, digital revolving credit, and debt restructuring), investments in digital technology and the development of online assistance.

Thanks to its regional roots and the complementary nature of its businesses, Groupe BPCE has set itself the goal of developing its customer base and its financing outstandings in the medium-sized segment.

In Asset Management and in Corporate & Investment Banking, Groupe BPCE has confirmed the United States as the second main market after France and is accelerating its development in the Asia-Pacific region (APAC).

A growth strategy in Europe through development, from Oney, and acquisition opportunities in the consumer loans and leasing businesses.

The Group aims to offer its retail banking customers the best experience thanks to a “3D” relational model, with a pragmatic and local approach to the network of branches. All of the Group’s business lines and companies have set Net Promoter Score (NPS) targets for 2024.

The customer advisor, the linchpin of a long-term banking relationship of trust, supports the customer in all of their life events

Customization of the solutions provided and of the proposed pathways according to customer needs, automated data collection, management of consents

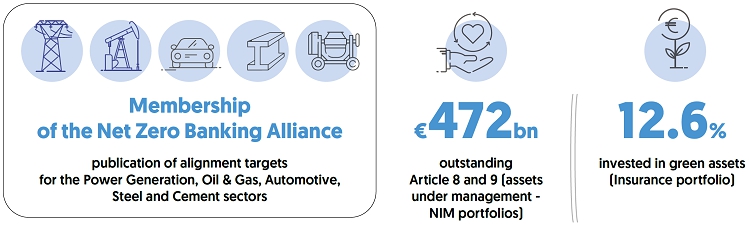

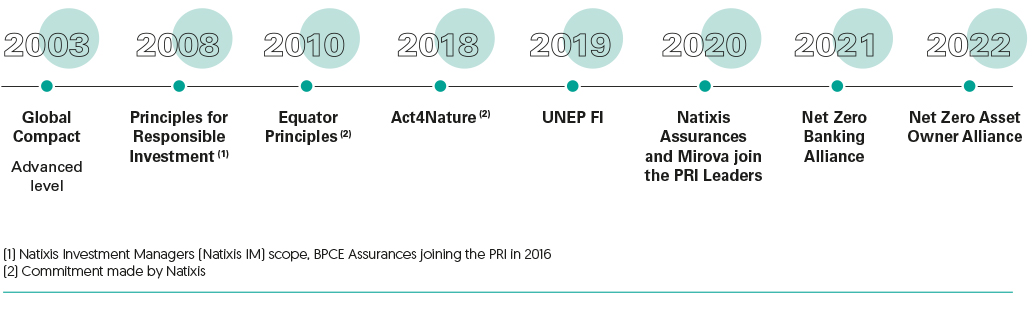

• A distribution and relationship model consistent with local roots • Networks of branches that value local relationships and advice and are constantly adapting • Varied branch formats designed to match market realities and customer expectations: consultancy branches, multi-site branches, specialized branches, temporary branches, seasonal branches, e-branches, sustainable development branches, etc. Groupe BPCE joined the Net-Zero Banking Alliance in 2021 and made concrete commitments to achieve carbon neutrality by 2050.

• By prioritizing the portfolios where the bank can have the most significant impact (most greenhouse gas-intensive sectors) • By measuring the climate impact and defining an alignment trajectory for the main exposures of its banking book • Project financing, privileged advice and strategic dialog around the transition, dedicated ESG savings offers Towards a low-carbon economy

•

Groupe BPCE has published a climate report following the recommendations of the TCFD(1) and details its actions to support the transition towards a low-carbon economy and adaptation to the effects of climate change.

• Grouping of business lines serving the networks: Insurance, Payments, Financial Solutions & Expertise (FSE) • Creation of Global Financial Services (GFS) bringing together the Asset & Wealth Management and Corporate & Investment Banking businesses • Simplification of the coordination of functions between BPCE and the GFS, Insurance and Payments business lines • Harmonization, self-care, automation of key local banking processes • Strengthening of pooling and cooperation (fiduciary, checks, desktop publishing, credit, etc.) • €400 million investment in data • Invest in fintech/insurtech, enrich offers and diversify revenues through open banking Place the use of data at the heart of business

•

To develop and personalize the customer relationship (identification of life events, management of customer satisfaction), improve operational efficiency (automated collection and control of documents, detection of fraud), and reduce risks (predictive approach, industrialization of reporting)

Develop a reference platform for employee benefits

•

Bimpli (contraction of “Better” & “Simply”) is becoming THE sole and simple solution combining the best of employee benefits (gift vouchers, restaurant vouchers, CESU, prize pools, etc.) on a single platform.

Building tailored career paths

•

The transformation of the business lines within Groupe BPCE requires the development of relational and managerial positions in line with the new ways of working. The BPCE Campus supports the Group’s strategic priorities with programs dedicated to career progression and development in the commercial networks and the promotion of banking services.

TIGHT ECONOMIC PERFORMANCE AND FINANCIAL STRENGTH, AT THE HEART OF THE AMBITIONS OF THE STRATEGIC PLAN

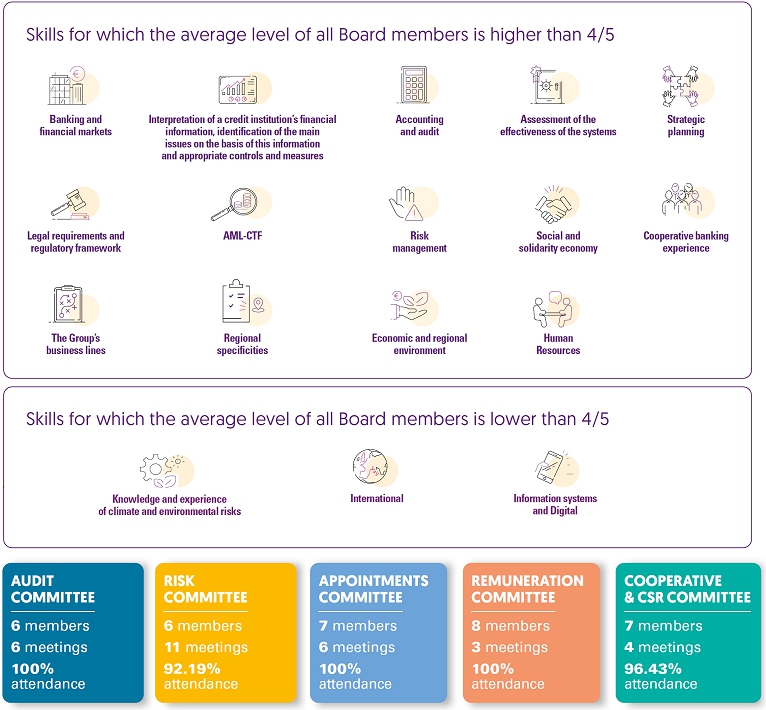

• Significant increase in profitability by activating growth drivers, simplifying the operating model and controlling the cost of risk • Cost savings: simplification of the IT organization, modernization of banking services, real estate portfolio, operational efficiency plan for GFS businesses, etc. • Financial resilience requirement: reinforcement of recurring solvency mainly from reserves • Tightly managing risks by confirming the Group’s current level of risk appetite and investing in risk management systems * The average skill levels of Board members are detailed in the Supervisory Board’s collective skills matrix, Section 3.3.2 of this Universal Registration Document. OUR PURPOSE: Resolutely cooperative, innovative and committed players, retail bankers and insurers,Groupe BPCE companies and employees support their cooperative shareholders and customers with financial solutions adapted to each one and build a sustainable and responsible relationship with them

(1) Data restated for the effects of the first-time application of IFRS 9 and IFRS 17 relating to insurance activities. in millions of euros 2023 2022(2) 2021 Net banking income 11,009 10,901 11,780 Gross operating income 2,495 2,316 2,702 Income before tax 1,945 1,853 2,293 NET INCOME GROUP SHARE 1,229 1,154 1,185 FINANCIAL STRUCTURE in billions of euros 12/31/2023 12/31/2022 12/31/2021 Equity attributable to equity holders of the parent 27.8 27.0(2) 25.5 Tier 1 capital 20.0 19.8 18.6 Tier 1 ratio 11.7% 11.6% 10.8% Total capital ratio 18.6% 18.7% 17.9% -

1 PRESENTATION OF GROUP BPCE

1.1 Group history

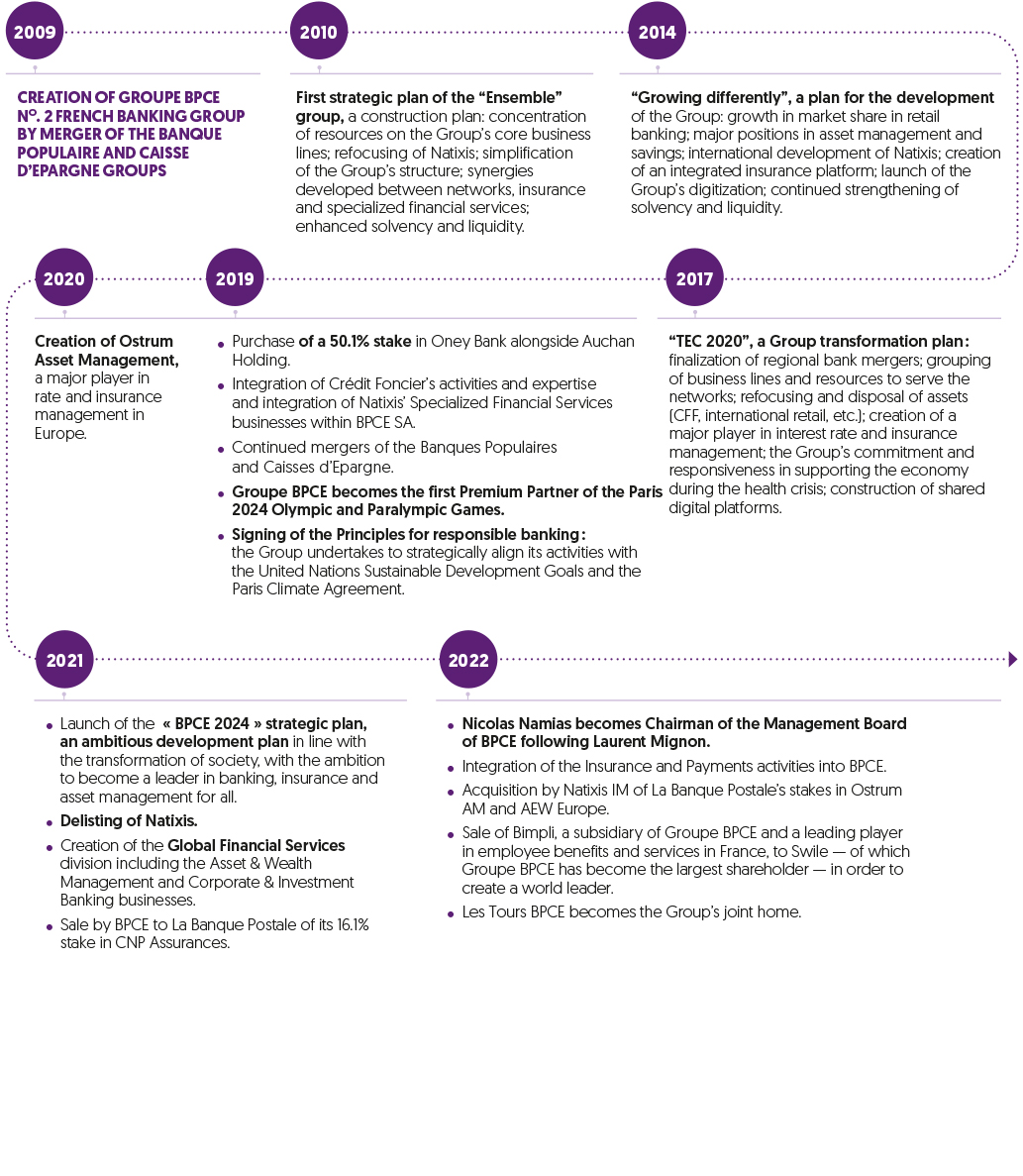

Groupe BPCE was established in 2009 through the merger of the Banque Populaire and Caisse d’Epargne groups. This marked the combination of two leading cooperative banks, created in 1878 and 1818 respectively, sharing common values rooted in solidarity, a local presence, democratic governance and a long-term vision.

The first step to forming the Group took place in 2006, with the creation of Natixis from the merger of Ixis and Natexis Banques Populaires.

In 2021, Natixis shares were delisted and the Group simplified its organization. It thereby strengthens its universal cooperative banking model.

True to its roots and history, Groupe BPCE supports the major changes of today, whether they be digital, environmental, or social.

1878:FIRST BANQUE POPULAIRE FOUNDED

The Banques Populaires were founded by and for entrepreneurs, to make it easier to finance their projects.1917:The Banques Populaires quickly become major players in their region’s economy, working for craftsmen, small retailers, and SMEs.

-

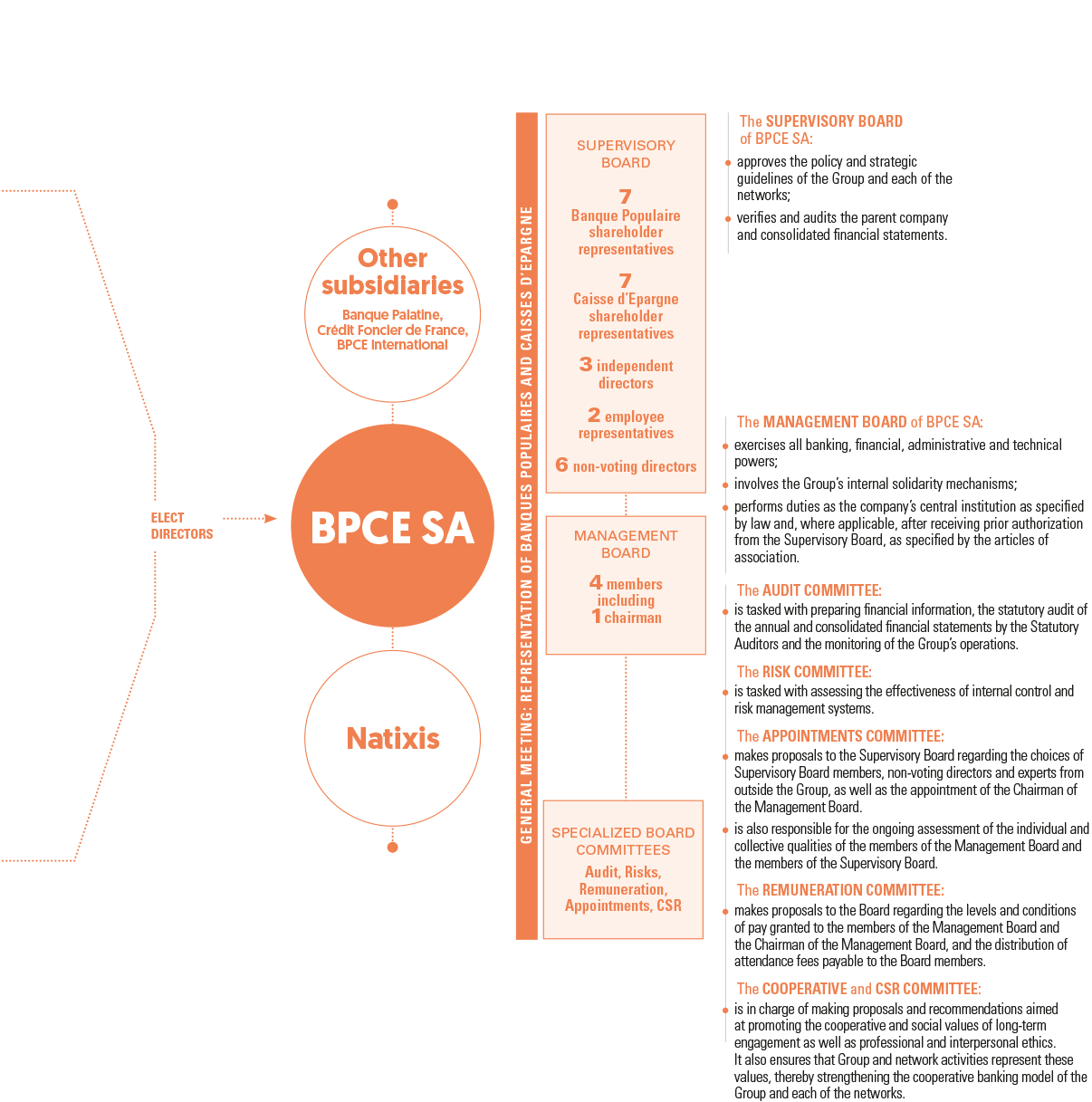

1.2 Understanding the Group’s organization

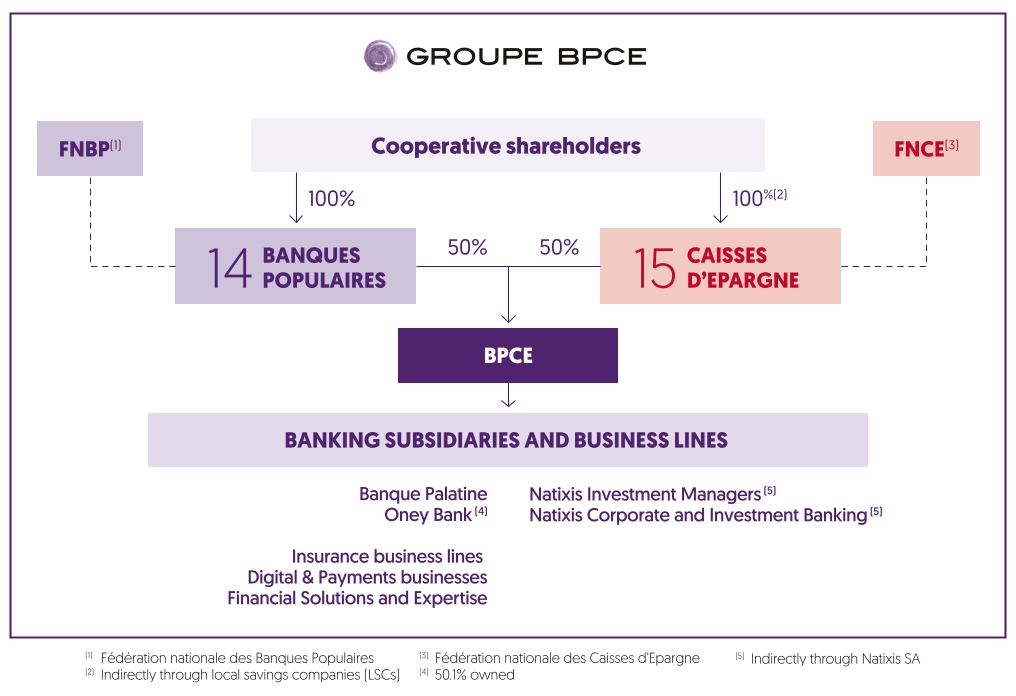

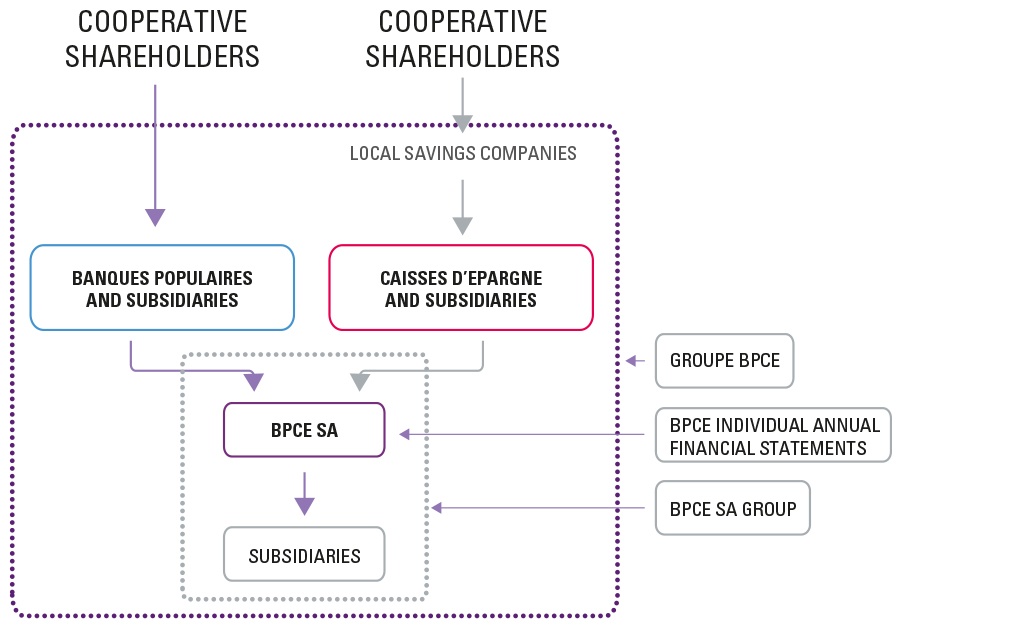

The Banques Populaires and the Caisses d’Epargne are owned by 9.6 million cooperative shareholders. This highly stable shareholding structure is imbued with a strong cooperative spirit.

The 14 Banques Populaires and the 15 Caisses d’Epargne hold an equal 100% stake in BPCE, which is responsible for defining the Group’s policy and strategic orientations, and coordinating the commercial policies of each network.

The Banques Populaires and Caisses d’Epargne are banks in their own right. They collect deposits and savings, distribute loans and define their priorities locally.

The Fédération nationale des Banques Populaires (FNBP) and the Fédération nationale des Caisses d’Epargne (FNCE), the bodies that provide deliberation, communication and representation for the two networks and their cooperative shareholders, play an essential role in defining, coordinating and promoting the banks’ cooperative spirit and social responsibility initiatives, in accordance with Groupe BPCE’s commercial and financial objectives. Persons representative of their regional economies sit on the Board of Directors of the Banques Populaires and on the Steering and Supervisory Board of the Caisses d’Epargne. Their resources are first and foremost allocated to meet the needs of local areas and regional customers.

Under the cooperative banking model, cooperative shareholding customers are the focal point of the Group’s governance.

The Banques Populaires and Caisses d’Epargne are credit institutions wholly-owned by their cooperative shareholders (via LSCs – Local Savings Companies – for the Caisses d’Epargne).

Cooperative shareholding customers – both individuals and legal entities – play an active part in the life, ambitions and development of their bank.

Being a cooperative shareholder means owning a cooperative share (a percentage of the share capital not quoted on the stock exchange), representing a portion of the share capital in a Banque Populaire or an LSC for a Caisse d’Epargne, and playing a role in the bank’s operation by taking part in General Meetings and voting to approve the financial statements and resolutions, validating management decisions and electing directors.

Each institution is governed by a Board of Directors and a Chief Executive Officer for the Banques Populaires, or a Steering and Supervisory Board and a Management Board for the Caisses d’Epargne.

BPCE brings together the central institution of Groupe BPCE, the retail and global business lines, as well as the resource pools.

The central institution is responsible for defining the policy and strategic orientations of the Group and each of the two networks.

• represent the Group and its networks, and negotiate national/international agreements on their behalf;

• take all necessary measures to ensure the Group’s liquidity and solvency, risk management and internal control.

All banks affiliated with the central institution are covered by a guarantee and solidarity mechanism.

Since November 2023, the retail and global business lines have been brought together under the umbrella of BPCE. This collective operates while respecting the legal structures, existing brands and specific characteristics of each business line. BPCE brings together the following activities:

-

1.3 Highlights

Following their alliance, Swile and Groupe BPCE created a new leader in employee benefits and worktech. Swile now owns 100% of Bimpli, and Groupe BPCE became Swile’s largest shareholder with a 22% stake.

Oney, a Groupe BPCE subsidiary specializing in innovative payment solutions and financial services, announced the signature of a cooperation agreement with Ingka Group, IKEA’s main distributor in Portugal, Belgium and the Netherlands. This agreement strengthens Oney’s leadership in Europe.

Banque Populaire strengthened its presence among innovative healthcare players by signing a partnership agreement with France Biotech, the leading independent French association of innovative healthcare entrepreneurs and their expert partners. In particular, this collaboration will bring new solutions to customers in the fields of e-health, medTech and bioTech.

Groupe BPCE became a shareholder of Scope Group, a financial and non-financial rating agency covering all asset classes (countries, companies, public authorities, financing, etc.). The aim is to support a European initiative in the rating market, which is dominated by the major Anglo-Saxon agencies.

The 15 Caisses d’Epargne launched their Utility Contract and deployed a new communications strategy to promote their commitments to “Be the most useful player alongside their customers in transforming society”. As regional cooperative banks, the Caisses d’Epargne are stepping up their action in support of regional development and transformation in three areas: the economy, the environment and social issues.

On the occasion of the Paris 2024 Olympic and Paralympic Games, BPCE became a major patron of Paris Musées and the leading patron of the Petit Palais. The venue will be fitted out to provide an unforgettable experience for over 20,000 guests, customers and teams. With this three-year partnership, Groupe BPCE is committed to three major initiatives. It will finance the restoration of the peristyle and its fresco. It will contribute to a new, responsible focus on the museum’s permanent collections, both its masterpieces and its sports-related works. Last but not least, it will support work to improve the Petit Palais’ energy performance.

The Group announced its participation in the financing of France’s fifth offshore wind farm, off the islands of Yeu and Noirmoutier. Construction will take two and a half years, and will directly employ 1,600 people. By 2025, the 62 wind turbines with a combined output of 496 MW will be able to supply nearly 800,000 people with renewable energy. More than 17 international banks are involved in the €2.5 billion financing package, including Groupe BPCE with Caisse d’Epargne Bretagne Pays de Loire, BPCE Energeco (a subsidiary of BPCE Lease), Natixis Investment Managers and Natixis Corporate & Investment Banking, and the Caisse d’Epargne fund dedicated to financing energy transition projects.

Natixis Corporate & Investment Banking inaugurated a branch in South Korea, to complement its product offering and customer base in the region.

Caisse d’Epargne accelerated its development in the wine market with the creation of Vitibanque. This comprehensive offering is built around an organization dedicated to winegrowers and a range of products and services tailored to their day-to-day needs. For its part, Natixis Interépargne launched the first customizable video guide to employee savings and retirement.

Groupe BPCE successfully carried out the first social bond issue in France dedicated exclusively to “Sport and Health” themes. The placement of this social bond, carried out by Natixis Corporate & Investment Banking teams, raised €500 million to refinance Sports and Health assets on behalf of the 14 Banques Populaires and 15 Caisses d’Epargne. With the launch of this issue, Groupe BPCE is part of the Agenda 2030 aimed at meeting the United Nations’ sustainable development Goal No. 3 “Health and Well-being”.

The Banques Populaires and Caisses d’Epargne, Official Sponsors of the Torch Relay and Premium Partners of the Paris 2024 Olympic and Paralympic Games, opened their recruitment campaign to select 900 future bearers of the Olympic Flame from among their customers, cooperative shareholders, employees and the general public. More than 55,000 people have volunteered.

Groupe BPCE mobilized to support Banques Populaires and Caisses d’Epargne customers affected by the damage caused by urban violence. Faced with this extraordinary situation, the Banques Populaires and the Caisses d’Epargne set up an emergency plan to help all affected customers. These measures concern all customers: individual and professional customers, particularly small retailers and craftsmen, and businesses.

With “Sport for Health & Collective Commitment”, under the patronage of Stéphane Diagana, Groupe BPCE set up a scheme to develop long-term physical activity and sports for employees in all Group companies. Beyond its positive impact, it is also a lever for attracting and retaining employees, and a support for diversity and gender equality policies.

Banque Populaire, Fédération Nationale des Socama and the European Investment Fund (EIF) signed a new agreement to counter-guarantee loans of up to €1 billion under the InvestEU “Competitiveness of SMEs” program. In 20 years, the partnership with the EIF has enabled Banques Populaires and Socama to support 250,000 entrepreneurs with €9 billion in loans.

Banques Populaires and Caisses d’Epargne signed a partnership agreement with Papernest, a start-up specializing in simplifying the administrative procedures involved in household contracts and subscriptions. Against a backdrop of rising inflation and energy costs, Banques Populaires and Caisses d’Epargne helped their individual customers to improve their purchasing power by offering them comprehensive, free support in optimizing their gas, electricity, internet and cell phone subscriptions.

Banque Populaire expanded its range of services and launched Rythméo Start, an innovative, simple and digital banking solution to support all self-employed customers. Thanks to a fast, simple and secure online subscription process, the entrepreneur benefits from an adapted offer with all the essential services to get his or her business off to a good start.

Natixis Corporate & Investment Banking expanded its presence in North America by opening a representative office in Toronto. Natixis Wealth Management unveiled its new communication campaign around ‘What’s your next move?’.

Groupe BPCE launched the innovative Tap to Pay solution on iPhone to enable Banque Populaire, Caisse d’Epargne and Payplug customers to make contactless payments. Accessible via iPhone, it is perfectly suited to the needs of craftsmen, small retailers, mobile merchants and entrepreneurs, as it does not require investment in hardware or a payment terminal. Tap to Pay on iPhone also meets the needs of major retailers looking to digitalize their points of sale, while further optimizing the in-store shopping experience.

Several Groupe BPCE banks participated in the financing of Toulouse Blagnac Airport’s first sustainability loan, in line with its commitment to CSR. Natixis Corporate & Investment Banking, Caisse d’Epargne de Midi-Pyrénées and Banque Populaire Occitane are involved, along with three other banks, in this double-tranche financing for a total of €145 million, the margin of which is indexed to ESG criteria. Natixis Corporate & Investment Banking is also acting as ESG coordinator.

Banque Populaire and Caisse d’Epargne launched “Elan Avril 2024”, the first savings offer in France linked to an index that contributes positively to people’s health and well-being. This savings product, designed by Natixis Corporate & Investment Banking teams, is indexed to a “health and well-being” index, made up of 75 international companies whose products and services contribute positively to people’s health and well-being by improving their physical and psychological condition through health, nutrition and sport.

EPI (the European Payments Initiative) announced the successful completion of its first account-to-account instant payment transactions with wero, the instant payment solution developed by EPI. This milestone was reached thanks to a successful real-life test between customers of Sparkasse Elbe-Elster in Germany and Banque Populaire et Caisse d’Epargne (Groupe BPCE) in France.

-

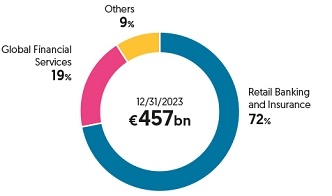

1.4 The Group’s business lines

The 14 Banques Populaires are shareholders in BPCE on an equal footing with the Caisses d’Epargne, and are fully-fledged banks owned by their cooperative shareholders. They form a first-rate banking network made up of 12 regional Banques Populaires and two national affinity banks: Casden Banque Populaire, the benchmark bank for the French public sector, and Crédit Coopératif, the bank for the social and solidarity economy.

The Banques Populaires are actively involved in local communities and remain true to their entrepreneurial roots, providing their individual, professional, association, corporate and institutional customers with a full range of financing, savings, insurance, payment and specialized financial services (such as private management, leasing and factoring).

The Banques Populaires are wholly-owned by their cooperative shareholders. The strength and durability of their cooperative model is based on balanced governance. Members are cooperative shareholders, co-owners of their bank’s capital, through the purchase of shares. They elect the directors, who are committed local personalities, at the General Meeting, reinforcing the local character of Banque Populaire institutions.

Each year, the Banques Populaires measure the cooperative and responsible actions they carry out in their regions, mainly in three areas: local proximity, entrepreneurial culture, and cooperative and sustainable commitment. These actions are evaluated in euros in the cooperative and societal footprint, a tool based on ISO 26000 (the international standard for CSR) which references all the voluntary, non-regulatory and non-commercial actions carried out by the 14 Banques Populaires.

IN 2023

•For the fourteenth year running, Banque Populaire is ranked No. 1 bank for businesses(1). Banque Populaire also remains No. 1 bank for franchisees and franchisors(2).

•The Banques Populaires stand by their professional customers in difficult times: energy crisis, urban violence, natural disasters.

•The Banques Populaires give young people under 35 the purchasing power to buy their own home through two schemes: the “PTZ +X” loan to complement the PTZ, and the Casden Banque Populaire Starden Immobilier loan for young civil servants.

•Launch of Tap to Pay, a new, simple and secure way of accepting contactless payments with an iPhone on the dedicated Banque Populaire app.

INDIVIDUAL CUSTOMERS

As a result of rising interest rates and inflation, the year 2023 was marked by a sharp slowdown in the property market, with two main impacts for Banques Populaires: a 47.3% annual decline in new home loan production and a 13.5% drop in the number of new customers in the retail market.

Against this backdrop, the Banques Populaires decided to give young people under the age of 35 back their real estate purchasing power through two schemes: the “PTZ +X” loan in addition to the PTZ, doubling the amount granted up to €25,000, and the “Prêt Starden Immobilier” from Casden Banque Populaire (for civil servants), to finance the main residence at a fixed rate under attractive conditions and without guarantee fees, over a term of up to 25 years and cumulative with the “PTZ +X”.

The number of principal active customers continued to grow (+1.9% compared with 2022). At the end of September, 1.5 million customers were equipped with the Cristal agreement, a bundled offer of products and services for day-to-day current account management launched in 2019.

In consumer loans, the pace of development remained very brisk, with growth of 5% in consumer loan outstandings in 2023.

In the payments business, over 3.2 million individual customers have adopted Sécur’Pass. This strong authentication service has been extended to customers without a bank card (activation possible independently from the Banque Populaire app) since September 2023. Meeting the requirements of the DSP2 directive, this system strengthens the security of online payments by limiting the risk of fraud. To date, 87.7% of customers making online payments are equipped with Sécur’Pass.

Overall, principal individual active customers are increasingly active on their mobile app: 85% of them made at least one visit in September (+2 points since December 2022). The Banque Populaire application is one of the best rated in the banking industry: 4.7 on App Store, 4.6 on Google Play, and 4.7 on Huawei.

In non-life insurance contracts and personal protection insurance, Banques Populaires recorded a +1.6% increase in gross sales of contracts to individual customers. The quality of their offers was rewarded with the Label d’Excellence 2023 from Dossiers de l’Epargne for their Car Insurance, Home Insurance, ASSUR-BP Health and Legal Protection contracts.

In 2023, the Banques Populaires strengthened their commitment to future healthcare professionals, notably by signing a partnership with FNESI (Fédération Nationale des Etudiants en Soin Infirmier) to provide a revision application for student nurses, and by launching Medical Civil Liability for healthcare students so that they are insured during their internships.

In 2023, Banques Populaires remained very active in supporting their customers’ environmental transition. In bank savings, Codevair’s outstandings now stand at over €2.1 billion, down 12% since January. In financial savings, over €746 million had been raised in the form of green bonds by the end of September 2023. Finally, over €240 million worth of projects were financed thanks to the Energy Renovation Loan and the Clean Vehicle Loan. To support their individual customers’ environmental transition, the Banques Populaires have given them access to the “Sustainable Tips and Solutions” platform. This new space allows customers to calculate their carbon footprint using a simulator provided by ADEME (French public agency for ecological transition). It also enables them to visualize their energy and transport expenses, while discovering the eco-actions they can adopt to reduce them, to find out about the financial aid available, and to access the banking (financing, insurance and savings) and non-banking (support for home energy renovation with our partner Cozynergy) solutions dedicated to energy renovation, clean mobility and responsible savings offered by their Banque Populaire.

€18.2bn in new loans, -47.3%

€154.9bn in loan outstandings, +0.5%

€195.7bn in savings deposits, +3.7%

332,792 new non-life insurance contracts

Despite a highly inflationary environment, Banques Populaires customers continued to build up their precautionary savings, with less emphasis this year on risky products.

The assets of wealthy customers (greater than €150,000 in assets or €10,000 in monthly income) and high net-worth customers (over €1 million in assets) increased by 4.70% with changes in the structure of their portfolios. In life insurance, net inflows totaled €2.6 billion. At the same time, investments in demand deposits fell by 15%, while financial savings and money market savings rose by one point each. The main change in 2023 came from term deposits, which increased 4.5-fold to €7.5 billion. They now account for 17% of private wealth management customers’ money market assets.

Lastly, the year was marked by the success of BPCE bond issues. Nearly 80% of inflows were subscribed by premium customers.

564,180 customers, +4.10%

€109.3bn under management, +4.70%

PROFESSIONAL CUSTOMERS

Faced with a troubled economic environment, the Banques Populaires have reaffirmed their commitment to their professional customers: contacting all bakery customers to provide them with personalized support and study their situation in the face of the energy crisis; setting up a simplified insurance declaration system and a 0% interest rate loan after the urban violence; mobilizing to help disaster victims during the various climatic events, including Storm Ciaran in the autumn.

Against this backdrop, the level of new business remained resilient, despite the credit crunch. The number of new customers fell by 3.7%, but the number of new business start-ups remained high, with +64% of new customers.

In the emblematic franchising market, Banque Populaire remains the leader in both the franchisee and franchisor segments.

The number of Banques Populaires’ agricultural customers stands at 69,091. At the same time, credit flows increased by 1.5% to over €195 billion.

In terms of financing, equipment loans to professionals fell by 23.7% in volume. However, the commitment of Banques Populaires to supporting professionals in their projects was confirmed by a clear increase in volume, at +11%, and in value for equipment leasing at €659 million. To secure loans, a further €1 billion has been negotiated with the European Investment Fund (EIF) for Socama, which guarantees Banques Populaires’ business loans.

In insurance, the number of contracts sold rose by 11%, a trend driven by professional motor insurance (+17%) and personal protection (+16%). New solutions were added to the range, notably for customers in the healthcare and agricultural markets.

In employee savings, a 4% increase in outstandings was recorded, reflecting customers’ growing need to prepare for retirement.

Lastly, the number of premium cards rose by 8.7%, boosted by the partnership with Visa in connection with the Paris 2024 Olympic and Paralympic Games.

This dynamic activity was accompanied by a historically high level of customer satisfaction, with an NPS of +16.

2023 was also marked by the launch of innovative customer solutions:

•Tap to Pay: an innovative, simple and secure way to accept contactless payments, using only an iPhone and the dedicated Banque Populaire app;

•Tourism Pack to enable customers to cash foreign cards (unionpay, Discover/dinerclub/jcb) and thus develop revenues;

•Medical third-party liability and a solution for managing third-party payment and healthcare advances via Santé pro;

•Rythméo Start, a complete digital offering dedicated to self-employed customers, including complementary solutions for civil liability, cash collection, pre-accounting and invoicing for all entrepreneurs via a partnership with Ipaidthat.

Finally, new digital solutions have reinforced the autonomy of customers, who can now open an account online in just a few clicks, apply for financing, secure their cash flow by transferring their invoices in selfcare via FlashFactures, carry out a cash flow diagnosis via Solutions Paiements, or make retirement savings appointments with their Banque Populaire and a Natixis Interépargne expert.

Once again this year, Banque Populaire was recognized and rewarded several times: No. 1 franchising bank (nineteenth franchise survey); Trophée du palmarès du monde du chiffres 2023, which rewards the best partners of chartered accountants; Label of excellence awarded by Les Dossiers de l’Epargne for professional multi-risk insurance.

1.2 million professional clients

517,762 tradesmen

185,446 liberal professionals

69,091 farmers

€77.3bn in loan outstandings, +0.3%

CORPORATE CUSTOMERS

In 2023, Banque Populaire confirmed its historic position as a bank for businesses by becoming, for the fourteenth year running, the leading bank for businesses in France(1), with a growing penetration rate and the confidence of more than 5,899 new SME customers.

After two very dynamic years in terms of new business, 2023 confirmed this trend, with a 3% increase in the number of new corporate customers with revenues in excess of €1.5 million, and a particularly marked 13% increase in the SME segment (revenues in excess of €5 million). Banque Populaire continued to support its customers, with a 5.7% increase in investment loans to businesses and a 14% rise in short-term loans. This dynamic also applies to supporting customers in their investments, with new equipment loans reaching over €7 billion. This trend applies to entrusted flows, which are up by 8% to €471 billion, compared with €435 billion in 2022.

At the same time, customer satisfaction improved, with an NPS of +21, 4 points higher than last year.

In 2023, Banque Populaire became the first and only retail bank to partner France Biotech, France’s leading independent association of healthcare innovation entrepreneurs. This collaboration will provide customers with solutions in the fields of e-health, medTech and bioTech. Banque Populaire is thus strengthening its visibility, and in particular that of its Next Innov subsidiary, among innovative players in the healthcare sector.

In line with the Climate priority of Groupe BPCE’s strategic plan, the Banques Populaires continued to strengthen their support for customers in their environmental transition. The “BP impact” loan was rolled out nationwide to encourage customers’ CSR behavior and commitments.

In addition, the Banques Populaires continued to support their customers in their transitions:

•Digital, in particular via new payment methods. Among the initiatives launched: payment initiation, transaction security, such as the availability of an API for IBAN verification, the launch of Cyber security insurance offers and the signing of a partnership with MailInBlack to train corporate employees and secure fraudulent e-mails;

•Environmental and social, with a strengthening of strategic dialogue with management and, in particular, the introduction of an ESG questionnaire to measure management maturity and propose the best support solutions (almost 6,000 questionnaires completed by the end of 2023).

145,739 corporate customers, +4.2%

222,500 non-profits and institutions, +0.4%

No. 1 bank for SMEs, 42% are customers

€40.9bn of medium- and long-term loan outstandings

COMMUNICATION

Launched at the end of 2022, the new communication territory proposes a new brand vision: success for Banque Populaire is a collective success that only has value if it is shared and has a positive impact. 2023 was an opportunity to highlight the success of customers and their positive impact on society and local communities, notably through press and digital campaigns.

The year was marked, in sailing, by the victories of Corentin Horeau in the Solitaire du Figaro and of the duo Armel Le Cléac’h and Sébastien Josse in the 24H Ultim and the Transat Jacques Vabre. An opportunity for the Banque Populaire brand to ensure a strong media presence. The surfing partnership also raised its profile, with the Banque Populaire Surf Tour and the Championnat de France by Banque Populaire.

With the Paris 2024 Olympic and Paralympic Games just a year away, communications actions around this partnership intensified, particularly in anticipation of the Paris 2024 Torch Relay, for which Banque Populaire is one of the Official Sponsors, with recruitment campaigns for Olympic torchbearers.

CASDEN BANQUE POPULAIRE

CASDEN Banque Populaire, a cooperative bank serving specifically members of the French civil service, continued its development. At the end of 2023, it had 2,294,219 cooperative shareholders, i.e. +3% compared to 2022.

To better meet the needs of its cooperative shareholders, CASDEN Banque Populaire offers several solutions to support them in their energy transition.

The Energy Renovation Loan and the Clean Vehicle Loan, both reserved for civil servants, offer attractive financing terms – reduced interest rates, instant response in principle, flexible monthly repayments – whether you’re looking to finance work to improve the energy performance of your home, or acquire a more environmentally-friendly vehicle.

CASDEN Banque Populaire also gives civil servants access to its partner Cozynergy’s offer, which provides real support at every stage of their energy renovation projects, from the building’s energy assessment to the subsidy search and completion guarantee.

The year 2023 was also marked by the launch of the casden.fr website, which has been completely redesigned to make it a real lever for commercial development. It offers digital services in line with cooperative shareholder expectations, with an affinity dimension and a fluid, simplified customer experience.

The maturity of its approach to social responsibility was recognized by AFNOR, which awarded it the “Committed CSR” label. CASDEN Banque Populaire made new commitments in 2023. As part of its “responsible company” strategic project, it signed the Cancer@work charter, thereby committing itself to promoting the inclusion and continued employment of people affected by cancer or a chronic illness.

The launch of the SoPOP program gave employees the opportunity to help associations supported by CASDEN Banque Populaire in the fields of solidarity, education and the environment.

CASDEN Banque Populaire also renewed its participation, in collaboration with the Banques Populaires, in the Défi des pas, a sporting and solidarity challenge organized for the second time in aid of the Hospitals Foundation. Thanks to the mobilization of nearly 10,000 participants, civil servants and employees of the organizing banks, a donation of €30,000 was collected to finance a project by the Hospitals Foundation to benefit caregivers.

Finally, the “History, Sport and Citizenship” program continued its tour of France, visiting schools and Public sector establishments. This unique national educational program, proposed by CASDEN Banque Populaire and designed by the ACHAC research Group, now has over 3.5 million visitors.

+2.2 million cooperative shareholders

Nearly 10,000 activists

CRÉDIT COOPÉRATIF

As the benchmark bank for the social and solidarity economy and committed citizens, Crédit Coopératif recorded dynamic activity, particularly on the corporate market, with a total of 29,504 new customers. The number of cooperative shareholders rose sharply by +10.95%.

In the retail market, the year was marked by the launch of three new offers: personal protection insurance and non-life insurance designed by BPCE Assurances IARD, and the Millevie offer, which gives access to a wide choice of unit-linked products within customer life insurance contracts, and the 12-17 Agir card, a solidarity card made from PVC, which enables teenagers to learn how to manage their budget in complete security, without the possibility of exceeding their available balance.

Two branches dedicated to individual customers were opened, the first in Toulouse and the second in Lyon.

Service quality remained a priority, and customer satisfaction was on the rise, with an NPS rate of 29 for individual customers.

On the corporate market, Crédit Coopératif strengthened its green solutions with the launch of green sustainable mobility loans, to finance customers’ switch to electric or hybrid vehicles, and the Choisir vert (Go green) term account, which enables customers to optimize their cash surpluses while investing in a responsible, environmentally-friendly savings product.

These innovations are part of Crédit Coopératif’s CSR approach, which measures the impact of its activities on the environment. According to the Carbone 4 study, Crédit Coopératif’s financing and investment portfolio is among the least carbon-intensive of French banks (120 tCO2eq/€ million financed).

126,277 cooperative shareholders

421,688 customers

Nearly €6.2 million in donations, raised from solidarity-based products, distributed to 50 associations

Caisses d’Epargne

The 15 Caisses d’Epargne are equal shareholders of BPCE with the Banques Populaires, and are fully-fledged regional cooperative banks. Committed to local community life, they offer their individual, professional, association, corporate, institutional and local authority customers a comprehensive range of financing, savings, private management, insurance, payment and specialized financial services (such as leasing and factoring). They make decisions and act locally, in a short circuit, and reinvest their customers’ savings where they live to finance useful projects close to home (schools, hospitals, associations, etc.).

As cooperative banks, the Caisse d’Epargne belong solely to their 4.4 million cooperative shareholders, who participate in the decisions of their bank, voting on resolutions at the General Meeting and electing their representatives, the 2,500 Directors, from among their peers. Cooperative shareholders and directors are brought together in the local savings companies (SLE), which hold part of the capital of a Caisse d’Epargne and constitute a local tier, reinforcing the regional anchoring, proximity and expression of the cooperative shareholders.

The Caisses d’Epargne are the only banks to provide long-term support to all players in a given region: individual customers, businesses, professionals, social housing and social and solidarity economy players, institutions, local authorities and associations. As such, they have the capacity to create the synergies required for local development.

In 2023, the 15 Caisses d’Epargne launched their Utility Contract to strengthen their commitment to the regions, for the benefit of those who live there.

•100% useful to economic development: as banks serving all their customers and their territory, but also as local businesses and major employers in the region;

•100% useful to the environmental transition: by building solutions to enable everyone to become a player in this transition, and by financing projects that will help accelerate it in local areas;

•100% useful to social progress: as cooperative banks, having always been committed to the principles of solidarity and the fight against exclusion.

IN 2023

•Launch of the Utility Contract, through which the 15 Caisses d’Epargne make concrete commitments in favor of regional development and transformation, and reaffirm their DNA as cooperative, regional and useful banks.

•As a “family bank”, the Caisses d’Epargne mobilized to facilitate home ownership by launching two schemes aimed at young people under 35: the “Progressive Home Ownership Loan” and the “Prêt Primo Jeunes 0%”.

•National launch of Caisse d’Epargne Vitibanque, a comprehensive, tailor-made solution for the wine industry.

•Launch of Tap to Pay, an innovative, simple and secure way to accept contactless payments using only an iPhone and the dedicated Caisse d’Epargne app.

•Increased marketing of the Impact Loan dedicated to SMEs, medium-sized companies and players in the social and solidarity economy.

INDIVIDUAL CUSTOMERS

Against a backdrop marked by a sharp rise in inflation and interest rates, the Caisses d’Epargne pursued their objectives of winning new customers and building loyalty through a bancarization strategy underpinned by their flagship everyday banking offer, Formules. In 2023, more than 1 million new subscription plans were recorded. Caisses d’Epargne activity remained buoyant, with more than 428,756 new individual customers. There was also a dynamic increase in the number of regulated bank customers, with a net increase of +45,000, up 42%.

Service quality remains a priority for all the Caisses d’Epargne, and customer satisfaction is on the rise, with a Net Promoter Score of 16.

As a result of the very sharp slowdown in the residential real estate market, new home loans fell by 37%.

Caisse d’Epargne mobilized to help young people under the age of 35 to become homeowners, with the launch of two new schemes: the “Progressive Home Ownership Loan”, which enables borrowers to start repaying their loan with lower initial installments, a fixed rate and a term of up to 25 years; and the “Prêt Primo Jeunes 0%”, which offers advantageous features in addition to the zero interest rate loan: its maximum amount is €20,000 at 0% interest, up to a limit of 10% of the amount of the property financing, and its term can be up to 20 years, with free application fees.

On consumer loans, financing was down slightly, with the share of financing focused on energy efficiency and green mobility rising sharply. Revolving credit continued to perform well, with cumulative financing of almost €1 billion, up 9% on 2022.

Market share of total inflows rose by 1 point to 9.35% (in the third quarter of 2023), and balance sheet inflows reached €3.3 billion, up 145%.

Boosted since the beginning of 2023 by BPCE bond issues, life insurance business was particularly buoyant, with gross inflows reaching €12.7 billion on a cumulative basis, generating an overall surplus of €2.7 billion.

Lastly, the support for the E-Enfance Association, which supports young people and families on cyber-harassment, was renewed.

€204.5bn in loan outstandings, +2.2%

€394.8bn in savings deposits, +4.2%

€12.7bn collected in life insurance, +3.8%

6.4 million non-life insurance contracts marketed, +3.7%

PRIVATE MANAGEMENT

The Caisses d’Epargne continued their drive to win new customers, with 176,000 new high-net-worth customers in 2023, representing 5.7% growth in the customer base.

In this way, 3.3 million high-net-worth customers, representing €302 billion in financial assets under management, place their trust in the Caisses d’Epargne to support them in managing their assets and in all their areas of need.

In 2023, this strengthened relationship of trust led to a significant increase in the number of customers with loans, insurance, personal protection and bank accounts, with 7 out of every 10 high-net-worth customers now using bank services.

The increase in the NPS to +21 reflects the continuous improvement in the satisfaction of high-net-worth customers.

Finally, the expertise and performance of the Caisses d’Epargne fund ranges were rewarded again this year at the Corbeilles Mieux Vivre Votre Argent awards, with the prestigious Corbeille d’Or award for network banks and certificates for Best SRI fund range over one year and Best diversified fund range over one year and five years. These awards recognize the performance of the solutions we offer our customers.

No. 2 in France

3.3 million customers

€302bn in assets under management, +4.5%

PROFESSIONAL CUSTOMERS

In a turbulent economic climate, the Caisses d’Epargne maintained a dynamic of customer conquest, support and innovation.

More than 45,000 new professional customers were won over in 2023, boosting growth in the customer base to 3% year-on-year, in a variety of business sectors, representative of the Caisses d’Epargne’s presence in the regions. At the same time, new loans to support investment projects now total over €7.6 billion.

The year was marked by the strengthening of Caisses d’Epargne’s presence with two professional customer groups.

Winegrowers benefited from the national launch of Caisse d’Epargne Vitibanque, a comprehensive, tailor-made service dedicated to the winegrowing sector, which includes banking and insurance products and services, as well as the presence of some 50 experts and the creation of branches and business centers in each Caisse d’Epargne with winegrowing potential.

Future healthcare professionals can now benefit from a comprehensive, loyalty-building package to help them set up in business for the first time. All healthcare professionals also benefit from a new digital affinity space, enabling them to consult their bank’s offers and access useful tools and advice, while keeping in touch with their advisors.

Still on the digital front, a new procedure enables micro-entrepreneurs and freelancers to apply for an account in less than 10 minutes. They have access to a dedicated banking offer and can consult their personal and business accounts from the same mobile application.

In the payments sector, a new “Diag Solutions Paiements” tool provides customers with personalized advice on the best development opportunities for their specific uses, projects and equipment.

Last but not least, Caisses d’Epargne continued to innovate in the payments sector, becoming the first French bank to offer the exclusive Tap to Pay solution, a new card payment service available directly on the merchant’s smartphone, without the need for an EFTPOS terminal or terminal box.

437,660 professional customers, +2.9%

€19.4bn of medium- and long-term loan outstandings, including leasing, +2.4%

8,891 employee savings contracts signed

13,722 Pro non-life insurance contracts taken out

36,098 personal protection insurance contracts subscribed

CORPORATE CUSTOMERS

With over 37,000 customers (VSEs, SMEs and ISEs), the Caisses d’Epargne continued to support business development in 2023, against a backdrop of monetary tightening in the face of persistent inflation and near-stagnation in Eurozone GDP.

The year was marked by the acceleration of support for corporate clients in their decarbonization process, through various initiatives: deployment of the ESG strategic dialogue, acceleration of green financing production and ramping up the marketing of the Impact Loan dedicated to SMEs, ISEs and players in the social and solidarity economy. For each Impact Loan, the corporate customer chooses a social or environmental theme as well as an indicator defined by Caisse d’Epargne on which it wishes to position itself. Caisse d’Epargne encourages them to always take better account of non-financial criteria in their activities. The system as well as the relevance of the indicators chosen were audited by Moody’s ESG Solutions, one of the world leaders in ESG (Environment, Social and Governance) analysis.

Concerning the agricultural sector, the member cooperatives of the UFG (Union Finances Grains), a union of 34 cooperatives whose objective is to facilitate the provision of funds to finance their cereal stocks, were supported through the establishment of the NeuCP (Negotiable European Commercial Paper) Program. This issue of short-term negotiable securities represented a credit line of around €132 million for Caisse d’Epargne.

In addition, through the Néo Business program, the Caisses d’Epargne support the development of innovative companies in their territory and in all business sectors. Today, 2,000 start-ups/scale-ups benefit from this scheme with dedicated solutions, including 6 of the 26 French unicorns, 31 from the new French Tech 120 class in 2023, and 25 out of 125 from the new French Tech 2030 program.

37,510 customers, +8.3%

2,879 new relationships

€4.1bn in short-term loan outstandings

€33.5bn of medium- and long-term loan outstandings

€9.6bn in medium- and long-term commitments (excluding CBM & CBI)

€19.1bn in outstanding balance sheet inflows (excluding demand deposits)

FINANCIAL ENGINEERING

The Caisses d’Epargne offer a full range of financial engineering solutions: private equity, consulting on disposals-business transmissions, and structured financing (arrangement, syndication and management of financing solutions).

Debt structuring activity was particularly buoyant in 2023, generating €103 million in net fees and commissions, up 9.6% on the previous year and setting a new record.

2023 was marked by the strengthening and structuring of financial engineering teams in all the Caisses d’Epargne. The development of risk pooling tools (GIE syndication risque) and dedicated risks and liquidity (“ENR” and “ETI” funds) enabled the Caisses d’Epargne to position themselves in major renewable energy and energy transition financing operations, such as the Dieppe offshore wind farm (a 62-turbine wind farm that will supply almost 850,000 people with sustainable electricity from 2026, equivalent to nearly two-thirds of the current population of Seine-Maritime) and Noirmoutier (a 62-turbine wind farm that will supply nearly 800,000 people with renewable energy by 2025, equivalent to the population of Vendée). Lastly, new activities such as equity bridge loans and financing for long-term real estate investors were rolled out, diversifying the sources of fees and commissions generated.

The activities of the Caisses d’Epargne also cover mergers & acquisitions and equity investment in their region. Equity capital activities are a strategic development focus, with 17 regional structures, a national venture capital company (Caisse d’Epargne Développement) and the creation of regional “Rebound” funds.

INSTITUTIONALS

Against a backdrop of rising interest rates and tightening liquidity, the Caisses d’Epargne confirmed their commitment to serving their customers in the regions. They remain the leading private banks for local authorities, with €26.5 billion in outstandings and almost €4 billion in new financing loans. They are also the leading private bankers for social housing, with Habitat en Région, and for the semi-public sector, with over €2 billion in new MLT loans and €10.5 billion in MLT loan outstandings.

In the social housing and public-private partnerships markets, equipment loans activity amounted to €2 billion over 2023. At the end of December 2023, outstanding deposits were up to €10 billion, with a major shift in their distribution in favor of balance sheet savings, which are more attractive than Livret A and sight deposits.

In the Public sector, investment financing activity reached €4 billion, up 3.5% on 2022.

In 2023, three EIB envelopes focusing on energy renovation were being marketed by the Caisses d’Epargne: Water and Sanitation III, Energy Efficiency and Sustainable Mobility, and Renovation or Extension of Existing Sports Facilities. The latter contributes to Caisse d’Epargne’s positioning as a sports bank, in line with its partnership with the French National Association of Sports Officials and the promotion of the Sports Economy Observatory.

The year was also marked by the operational implementation of the new digital platforms dedicated to the Public Purchasing Card and Interactive Cash Line services, accessible on the CE Net Public Sector, the remote banking area dedicated to professionals in the public sector and social housing. The aim is to offer them services of the highest quality standards.

At the same time, a first-class money-market mutual fund is being created to expand the range of social housing investments. This product is eagerly awaited by customers in the current context of rising interest rates.

Lastly, the Caisses d’Epargne pursued their commitment to environmental transition with the roll-out of the ESG questionnaire to their customers and the signing of a new partnership with Delphis, an association that supports social landlords, to propose a sector-specific ESG reporting standard for social housing.

No. 1 private financier of local authorities

No. 1 private financier of social housing

SOCIAL AND SOLIDARITY ECONOMY

Caisses d’Epargne is a leading financier of the SSE sector, with loan outstandings of €6.5 billion in 2023, and supports more than 12,000 customers, including associations and other SSE companies. In the field, 130 account managers, dedicated to this clientele, master all the legal, tax and governance specifics and business models unique to these players in the private not-for-profit sector. There were close to 1,000 new relationships in 2023. This development is based on a long-standing partnership with the entire SSE ecosystem and social innovation support networks (SSE France, France Active, Impact France movement, La Ruche, etc.) and on partnerships renewed in 2023 and expanded regionally.

The year was marked by a new partnership with UDES – Union des employeurs de l’économie sociale – and Natixis Interépargne, which resulted in the production of a brochure and several events on value-sharing solutions. Faithful partners of the National SSE Observatory since its creation, 2023 was marked by the publication of a National Atlas with Editions Dalloz.

Major SSE financier

€722m in new medium- and long-term loans

€6.5bn in outstanding credits

PROTECTED PERSONS

The Caisses d’Epargne remain the leading bank for protected persons, persons under guardianship, trusteeship and dependent adults living at home in France. Across France, 200 specialized advisors are on-hand to assist family representatives and legal guardians. Business was brisk this year, with the acquisition of over 5,000 new protected adult customers. Savings deposits under management now exceed €11 billion. In 2023, 39% of total surplus inflows were in life insurance, amounting to €250 million.

342,787 customers

€11.43bn in deposits and savings

No. 1 bank for protected persons

COMMUNICATION

The year was marked by two major events.

The launch of the Utility Contract, which aims to strengthen the commitment of the Caisses d’Epargne to the economic, environmental and social development of the regions in which they operate, for the benefit of the people who live there.

This launch was supported by a large-scale campaign, including a TV film, urban billboards and personalized publications in the regional daily press, enabling each Caisse d’Epargne to communicate the proof of its commitment to its territory.

Caisse d’Epargne, Official Sponsor of the Torch Relay and Premium Partner of the Paris 2024 Olympic and Paralympic Games, has also mobilized to take part in the recruitment campaign for Olympic Flame torchbearers. The campaign was a resounding success, with 34,235 applications received. To highlight its commitment as official sponsor of the Paris 2024 Olympic Torch Relay and its desire, through it, to make all regions shine, a communications campaign was launched at the end of November. In particular, a TV film was broadcast in event format in the media, as well as digitally and on social networks.

Banque Palatine

Banque Palatine, a 100% subsidiary of Groupe BPCE, is mainly dedicated to mid-sized companies, executives and private banking. For more than 240 years, Banque Palatine has been working alongside entrepreneurs on both a professional and personal level. It provides them with a range of banking products (current accounts, real estate and personal loans, financial investments, financing solutions to meet environmental challenges) and insurance products. Its network is made up of 26 “Corporate and Private Banking” branches and four “Banque Palatine Premium” remote branches offering all the remote banking services to meet their specific needs.

Banque Palatine offers value-added expertise dedicated to supporting its customers’ growth and performance: wealth, legal and tax engineering, investment advice, global approach to managers’ assets, corporate finance, specialized approach to real estate, trade finance, client desk, etc. In the regulated real estate market, where the Bank is the market leader, and in the audiovisual market, where it is a key player, it deploys a dedicated national organization.

Its signature “The art of being a banker” illustrates Banque Palatine’s determination to develop a model of close relationships based on excellent support for its 13,000 corporate and 48,000 private customers.

Banque Palatine is a patron of the French Sports Foundation. Through this sponsorship, Banque Palatine finances the training, socio-professional integration and retraining of four top sportsmen and women.

In 2023, business was brisk in both the Private Banking and Premium branch networks. The number of new private customers exceeded 990. Distribution of real estate loans amounted to almost €620 million.

The drive to win over companies with revenues in excess of €15 million continued, with 328 new customers active in this segment. The teams also won 377 new private customers, executives and senior managers among our corporate customers.

In 2023, Banque Palatine enhanced its range of products and services. Palatine Asset Management marketed two “buy and hold” collective investment products to private customers, which involve buying bonds with the aim of holding them to maturity. A dedicated portal was opened for property administrators, enabling them to open new condominium accounts in selfcare.

As a partner in the environmental transition of its ISE customers, Banque Palatine took a number of initiatives in the field of CSR, including: the marketing of BPCE green loans to complement its range of impact-based structured loans; the launch of the first “copro loan”, designed to finance co-owners in the context of energy and other renovation work; the raising of awareness among over 200 employees through the climate fresco; and the deployment of ESG questionnaires.

Lastly, the year was marked by the acceleration of Palatine Asset Management’s transformation around the first listing in the Group of its Article 9 Palatine Europe Sustainable Employment fund, which can now be marketed by Banques Populaires and Caisses d’Epargne to their customers.

A subsidiary of Groupe BPCE (50.1%) and Auchan Holding (49.9%), Oney is a French bank with an international dimension, expert in payment, financing and insurance solutions. Founded in 1983, Oney supports the daily lives of over seven million customers in more than 10 European countries. As a player in new consumer trends, it offers its customers solutions for financing their consumption through simple, secure purchasing paths, both in-store and online. Today, Oney is the leader in three or four split payment in France. Through its subsidiary Oneytrust, it is also a leader in fraud detection and digital identification.

In 2023, Oney’s sales momentum varied from one market to another, impacted by an unfavorable external context linked to rising inflation (which constrained household consumption and budgets) and rising refinancing rates. All players in the consumer finance sector have been affected by this environment, especially fintechs, for whom access to liquidity has become more difficult.

Oney recorded a +3% increase in new split loans, confirming its leadership with a market share of over 30% in France (Source ASF). Today, one in three split payments in France is made with Oney. This result is the fruit of a development strategy (17,000 sites and stores now use Oney solutions), illustrated in particular by the signing of new partnerships with Parc Astérix (leisure/Compagnie des Alpes Group), Canyon (sports) and Ovoyages (travel). Commercial synergies with the Caisses d’Epargne, Banques Populaires and Payplug were developed in the small business segment, in support of the 3x 4x split payment offer. In 2023, over 8,000 independent businesses in France used this payment service. In total, 7.2 million customers have used Oney’s services for their purchases and projects.

The expansion of the retail offering continued, with the roll-out of 5x to 12x split payment by bankcard. More broadly, Oney confirmed its expertise in consumer loans, with, for example, the signing of a European partnership with Ikea for a range of financing cards and long-term credit, as well as split payments. The roll-out of this partnership began in Portugal and in Belgium in 2023.

In full consultation with its two shareholders (BPCE and ELO, formerly Auchan Holding), Oney launched a transformation plan at the beginning of the year, with the aim of returning to profitability by 2024. In the final quarter of 2023, shareholders approved a 2024 -2027 strategic development plan positioning Oney as one of Europe’s leading consumer finance companies serving the retail sector.

BPCE Assurances is Groupe BPCE’s Insurance division. A fully-fledged insurer, it designs, distributes and manages a comprehensive range of personal and non-life insurance products for customers of Groupe BPCE’s banking networks:

•personal insurance: life insurance, retirement savings, creditor insurance and individual and professional personal protection insurance;

•non-life insurance: motor insurance, multi-risk home insurance, supplementary health insurance, personal accident insurance (GAV), multimedia equipment insurance, legal protection, parabanking insurance, professional car and multi-risk insurance, etc.

BPCE Assurances’ insurance subsidiaries (BPCE Assurances IARD, BPCE IARD, BPCE Vie, BPCE Life) do not distribute their products. The Group’s banking networks distribute their insurance products(1).

(1)

With the exception of BPCE Life, a subsidiary of BPCE Assurances, which can deal directly with its customers.

BPCE Vie confirmed its vitality in savings and pensions, with gross inflows up 16% to €12.95 billion. Net inflows of €5.5 billion were 17.7% higher year-on-year.

In personal protection insurance, sales momentum was driven in particular by funeral insurance in the retail market and by the Key Man contract in the professional market.

In borrower’s insurance (ADE), business held firm despite a significant reduction in the number of real estate loans granted, following the substantial rate hikes decided by the European Central Bank and passed on by commercial banks. ADE’s business was also constrained by the application of the Lemoine act, which came into force in 2022.

The year was marked by the opening of a new regional site dedicated to the personal insurance business in the metropolis of Rennes (Saint-Grégoire, Ille-et-Vilaine), bringing together all the company’s activities, with the exception of the customer relations centers, which remain located in Lille, Reims and Paris. This site will create 150 jobs in the region over the next five years.

Finally, BPCE Assurances confirmed its status as a pioneer insurer in terms of climate commitment. Each year, 10% of investments are dedicated to green assets so that they represent 10% of outstandings by 2030 at the latest. In 2023, 51.8% of its investments included a green criterion, going beyond the target. The share of its green outstandings rose to 12.6% of total outstandings, an increase of 5.1 points in one year. Lastly, the proportion of SRI-certified funds offered to BPCE Vie customers now stands at 61%, with a target of 60% by 2024.

Non-life insurance business was buoyant in 2023, with over 7.23 million contracts in the portfolio, up by almost 3%. Service quality remained high and continued to improve, with an annual NPS of 68 for the Customer Reception and Relations Platform and 41 for the Compensation activity.

Against a backdrop marked by a significant decline in new real estate loans, BPCE Assurances Non Vie managed to increase gross sales by 3%, driven by the motor business, and to maintain sales of home insurance contracts in particular.

BPCE Assurances IARD was there for its customers in the aftermath of both the urban violence in June and the multiple severe storms in November, which caused extensive damage.

The year was punctuated by the marketing of BPCE Assurances IARD products throughout the Crédit Coopératif network, enabling this institution to broaden its range of products and services for its customers, following the example of all the Banques Populaires.

Pursuing its policy of regionalization, BPCE Assurances IARD set up new claims teams at its Lens site.

Acting as a responsible insurer, BPCE Assurances IARD has a rate of 28.3% for the use of re-used or repaired parts. In addition, BPCE Assurances IARD has decided to place prevention at the heart of its strategy. For the third year running, it published its two-wheeler barometer of motorized two-wheeler users, conducted by Harris Interactive. The aim: to understand drivers’ behavior on the road and their relationship with safety, while identifying their expectations in terms of prevention.

In particular, to reinforce the security of its insured customers, BPCE Assurances IARD offered a one-year subscription to the “Liberty Rider” service. The app, which claims 1 million downloads since its launch in 2016, offers a host of features to make travel safer. Already available to the Banque Populaire network, it has now been extended to Caisse d’Epargne 2-Wheeler customers.

The Digital & Payments division brings together all of Groupe BPCE’s business lines and expertise in the fields of innovation, digital, data and artificial intelligence, payments, and trade finance with Oney. The division’s extensive expertise contribute to making Groupe BPCE the benchmark banking group in the digitalization of payments and customer experience:

•the banking applications developed thanks to the division’s digital expertise have made Banques Populaires and Caisses d’Epargne leaders in online banking;

•with the most comprehensive range of payment services on the banking market, Groupe BPCE is one of the leading players in the payments sector.

IN 2023

2023 was marked by numerous innovations in the division’s various fields of expertise.

The success of digital banking was confirmed in 2023, with more than 11 million active customers on mobile applications and the threshold of 10 million customers using Sécur’Pass (reinforced authentication) crossed. Ratings for the Group’s mobile applications remain among the best on the market, with 4.7/5 on the App Store for example. 2023 also saw an acceleration in customer adoption of alerts. Offering a wide choice of real-time alerts is very popular, and today more than 8 million customers already have at least one alert activated.

In the field of Data and Artificial Intelligence, the work of Data in the service of sales performance generated 2.9 million sales opportunities in 2023. Data initiatives to boost operational efficiency continued: data enabled us to automatically collect and check more than 5.8 million documents over the year (+30% compared with 2022). In the field of generative AI, the first business line applications were launched.

In payments, the Group continued to enhance its range of payment services, notably with the launch of Tap to Pay on iPhone in November 2023. The Group marketed this iPhone cash solution when Apple launched it on the French market. This new service enables Banque Populaire, Caisse d’Epargne and Payplug to enhance their local payment offering for professionals, businesses and retailers. The division, and in particular its fintech Payplug, was also selected by the Olympic Organizing Committee to manage payments for the single ticketing system for the Paris 2024 Games. This global sales platform, a first in the history of the Olympic and Paralympic Games, will eventually sell over 13 million tickets. At the end of 2023, more than 800,000 transactions had been managed by Payplug. Work also continued on the launch of the EPI solution, and Groupe BPCE carried out the very first instant account-to-account payment transactions with Wero in real-life situations, between Banque Populaire and Caisse d’Epargne customers and the Sparkasse Elbe-Elster bank in Germany.

In January 2023, the division also launched the very first annual edition of its Digital & Payments Barometer, based on the anonymized transactions of 20 million bank cards issued by the Caisses d’Epargne and Banques Populaires and managed by BPCE Payment Services. Age, location of purchases, amount spent: this Barometer is the only one in France to be so representative of the French population, making it a unique tool for analyzing consumer spending in France, at the service of Groupe BPCE’s banking institutions, business lines and customers.

For 40 years, Oney has been creating payment, financing and insurance solutions to help consumers improve their daily lives and consume better (see also page 35). In just a few years, Oney has become the leader in split payments in several European countries, and particularly in France, where one in three split payments is made with Oney. Since 2019, Oney has been backed by two shareholders: BPCE (50.1%) and ELO (formerly Auchan Holding) (49.9%). In 2023, Oney’s NBI was impacted by changes in the interest rate environment. Nevertheless, BNPL (buy now pay later) production was up 3% vs. 2022, and Oney remains No. 1 in BNPL market share in France.

Through its recognized expertise in the field of electronic payment processing and payment flows, BPCE Payment Services supports Groupe BPCE’s banks and subsidiaries as well as external customers consisting of financial institutions and payment service providers. The trends observed in 2023 in terms of payment usage show a +8% increase in electronic payment transactions and continued growth in mobile and instant payments (x1.8 vs. 2022). In 2023, BPCE Payment Services also signed an agreement with Numeral to launch a single API dedicated to fintechs, giving them access to all SEPA payment schemes.